Another Bank bites the dust. Credit Suisse, one of those "too big to fail" institutions that are a global systemically important bank that is not allowed to collapse. And it won't because it is being bought out by another Swiss Bank, UBS - for a paltry three billion. Not only that, it is being pushed through by Swiss regulators without even getting shareholder approval, which is literally making new rules. The Swiss government changed the laws to make it happen.

So much for Swiss stability.

Well, Credit Suisse had a good run of it really. Almost 170 years of screwing people over.

But of course, nothing is really lost in the economy. It is like energy, in that sense, as while value can be created, rather than destroying it, it is just stored in another firm's pockets. And, of course, the only people to suffer the consequences of financial mismanagement, are the normal people who effectively have no say over what happens in the economy. Sure, it is by choice, but the majority of us don't know that, because we have been conditioned to believe that we are far too stupid to understand the economy, so we have to leave it in the hands of others.

They will look after us.

And we will suffer, because like it or not, we are tied to the outcomes of mismanagement globally, and so are all of the firms we are working for, one way or another. When the economy collapses and people stop spending, businesses stop spending too and make cut backs, which means people suffer more and spend even less. Then the governments come in and give handouts to the people who are struggling, using money borrowed from the future and will have to be paid back with interest, with the payback and interest coming out of the pockets of the people they were helping with the handouts.

The circle of life.

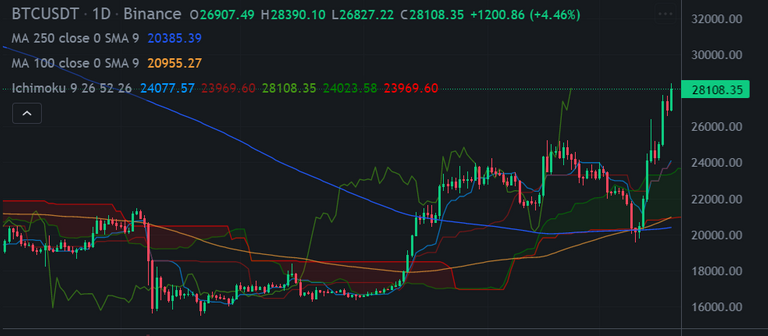

Almost 50% in 10 days. Around 80% since the start of the year.

Where's MSM the news on it?

I wonder how much of the drive on BTC at the moment is caused by the withdrawals from the banks? It would be interesting to have full visibility on all the money flows to see what is going where and when. Transparency is not something banks want however, because you know... how are they meant to get up to nefarious business when everyone can see what they are doing? The governments would never let it happen, because if there was banking transparency, the governments are screwed also - because of their nefarious activities.

But, what is interesting in a digital world, is very little is forgotten and eventually, most of the secrets are going to be uncovered one way or another. Hacks, leaks - stupidity. All that laundering, will come out and destroy all the "behind the scenes" work that has been done. You know, Credit Suisse isn't exactly the picture of morality, but are any of these banks?

How can we know?

They might get "rocked by scandals" but scandals are only so when they are discovered, it doesn't mean there aren't other scandalous activities going on. They talk about how "interconnected" the global economy is through the banking systems and banks themselves, so how different do you suspect their practices are, when they are all not only dealing with each other, but also competing against each other? Incentives drive behavior, so even if there is no conspiracy, there will be alignment of activities due to the incentives, which in terms of business, is defined by the basic algorithm of, "for profit".

In this day and age, it is actually quite incredible that we are still acting as if there are no better alternatives than this current system. Acting as if more regulation of the sector is what will fix it, despite nothing actually changing through those regulations, because the incentives stay the same. Open up the transactions for public viewing however and suddenly, the incentives change, the behaviors change.

Most people are not exhibitionists - so when the blinds are open, they aren't going to have their pants down. And while personal privacy is important, do you think that so much of the banking sector and government activities should be done behind closed blinds? If the curtains were pulled open, they would have to change their behaviors, because ultimately, they are beholden to the opinion of the people for their success.

I don't take pleasure in the collapse of the banks, because real people are affected, and we will all feel some of the repercussions. However, something has to change and unfortunately, nothing will until there is so much pain being experienced, that there will be a strong enough push back. This is not the best way to go about change, but humans aren't the smartest of creatures, though we might be the greediest.

It is easy to complain about what goes on in the world of government and finance, but if put in the same situation, would the average person do differently? unlikely, because the people making all of these decisions, were also average people too and likely also thought once upon a time, they wouldn't be acting like they are today. Given incentive and the power however, you like the Swiss government in regard to the Credit Suisse merger, they made up new rules for themselves.

Given the opportunity - who wouldn't?

Taraz

[ Gen1: Hive ]

Posted Using LeoFinance Beta

We have to act as if there isn't a better alternative because admitting there might be something better would be having to think about changing and change is terrible and horrible and uncomfortable and discomfort is to be avoided at any and all cost.

Also taking responsibility for self is something else to be avoided at any and all cost as it's much more satisfying to pretend that we have absolutely no control whatsoever over our lives and the state of the world and it's all someone else's fault, otherwise we might have to actually do something.

You know how it is xD

Also I wouldn't. But we all know I'm defective so I don't think I count XD

It all comes down to convenience and a victim mindset these days, doesn't it?

Definitely a convenience thing involved too. Change is too much hard work XD

Rules and laws are just for us the little people. Who would think 2 decades of crazy low interest rates could just be reversed in a few months with no consequences...!? Lol. Thank god we have crypto to take shelter in.

Whether it is shelter is yet to be seen, but at least it is supporting an alternative, rather than this clusterfuck of the economy that is.

I think technically Credit Suisse shareholders lose about half their value. They get 1 UBS share for 22 shares of Credit Suisse. 1 UBS is bout $18 and 1 Credit Suisse is about $2... but this is really only a short-term issue I'm sure.

I'd say 99% of BTC's price rise is to do with all this bank news and people fleeing to a different asset. The problem is, I don't think people realize just how manipulated BTC's price can be, I have exposure to BTC but I don't think it's a safe haven in the slightest.

BTC is definitely not a safe haven, however perhaps people with a little more cash are likely looking that other people will go into it too, so there is a fair amount of speculative potential.

credit suisse is a big entity I know that they sell many derivatives, how many are going to be unemployed by these restructurings, what they seek is to make a profit, my God, where are we going to end up if we have money in a bank that guarantees that it will not go to dust? From overnight. maybe having monsters in splinterland will be safer than being in a bank waiting for high returns. best regards hand

The banks have been operating very poorly once again - which is to be expected, because that is what they do, and will continue to do, as that is their model. Not sure about monsters, but it can't be much worse :D

It’s a good question. Not many given the same things drive us. Security, safety of our efforts, relationships, food…

The democratization of value makes the only feasible consequences of these events. It does not serve to hasten this eventuality, but to participate inoculates one for the future, done correctly.

If there is another 2008, it will be interesting to see what happens. 2008 generated Bitcoin - what will this one do?

Greetings from the United States of a Sovereign People... It's a sure bet, that you're prepare for what's heading our way...

Do you think it is possible to be a sovereign citizen of any nation?

I've always thought it was interesting how the world of finance ties so closely to the rules of physics and thermodynamics as we currently know them. Things like you mentioned above and the idea of equilibrium. Just like nature always finds a way to even things out.

For some reason, i am not seeing your profile image.

Absolutely. It always balances, which is why some people can have a lot and the rest next to nothing. While not the sense of "equal" that people might want, it is equal in the way it still adds up to 1.

Are you using Ecency? That happens sometimes. They had to fix something on the back end last time.

Nope. Peakd. It is there again now. Must have been a server issue somewhere, as when I scrolled I saw a few others missing too.

Ah okay. I guess that happens sometimes! I am glad it is back so you can put a face with my awesome content :P :)

Let's see if First Republic Bank is the next one to join the party after the market opens tomorrow.

This list is growing every week!

What do you think will be born out of a major financial crash?

I clearly believe crypto assets, will grow in use. Many ppl see BTC as a hedge against fiat currencies and many institutions will start to invest, the same way gold had big demand during last century's recession.

Authorities will probably try to stop those crypto projects with a clear central authority but those such as BTC or Hive will prevail and that will push the whole ecosystem forward.

The traditional system is full of slow laggards carrying too many backpacks. There is no way they can fight a system that is better, faster, and welcoming to everyone, not just some privileged living in first-world countries.

There is no way you can stop the amount of innovation taking place, only hacking issues every now and then may stop someone from jumping in, right now, the hacking issues come from the "official" status, it is just that there are still too many ppl not willing to see it and face it. I believe a new financial space will emerge full of entities giving custodial crypto services for those not willing to deal with the new space but all in all, demand will increase as more and more centralized legacy financial institutions keep falling.

Just last week Moneriun, a new wallet was presented in Eth Porto where you can have crypto Euro and a traditional IBAN number to send your crypto Euro to any traditional bank account which receives fiat Euro and vice versa. As projects such as this start pumping and offering cheaper and faster services, there is no way traditional banking will remain the same. They will either die or jump into the new train.

Credit Suisse must be really bad because I saw the type of things the other bank wanted to take the deals. They basically want a way out of the deal and I am guessing they don't really think the deal will go smoothly at all. The banks aren't looking so great and they are a bad choice for people to hold during a recession.

Posted Using LeoFinance Beta

I think all the banks are pretty bad - we just don't see all they do. If we did - would we put our money in them?

Even if people did see that they are bad, I am sure they would put money there for convenience until the situation gets so bad that they get scared.

Posted Using LeoFinance Beta

You reminded me of a phrase;

When elephants fight ants die.

I haven't heard that one!

The bigger they are, the most noise they make when falling.

Central CH bank is injecting more liquidity in the banks and the question is all times the same: "where the heck all this money come from?"

Well, I think that at this point, we know the answer!

We definitely know the answer.

Our future pants are being pickpocketed.

Hive instead of banks. +20% in HBD, +20% in HIVE and sometimes even faster than in a year))

At least on a small scale, this works :)

Yeah, one of the 30,000 richest people in the world will have enough liquidity. Today, trading volume on HIVE is $250 million.

Discord Server.This post has been manually curated by @steemflow from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @steemflow by upvoting this comment and support the community by voting the posts made by @indiaunited.

Congratulations @tarazkp! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!

Sadly, this is so true. The commoners who just wanted to put their Savings in the so-called safe enterprises ends up getting caught in the tide with no one go hear their cry😢

And this is true, come to think of it, there's never transparency in the Economy not because there's anything wrong with us seeing that but because the Government officials will love to cover their "illegal activities".

I really hope everyone gets to know those alternatives and make good use of them because in as much as we may fail to admit it, it's not all that safe again with financial institutions

Thanks for this engaging post... I really appreciate

Yeah it's quite peculiar that shareholders of a publicly listed company didn't get a say in this... Then again the situation is evolving faster than I can catch up with the news. Insightful sharing once again!

To be honest, I have no idea what to do with my cash currently. I have about 20% of my retirement investment portfolio in cash right now earning low, short-term yield, until this market figures itself out.

When it comes to transparency, there is good and there is bad. I was originally quite pleased that Celsius was going to do a proof-of-reserves and disclose the positions of all their assets. However, bad actors used this knowledge against the company, took advantage of its illiquid investment positions and started a FUD campaign that eventually made the company insolvent due to the shorting of its investment positions. Sadly there will always be bad actors who take advantage of a system of transparency to amass profits for themselves at the expense of others and I'm not sure how this problem is solved...

~~~ embed:1637897499200331778 twitter metadata:ODYzOTEyNTQ2fHxodHRwczovL3R3aXR0ZXIuY29tLzg2MzkxMjU0Ni9zdGF0dXMvMTYzNzg5NzQ5OTIwMDMzMTc3OHw= ~~~

The rewards earned on this comment will go directly to the people( @videoaddiction, @celi130 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Whatever happens now we have it coming. Bitcoin's been available for a decade and humanity's all but ignored it. I used to think we reluctantly used money because we had no choice. Turns out that's not it.

Are we going up from here or doomed to go back to test 20k ? What do you think about BTC pump?