A friend of mine sent me a picture at eight in the morning from a book he is reading, of something that reminded him of the things I talk about. He is reading Atomic Habits, a book that looks at making small changes that stack to amount to large scale impact on our outcomes. It definitely sounds like me and while I didn't write the book, I have been using at least some of the philosophy in my business and training for well over a decade now.

If only I was an author.

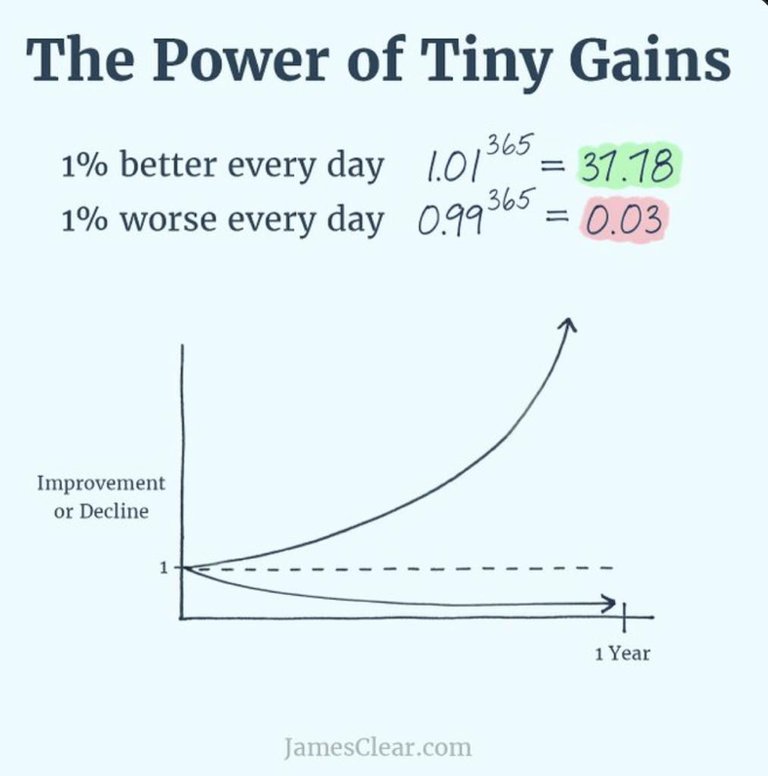

The image he sent was showing the effect over a year of a 1% change per day over the space of the year, where compounded, it will lead to a 3700% (37x) gain, or in the opposite direction, degradation will approach zero.

Small shifts in our behavior can make enormous impacts on our lives, but they are difficult to maintain and of course, it is impossible to consistently get 1% of improvement (or degradation) daily. However, what is important to remember is that overtime, these small shifts stack up, because we often miss what happens in our environment, when it is changing what appears to be slowly.

For instance, the other week I wrote an article about the distribution of wealth, giving a practical visualization of the situation across wealth brackets.

As a refresher:

Using 100 people as total population and 100 dollars to represent total wealth:

1 person has $38

9 people have $4.22 each

90 people have $0.26 each

But averages lie.

In reality, the difference between the top and the bottom of the one percent, is far greater than the difference between the bottom of the one percent and the bottom.

We can look at this if we use 1000 people and 1000 dollars.

10 people have $38 each

90 people have $4.22 each

900 people have $0.26 each

But the top 1% looks more like this:

1 person has $250

2 people have $40

3 people have $10

4 people have $5

At least for me, that was a useful exercise to create an understanding of the distribution of wealth in the world, but it is equally important to understand that it wasn't an overnight event that brought this about. Instead, the current economic distribution and the wealth gap, is a process of incremental change, where instead of 1 percent a day, it was more like 1-2% a year. But the longer this seemingly insignificant difference progressed, the greater the gap became.

For example, if we look at two people who are earning 60K a year for a full forty years of their career, which is 5K a month. One pays their bills, pays their mortgage, and saves a little for rainy days in the bank. The other puts $100 into an investment portfolio that earns 10% APR.

In the first 15 years, the investor has around 36K in the portfolio. 6 years later, they have doubled it to around 72K. 7 years more and they have doubled it again to 144K. 7 years later they have doubled again to 288K and after 40 years, based on 48K invested, they will have 531K in the portfolio.

But, this isn't where the real gains are made, because on top of a house, the next generation of the investor has a half million head start compared to the one without the portfolio. This means that for instance, of the children of the investor are 40 years old when their parents pass, they get a massive investment portfolio that could essentially keep ticking along in the background of their lives. They can do nothing but let the investment ride and when they turn 60 twenty years later, that inherited investment will be worth $3.5M, plus they will have an inherited house, plus whatever they have from their own work and contributions.

If their children do the same, that amount is over 23 million dollars worth from the portfolio, which had 48K invested into it over the first 40 years, but nothing added for the next 40 years. However, as amazing as that sounds, humans have wants and desires, and perhaps especially if we aren't the ones who made the original sacrifice, spending comes easy. We have wants and desires, so compounding as if we are robots, isn't realistic.

However, what is good to acknowledge is that consistency matters, even if the amounts are small and seemingly insignificant. So many times I have heard people discount small amounts as if they don't matter, and I know I am guilty of this too. We have been led to believe that in order to become wealthy, we have to make big moves, but that is actually not the case, especially if we are looking at wealth across generations.

Money begets money.

And whilst this is true, it is also good to understand that part of the reason that money attracts money, is because having money means not having to spend everything on living expenses and wants. Having that financial "head start" gives leeway to keep investing, even in the early years when the job might not provide a huge amount. Having a rent- or mortgage-free house to live in saves costs and frees up potential investment capital. But, that investment still needs to be made. Savings are useless, unless put to work to generate.

Due to changes in my friend's life, he is now far more interested in what they can do to save money, but more importantly, make money. They realize that over the last decade, they bypassed opportunity after opportunity to make a improvements in their life for now, because they felt that it wasn't worth it or, the momentary fulfilment of desire was more valuable. Looking back with little to show for all those moments that aren't even remembered, they think that perhaps they could have taken a hybrid approach, and invested a little, instead of spending it all.

But, what is really interesting to consider, is why people do or don't do these things, because it speaks to what they desire. Some people talk about living in the moment meaning enjoying that moment, where they spend for a positive emotional feeling. However, other people live in the moment and are working.

Why do we value the enjoyment so much, especially if it brings us future pain?

I know a few very wealthy people and while they face plenty of challenges just like everyone else in this life, they tend to enjoy what they do for work. Sure, they enjoy going on a beach holiday too, but the holiday isn't an escape from their work, it is a perk of their success in their work. I believe too many people are looking to avoid work, using "living the moment" as the excuse.

Similarly, there are a lot of people who blame the wealth gap on the wealthy, without recognizing that we all play a part in that process, because for them to be wealthy, they have to coax value out of us. If we aren't generating value ourselves, if we aren't investing into generative investments, we are getting milked. And, even if we are growing half a percent a year less than those at the top, a generation or two down the track, and the gap is far wider than we can imagine.

Unless we open our eyes and see the reality of incremental gains and losses.

Taraz

[ Gen1: Hive ]

I have never been very good at investing until I found cryptos.

In December 2011 I bought 200 Bitcoins for US$1400. My wife told me that I would lose my money, but if I earned CAD$10,000, I would owe her a cruise!

Three weeks later, I sold 50 Bitcoins for US$1500, so I got my money back. Then, in 2013 I sold 10 BTCs for CAD$10,000. So, I owed my wife a cruise, but we never decided when to take this cruise. I still owed her a cruise!

Unfortunately, I left most of my BTCs on MtGOX, so I lost them in 2014. As the MyGOX saga is finally ending, I will soon get some BTCs (around 4, I believe) in 2014.

I invested again in cryptos in November 2016, including STEEMit. I bought different crypto tokens for CAD$47,000. In 2018, I sold some NEO (I had bought 1,000 at US$0.7 each when they were called AntShares) to get my money back. Then, I sold more and I got CAD$100,000. That helped me to buy the apartment we are living in now mortgage-free.

in 2021, I sold more crypto for CAD$500,000. I distributed half of it to my children and grandchildren.

I still have plenty of cryptos. I sold my STEEMs to buy HIVEs and I never sold any HIVE. This is the reason why my initial 17,000 STEEMs are now more than 400K Hives.

:D

That sucks, but at the same time, at least there is something coming back. MtGox was before my time in crypto, but I had the "opportunity" to buy in 2010/11, but couldn't work out how to do it, so let it slide - sliding doors.

You have made some very good moves! I wish that I had been more willing to sell at the highs, as I have been a holder and have yet to use any of my crypto in "real life" at all. I came into Steem at the start of 2017 and have worked my way to where I am now. I bought a little here and there too, but most of it is through sweat equity. It has been a lot of work, but I like being able to work for ownership, especially when I didn't have the money to invest directly.

What has been invaluable through Hive has been the view into the strategies of many people, and the chance to practice and learn along the way. While there are a lot of negatives in some areas, the core people of Hive tend to be decent people with good experience. I think this is also whey the decent content contributors on Hive, also tend to be the ones who have some real world experience, families, have traveled, worked multiple jobs, lived.

I like Hive :)

Me Too!

I'm probably better off than a lot of people, but I still wish that I had started investing money sooner than I did. I actually always love this time of year because at the end of December I get to see how much it grows from my dividends and capital gains.

One day I will get into some traditional investing too! :D

One of my life strategies is that making a small effort is always better than none at all. I presume is similar.

Yep. I think so. It is not that every effort brings reward, but it can build the muscles for consistency and consistently doing the right things, even if only in small amounts, will eventually pay off.

Yes if only you were an author, you could be raking it in 😆

Another possible side gig? 😜

I wonder if the delusion my friends and I had back at uni is still prevalent in that age group.

Delusion is probably the way for every generation at that age :D

It is funny, I have always "wanted" to write, but it wasn't until coming to Steem/Hive that I ever did.

The wealth gap is indeed a challenging thing to view, because of the loads of variables involved. I think a fair bit of it these days is with laziness and entitlement. People aren’t as willing to look for options to explore to get ahead and make some investments to stay ahead. It’s unfortunate for sure but I’m hoping like everything, these things will change with time. I’m hoping that we can foster a better financially literate generation than previous ones. I guess that always happens though and it’s just a little more pronounced with the internet. Hopefully we can make real progress on it!

I think there needs to be the learning and the practice. This is one of the massive opportunities with Hive - you get to apply what you know.

This is a nice post. I think Warren Buffet is one of the people that advocates compounding interest. Compounding doesn't necessarily have to apply on finances only, but as you've said, in our day to day life. It can be in work and training, it can be in our health. If you want to accomplish or change something, you also need to do something. If you can't immediately get it done, small incremental changes will add up and get you there.

One of the challenges is that it is hard for us to apply, because we don't really visualize where it leads in the future well. It is also hard to make small" insignificant" changes, because they don't feel like they matter at the time. Our whole lives though are a compound of small, insignificant changes...

Maintaining consistency, no matter how small can lead to a greater amount of success.

Thanks for sharing

A bit at a time, large scale changes are made.

And that reminds me of the butterfly effect. I believe that smal changes in our life might have a big impact on things.

Precisely. It would be interesting to see a matrix of all the little events in our lives and where they have led us.

There was a time when I didn’t take little gains seriously until I knew the power of little gains and compounding. When small gains accumulate, it becomes a lot of money

That’s how we grow

More important than small gains in money, is small gains in skill. Work at developing the right skills, and then larger amounts of money are possible too.

“Save money” or “Make money”? The first one is traditional way to earn but the second one is more popular especially last decade. I also focus on the second one and I believe I earn money from money✌🏼😊

Thank you share us this point🙏🏻

Saving can only go so far - there is no roof on earning.

I agree✌🏼

Hello tarazkp!

It's nice to let you know that your article will take 15th place.

Your post is among 15 Bestblind-spot articles voted 7 days ago by the @hive-lu | King Lucoin Curator by

You receive 🎖 0.8 unique LUBEST tokens as a reward. You can support Lu world and your curator, then he and you will receive 10x more of the winning token. There is a buyout offer waiting for him on the stock exchange. All you need to do is reblog Daily Report 133 with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by szejq (Lucoin) and get paid. With 50 Lu in your wallet, you also become the curator of the @hive-lu which follows your upvote.

STOPor to resume write a wordSTART