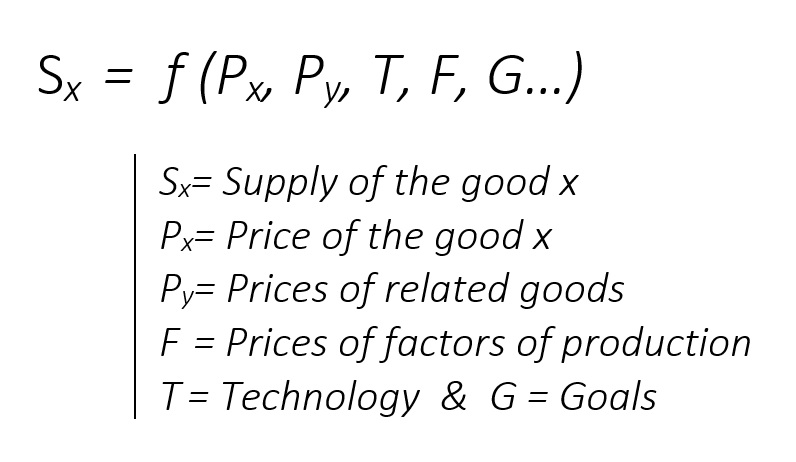

Factors or Determinants of Supply

Supply of a commodity depends upon a number of factors or determinants. According to the classical theories of economics, The most important of these are: Price of the good, Price of the factors of production, Technology, Goals & Prices of related goods.

When anybody wants to deal with crypto currency, he should know about it's behaviour and how it reacts with the change in different determinants.

.jpeg)

As I like to explain the behaviors of cryptocurrencies by the classical economics theories, today I will discuss about how these factors influences the cryptocurrencies...

We can put the impact of a number of factors or determinants on supply in the functional form by the following equation:

1. Price of the good (Px)

Classical Theories: As we know that price determines the supply of a product. When price is high, supply is more and vice versa. Producers are encouraged to produce more when price is high because of high profit margin.

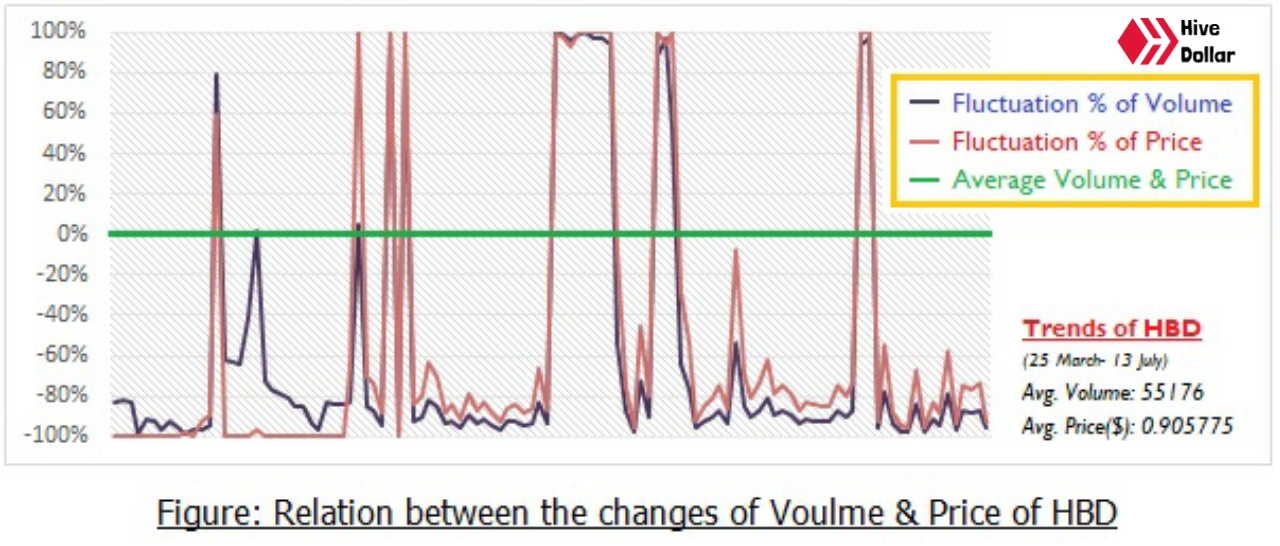

Actual impact On Cryptocurrencies: The supply of currencies are not been affected by the change of price. Because there is no actual relation & direct impact of price on its supply. but historical data shows that whenever the supply or volume of the cryptocurrency increases, then the price of that currency tends to be also increased.

This is not in a perfect parallel correlation, but it maintain a nearly parallel impact. You may find it at my previous one leo post where I have shown the analysis of the relation between Hive Dollars and its volume.

2. Prices of related goods (Py)

.jpeg)

Classical Theories: Prices of substitutes & complements also affect supply of a product. When price of a substitute good rises, supply for that good reduces & vice versa.

For example, if prices of tea rise, it results in the reduction in production & supply of coffee as the producers will withdraw resources from the production of coffee and devote these to the production of tea.

Actual impact On Cryptocurrencies: There is no direct relation between the cryptocurrencies as they are created by its own strategies and technologies. But in case of real trading, there is a positive impact of the inter-transaction of cryptocurrencies. Whenever a cryptocurrency tends to bulling, than other currencies also do. this is nothing but the public confidence and public perception about the currencies as well as a positive correlation among market trends.

Here the major and strong currencies like Bitcoin acts as like as libor rate in case of different foreign currencies exchange rate changing and also changing in interest rate. you know that most of the country's exchange rate as well as interested are corrected following the libor rate. Though the exchange rate of cryptocurrencies are driven by market force, but there is a self-correction measure that is influenced by the rate of major currencies.

.jpeg)

(Yellow: Hive/BTC, Blue: Hive/USD)

3. Technology (T)

Classical Theories: The change in technology also affects supply of a product. It may reduce the cost of production and as a result supply will be more. Automation in textile machineries have increased the speed of production per hours and hence large production.

Actual impact On Cryptocurrencies: It is very much resemble to the classical theories as the change in technology also has a great impact on the generation and transaction of cryptocurrencies. Because the initiation of cryptocurrency is highly dependent on the technological support.

.jpeg)

Whenever the technical advancement occurs, then the mining of cryptocurrencies or generation of cryptocurrencies is boosted up and that's why the supply of cryptocurrency also being increased. Day by day due to the advancement of technologies, transactions of cryptocurrencies become more easier and they are exploring new horizon of using this cryptocurrency in real life.

For example, if a country open its barriers about cryptocurrency and allow transecting cryptocurrencies in all supershops, then the transaction of cryptocurrency as well as the supply of cryptocurrency will be increased.

4. Price of the factors of production (F)

.jpeg)

Classical Theories: When costs of factors of production come down, it reduces the overall cost of production and as a result, producers are induced to produce & supply more.

Actual impact On Cryptocurrencies: It is also directly related with cryptocurrencies. Because if the cost of factor productions decreases, then the currency generation will be increased and it's supply will also be increased.

.jpeg)

Such as, the country where higher internet facility is very much available and low cost, on that countries the transaction and engagement with cryptocurrency is better than the others. It is life example.

5. Goals (G)

Classical Theories: If sellers expect the prices to rise in future, they reduce supply of a product & hold the good to sell in future. This is done for creating artificial scarcity to get higher profits in future.

Actual impact On Cryptocurrencies: It has no real impact, because the traders may hold the cryptocurrencies as its prices raising. But the new users of cryptocurrency as well as who got cryptocurrency by data mining or any other currency generating process, who are not actually trader, they tends to sell their cryptocurrencies in a consistent manner.

.jpeg)

So most of them don't bother about the prices. But it has sometimes a little bit impact that is very much neglectable then the other factors.

About Me:

My Footsteps on Virtual World:

- Hive: My Blog

- LeoFinance: My Leo

- Dtube: My Tube

- 3speak: My Vlog

- Twitter: My Tweet

- FB: My Profile

- Pinmapple: My Tour

- TravelFeed: My Feed

"I am an engineer by graduation

a teacher by occupation

& a writer by passion"

I believe, Life is beautiful!

Posted Using LeoFinance

.jpeg)

Let's hope crypto keeps a nice bull trend going!

Posted Using LeoFinance

I hope so..

Posted Using LeoFinance