Bitcoin maximalists aren't going to like what is happening. We are seeing the dominance of Bitcoin plummet. Their views aside, this is a welcomed sight.

Any industry that is worthy is going to be see emerging players. Those that do not are either monopolistic in nature or not very promising. Neither of these apply to cryptocurrency.

Let us look at the situation as it transpired.

In December of 2020, Bitcoin accounted for more than 70% of the total market cap. This meant that everything was entirely dependent upon Bitcoin's price in terms of total market value.

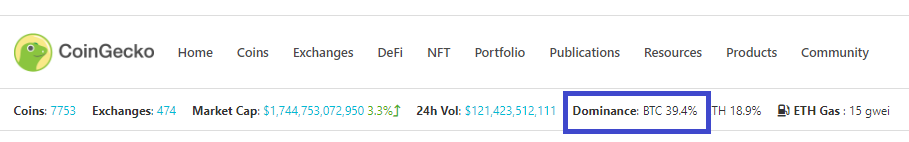

That dropped to an all-time low in May, a level it is now targeting again. Presently, we see the Bitcoin dominance residing at 39.4%.

Some believe that this could see even a greater fall. Resistance is now at 36%, a line that could give way to a much larger drop.

In any case, the ensuing downward movement could take BTCD all the way down to the range of 27.50%-25.40%. This target range is found using an external Fib retracement and Fib projection.

This is an interesting turn of events and one that looks very promising for the cryptocurrency industry.

Many of us held that there is not going to be one dominant token. Bitcoin's influence was going to drop as other projects started to take hold. The present move is most likely precipitated by the rise of Ethereum and Binance Smart Chain (BSC). They both garnered a great deal of attention of late.

However, this is also likely a phase. In the future, we are going to see a large number of projects eating into Bitcoin's dominance.

Utility

We are still at the point where cryptocurrency is looked at as financial. Most who are involved are playing the casino. They treat it like stock, buying at a price and hoping it ends up going higher.

This is the first generation mindset. Eventually, we are going to move beyond that to the point where people are using this stuff on a daily basis. When that happens, we will see an entirely new approach emerge.

Here is where we will see the true Network Effects kicking in. When we are at that point, the biggest movers will be those with the most utility. Thus, the development that is taking place now will result in activity in the future.

Thus far, it is mainly relegated to Ethereum and BSC. The DeFi craze really captured a lot of attention (and money) while NFT grew a great deal also. These two, combined, have pulled in many users, helping the value of the coins associated with those chains.

Nevertheless, this is still just a minor drop in the bucket compared to what is coming. To start, both those chains are suffering from scalability issues. This is a bit odd for the later since it is centralized system. This is also opening the door for other entrants.

We still have yet to see gaming really take off. This is an industry that has decades of experience with tokenization and in-game currency. While this was always closed, those users are accustomed to earning tokens and then spending them on gaming assets.

Of course, there are many who feel that gaming is the ideal utility for cryptocurrency. This is probably going to be the major wave that ends up pushing it into the mainstream. When popular games start to have them integrated, that will expose a hundreds of millions in a short period of time.

Ultimately, this is not going to be taking place on Ethereum or even a BSC. The activity will reside somewhere else. That will push the dominance of Bitcoin down even further as another set of players starts to have greater influence.

Source

As of November 2020, the global stock markets were worth $95 trillion. Since they have only rallied higher, we now see equities being worth over $100 trillion.

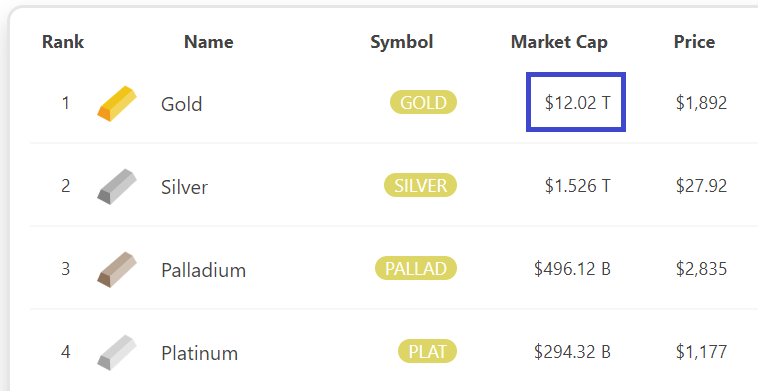

The above table shows that Gold is around a $12 trillion market. That is nothing to sneeze at but pales in comparison to the equities market.

Since we see Bitcoin taking on the characteristics of "digital gold", it is likely to fall under a similar scenario. We will see the dominance of BTC fall into the 10%-15% over time as the utility of the rest of the industry starts to expand.

Of course, we could actually see it drop a lot lower if we factor in a host of other cryptocurrency types such as security tokens and NFTs. Overall, this is a very healthy thing because it shows the expansion of the entire crypto space.

Decentralization is something that is often discussed. Here we see another example of the industry spreading out. Having all the value in Bitcoin is not healthy for the future progress. The fact that it is dropping, and relatively quickly shows how rapidly things are moving.

Over time, we will see this ongoing even while the value of Bitcoin keeps growing. There is no reason for Bitcoin not to hit the heights most have laid out. This means that Bitcoin will be worth even more than today yet command less market dominance.

It is at that point where we know the industry is strong and flourishing.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

There are already many better cryptocurrencies than Bitcoin (BTC). Even Hive itself. Hive is fast, and there are no transaction fees. These are huge advantages over Bitcoin (BTC). The more people discover these, the more the dominance of Bitcoin will drop.

I love Hive , But it can’t be bitcoin. Bitcoin might not be bitcoin , meaning decentralized &censorship resistant. If we use the volume of transactions we’d see the same issues on many cryptos. Hive is a part of my life and I love e it most. But it would fail in being decentralized money. It’s not what it’s meant for and it’s can’t do it

To be money, people need to be willing to utilize it. This is something that crypto is failing at because of the speculation. You are right, it might always be the case.

Posted Using LeoFinance Beta

I agree with you completely. There are better technologies out there other than Bitcoin. It will serve as the store of value but not much beyond that in my opinion.

Posted Using LeoFinance Beta

My intuition tells me that we're gonna see a plummetting down to 30% dominance this cycle. There are many undervalued alts which are promising projects and those will take back some of that dominance. NFTs though seem to have had their time already. A lot of the BTC pairings in alts are more that tasty.

Posted Using LeoFinance Beta

That might be true. Many are forecasting that.

The key, to me, is when projects start breaking out based upon utility and not just a shift in the speculation from Bitcoin to something else.

Then you are ready to see a huge drop in the dominance since it will crack the door open for others.

Posted Using LeoFinance Beta

I agree with your intuition. I mean the upsurge of meaningful projects will threaten bitcoin's dominance as most of them seek to find solutions to the problem of btc and eth

Posted Using LeoFinance Beta

Really enjoyed your article. Diminishing Bitcoin dominance/influence is so welcome. More capital flowing more into the projects with greater utility will be a big sign of maturity. We're still in the casino stage, as you mentioned.

Posted Using LeoFinance Beta

It does mean a healthier environment overall. Other projects are starting to get some attention.

Posted Using LeoFinance Beta

I think gaming is going to be HUGE in its own right, but also as a stepping stone to real, functional currencies. Totally agree that the future value of cryptocurrencies will be based on utility. If it's all just about market speculation rather than practicality, we're all wasting our time.

There will always be speculation and the market aspect to things. In fact, that is a healthy thing. However, right now it is the only thing. We need to move beyond that aspect of things.

Posted Using LeoFinance Beta

I think for the remaining half of the year, I foresee that more traditional and online games will be integrating with crypto space in different forms. I have seen FTX sponsoring a very visiible Chess Champtionships, FTX sponsoring gaming teams in League of Legends, NBA players promoting NFTs and even Floyd Mayweather espousing Eth.

I see a repeat of this business model the following months.

Could be. I do not follow that segment closely enough to make any guesses so we will go with yours. At some point I believe that companies and individuals will jump in head first.

Frankly I am surprised there hasnt been more activity up to this point.

Posted Using LeoFinance Beta

Utility of course will change the whole narrative especially When it comes to bitcoin in the future. I think we're seeing a lot of inorganic adoption as a result of the market price action, bitcoin will thrive even more, when more people find different reasons to hold it.

Posted Using LeoFinance Beta

It keeps biting me in the ass but I still don't really hold btc. I usually spend it, lately in stuff on hive engine, but next bull run I'm probably gonna divert most over to CubDeFi in one way or another.

Well from the high of $65K, you were validated while everyone who is holding is taking it on the lip.

Posted Using LeoFinance Beta

Lol. Yeah but I mean historically I just can’t hang on to it. A bill needs to be paid, or the price of something else bottoms and I gotta scrounge something together for that, or any one or all of a dozen other reasons.

That’s actually one of the benefits Hive offers me. Staking assets keeps me from spending them. I’d love to find a place to stake btc complete with an extended power down time but for now staking has on Hive keeps me anchored (Ha! Punned you right to your face in front of God and everybody).

I am not sure there is much utility to Bitcoin other than the store of value. It is not going to be a payment system since it is going to be too slow. And if people think that Lightening is going to be anything other than banker run, I think they are mistaken.

Posted Using LeoFinance Beta

I think it's very hard to predict what will happen with bitcoin in terms of market dominance in a few years, things can swing wildly in a few days

Posted Using LeoFinance Beta

It can swing wildly but do you think that Bitcoin will have most of the activity on blockchain and crypto?

Posted Using LeoFinance Beta

Doesn't ethereum have the most activity ?

Posted Using LeoFinance Beta

With the upsurge of different chains trying to improve on what bitcoin has done. The dominance may not go up at most it might just be where it is.

Just what I think

Posted Using LeoFinance Beta

I have a couple of holdings that I am purely hanging onto because I bought low and I hope to sell high. The rest of them are all projects that I actually believe in and see a lot of potential. They have a use case and that means a lot to me. I have always tended to gravitate towards tokens that actually have a use case.

Posted Using LeoFinance Beta

Nothing wrong with that. Speculation isnt a bad thing. We all have our lottery tickets. However, in the end, other than BTC's store of value, I foresee the winners being those that offer the most utility.

Posted Using LeoFinance Beta

I agree

Fair point.

It depends how long will it take for us to get there. I can happen over night, or it can happen in 3 years.

That's the toughest part, to hold and don't get distracted by what your missing...

Well it won't be overnight. Still a long way to go in terms of ease of use before we see that shift. Overall, this stuff is still too complicated and hard for the average person to mess with. They simply are not going to be bothered with dealing with it.

Posted Using LeoFinance Beta

Gamers will earn crypto then trade into Bitcoin. As more virtual worlds/play 2 earn networks develop many players may avoid cashing out to fiat all together. Some of the “one currency to rule them all” talk is just noise. In the end it’s about what is best for the user base or particular crypto community.

Posted Using LeoFinance Beta

True. Once I can easily swap DEC (Splinterlands currency), SIM (dCity), etc., to LTC or BCH and spend with something that auto converts like BitPay or whatever, using fiat only makes me more vulnerable to tax laws. Fucka, fucka, fucka all that noise.

I agree with this till when they notice the use case in a crypto project that meets their day to day needs.

Like you rightly said the future is community and this is where hive has an advantage.

Posted Using LeoFinance Beta

Well given the deflationary aspect of BTC, it will definitely be a top crypto as a store of wealth. But I do think other cryptos like ETH, BNB and HIVE have much more utility and this is where the development is happening.

Posted Using LeoFinance Beta

Yeah tough to argue with the SoV aspect of BTC. It has that title and will not give it up in my opinion. We need something that digitally stores value and Bitcoin is an excellent choice. Plus to do that, nothing has to change. Add in the fact that it is very secure and it is a winning combination.

Posted Using LeoFinance Beta

I mean, honestly, BTC is always going to trend downwards... it's honestly a bit crazy that we measure it at all... BTC is just one tiny possibility of blockchain technology... it feels like measuring Nike dominance on apparel, sure they might have a sizeable market share but with relatively low barriers to entry, who cares what it is at any one moment.

That is all true. However, for more than a decade, it held a fair bit of the "value" at least as expressed by market cap. Even as recently as the end of last year it was over 70%. Thus, even though there is a low barrier to entry, the rest of the stuff was not getting a lot of attention.

That will change in the future I believe as utility starts to enter.

Posted Using LeoFinance Beta

Oh absolutely... the entire blockchain space will always owe Bitcoin a debt of gratitude and you're completely right about the dominance it's held in the past... but the rate of innovation is so high in this space that it cannot continue the rate of dominance it's previously held... there's just too much going on in so many different areas (NFTs, defi, etc).

this could really change the market for the better. E.g., alt coins could have their own bull and bear markets (more or less) independent from bitcoin. Perhaps we are seeing the end of a "global" 4 year crypto market...

I think 4 year crypto markets are gone anyway at this point. Adoption is spreading faster so those gaps should close, hopefully by half or better.

I am not sure things are truly independent at this point. It seems then when Bitcoin gets crushed, everything still goes along with it. Perhaps there will be some separation at some point but I dont think we are there yet.

Posted Using LeoFinance Beta

yes, of course.. it will still take some time

Bitcoin is a transaction based token whereas ethereum is a utility based token. There are many utility tokens which are really fast but few transaction token which are feeless, scalable and fast (<1sec) which are $NANO and $BANANO. Please check them out if you are not aware of the same 👍👍👍

Education again. 😀

!BBH

Posted Using LeoFinance Beta

Because this is such an awesome post, here is a BBH Tip for you. . Keep up the fantastic work

. Keep up the fantastic work

Gaming is indeed one of best market for crypto currencies/assets. @splinterlands has really been a good success and shaping the future of gaming. Next few years, we can expect to see some crypto based gaming. But for now market need to normalize & grow more towards utility and usecases.

Posted Using LeoFinance Beta

I can't wait to see play station reward its players with cryptocurrencies for playing the game.

I feel hive has the potential to take leverage of its use case in going mainstream if we do what is right in terms of pushing adoption.

What do I know anyways?

Nice post

Posted Using LeoFinance Beta

Why don't you think that blockchain-based gaming will happen on Ethereum? I am open to other chains like WAX, Hive's own Splinterlands, etc -- but a lot of the most talked about games seem to be on ETH. Axie Infinity, Lost Relics, and Gods Unchained all come to mind.

Bitcoin is a means to an end, and it also represented the precursor to an entire industry. In the future we will see more currencies come into play and perhaps bitcoin will remain only as a store of value, while other currencies such as eth and bnb will remain for many more economic uses, while the other currencies represent specific uses within the industry.

Posted Using LeoFinance Beta

In my opinion BTC is and will continue to be the mother of cryptocurrencies, thanks to this today we know Blockchain technology (that perhaps something similar would have come out instead of BTC? It is likely), what is clear is that Btc was the one who triggered the word "Decentralization". However, the market vision that we have today is very speculative and with a society that is not yet ready to adopt and support this innovative technology, which leads to a lot of manipulation in the market due to BTC. Over time what you expose is the most realistic thing to happen, if not why do we want another financial system manipulated by large masses? Altcoins will prevail in the future even if Btc in this case loses value on the market.

Posted Using LeoFinance Beta

One of the most frustrating aspects of cryptocurrency markets is not only Bitcoin's hegemony over other cryptocurrencies, but also their dependency of Bitcoin price. There are so many crypto projects with great potential, but they can't advance properly because every Bitcoin price dump has catastrophic effects on its token's price, regardless whether the project is good or bad. With Bitcoin dominance going below 30 % this state of affairs might change.

Posted Using LeoFinance Beta