The cryptocurrency industry is at a major turning point.

For so long, there was Bitcoin and that was all. This was what the entire world discussed when it came to cryptocurrency. It either led to, or was led by, maximalists who believe there is Bitcoin and little else.

Of course, not everyone fit into this category. We are now seeing certain things changing.

Many felt that the future of blockchain and cryptocurrency was far beyond simply one asset class. This meant that, over time, we would see major innovations taking place that would capture the attention of the others. This will eventually lead to increases in their token prices, further reducing the dominance of Bitcoin.

This is something that is becoming evident.

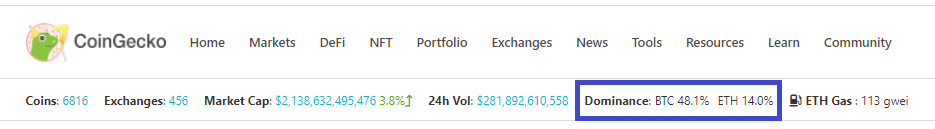

According to Coingecko, the most recent market cap domination puts Bitcoin below the 50% barrier.

We also see the combined total of Bitcoin and Ethereum accounting for 62% of the total.

These are still large numbers. However, it is important to consider that we are seeing a massive shift. It was not too long ago where both those tokens accounted for 70% of the total. Another fact is that Bitcoin was near 70% itself last year.

Naturally, markets ebb and flow. This could be a trend that continues uninterrupted or it could reverse course for a while. Either way, the overall direction of the industry is clear.

Sites like Coingecko do their best to track what is taking place. Yet, there is a lot that is left out of their totals. While most of these are not going to affect things immediately, the culmination of them, over time, could make a big different. When projects like Leofinance and Cubfinance are accounted for, that only adds a few million to the total. Nevertheless, projects like these can 10x or 20x over time.

This is important since there are hundreds, if not thousands, of projects like that out there.

Of course, we are basically overlooking the entire NFT market. We saw some really mind-boggling numbers assigned to some sales of late. It seems as the entire sector is in a mania mode.

Again, we can question whether this will last. Perhaps it will not and a more reserved process takes place. That aside, we cannot dispute the potential that is coming from this innovation. Digital ownership is not going away. In fact, it will only grow as we progress forward. A more digitized world means that ownership representation is crucial. NFTs provide this.

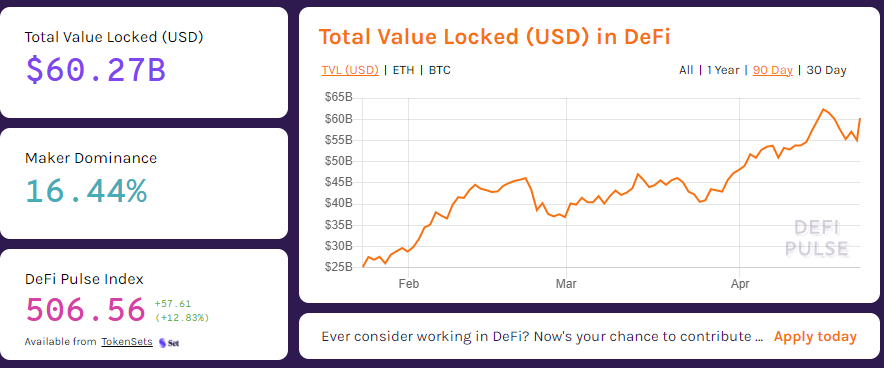

DeFi certainly captured the imagination of the crypto industry. It also is gathering up a lot of money.

Here we see something that is crucial this discussion.

Most are familiar with the DeFi activity taking place on Ethereum. It grew significantly over the last 16 months and continues to do so.

Here is the present TVL according to Defipulse:

We are now looking at over $60 billion. This, however, is not the only game in town.

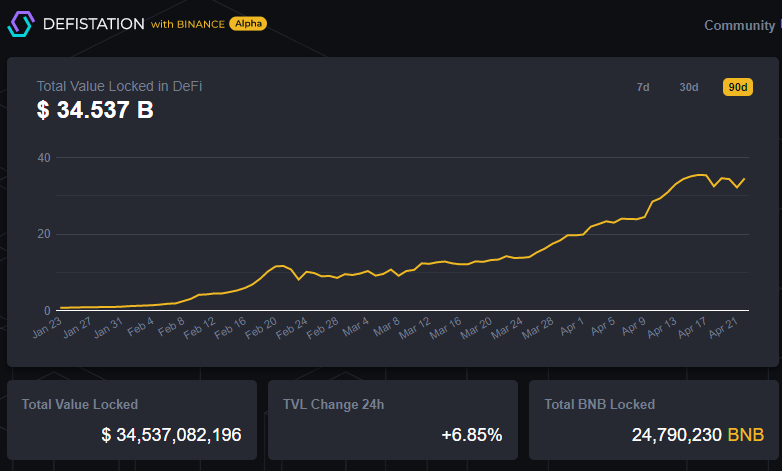

When we look at the numbers on Defistation, we see another large amount of money locked up.

Between the two of them, we are approaching $95 billion locked.

Of course, the later shows the amount of DeFi money locked on BSC. This is an arena that new to the crypto community. It also sent the BNB token skyrocketing this year, giving it a market cap of $87 billion.

Towards the beginning of the year I predicted the DeFi market (TVL) would grow to $300 billion from the little more than $15 billion. That was a forecast of 20x.

If that holds true, which we are on pace for, what will the values of BNB, ETH, and whatever else is involved in that sector be worth?

All of this is important from the standpoint of decentralization.

This is a topic often discussed. It is difficult at times to see how this is occurring when we focus upon a few chains or the token distribution within a particular project.

However, when we take the industry as a whole, we see how this is taking place right before our eyes.

Decentralization is important because it provides resiliency. When something is centralized, it has points of failure. This is no surprise to most in the crypto world. Yet, when we start the process of decentralizing, the attack vectors start to spread out. No longer is it possible to take down the entire apparatus with just a single move.

Bitcoin weathered a lot of attacks. It was the primary target of a near decade long FUD campaign. This was the one that provided cover for all others. Since few were paying attention to what was taking place elsewhere, progress could take place without much interruption.

Fast forward a few years and we see how the shadow Bitcoin provided was put to good use. There are many things starting to take shape which will make it orders of magnitude more difficult to take down. With the increase in overall market cap, the money required is only growing.

At the same time, the number of nodes running different chains is mind-numbing. Who knows how many there are in total. Over the last few years, the number of miners on Bitcoin increased. This does not include what happened on BCH, LTC, and the other Bitcoin forks.

Then we have the PoS systems which keep expanding. They have more master nodes along with block validators. Their totals keep growing with time.

Finally we see the number of whales growing. At one point, there really only were Bitcoin whales. That handful was the financial elite of the crypto world. That is no longer the case.

We are seeing projects (blockchains) become extremely valuable. Thus, large holders in those now have a significant amount of money building up. Many are now compounding it with DeFi, further increasing their positions.

The point to all of this is that the industry, in every way, is spreading out, which is a good thing.

Bitcoin's eroding dominance shows how cryptocurrency is growing and maturing. It is an important step. I would guess that the eventual dominance ends up dropping into the 10% range.

Considering the fact that it is likely that Bitcoin's price is higher in the future, and thus a larger market cap, it shows how much we can expect the entire crypto industry to grow in value.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

I am sure they can only get their hands on just fragments of data,there’s a lot of crypto data out there that they still haven’t been adding to those figures.

Decentralization is here for the masses and the masses will always win on the long run. There are people out there who’s spirit are already here but just not here physically here yet due to misinformation and maybe poor education.

I believe we all can make it out responsibility to enlighten as much as possible to achieve even more greater success.

I’ll also like to make this suggestion, if you would change the POB tag to proofofbrain. I don’t know maybe it’s a glitch on my side but I can’t find it on my feed in proofofbrain frontend

Okay thank you for the suggestion.

I will do that.

Posted Using LeoFinance Beta

You’re very much welcome sir 😎

I know the bitcoin maximalists might not be happy about this reduction in dominance as it brings btc close to altcoins hehe.

I do not really see NFT sustaining the initial hype they had a few months ago, I see Defi continuing with the upward boom.

The defi boom will see a further reduction in bitcoin dominance and that dominance being eaten up by Ethereum(that just made a new ATH a few hours ago) and BNB.

I also see more TVL in BSC than in Eth in a few months because of the low fees in the BSC and this might threaten Ethereum's place!!

Do you think BNB can surpass ETH in the market in the short or long term period??

Anyway, all in all, these developments show the true power of decentralization where any token that brings more value gains more attention.

Posted Using LeoFinance Beta

I think it could be possible. It will all depend upon how quickly Ethereum is able to address the issues they have. If they can get them under wraps rapidly, then it might be tough.

However, if the fees remain elevated for some time and BSC keeps pushing forward, I think it can radically alter the makeup of DeFi.

Hopefully we will see HSC within a few months and that will start the process of putting Hive's hat in the ring.

Posted Using LeoFinance Beta

Ethereum seems unbothered by the high fees though from the look of things.

The Eth guys would have solved the fees issue by now especially after the emergence of BSC, but I do not see anything happening(by Eth guys).

Anyway if Eth works on their fees, it will become competitive and hence give users a choice.

Right now the whales(over $5K transactions) use Eth for their defi and we the rest(as low as $10 investments) use BSC!!

We should all know that the $10 guys are many compared to the $5k folks and this is working in favour of Binance!!! Anyway, let us wait for what the next months will offer.

Posted Using LeoFinance Beta

That is true. The $10 really outnumber the $5K. However, the numbers of the later can get really big. It takes a lot of $10 trades to equal $5K, let alone a few million dollars.

It is good to have choices. The price of ETH is unaffected by the fees because they are not a problem to ones playing with millions of dollars. Hence, they will keep catering to that market until the fees are under control (which could take a while, like a few years).

Choices are good and I foresee BSC only picking up more activity and TVL being locked. The majority of the people coming to crypto will be of the $10 variety.

Posted Using LeoFinance Beta

Still a long way to go, repeat of 2017. Bitcoins dominance I think fell to around 30% and Ethereum was catching up. Ethereum always has a good chance of being the overtaker but yet again 3 I would say even 4 years later the same issue is coming up which is starting to stagnate crypto again and that's speed and fees of transactions.

There are a lot of alternatives now though the issue is non of them are really adopted into the networks yet. If we don't see one of the two following things happen soon it could stagnate things and see a hard sell off again.

Ethereum fixes their fees asap and speed asap talking next 3-6 months

Adoption of faster and lower fee blockchains are taken hold by games, marketplaces etc. Will create one of the biggest altcoin seasons ever and Ethereum's price will come crashing down.

That could be true. However, if someone else (or many others) step up, wont that, in totality, compensate for what is lost with Ethereum, thus further reducing the dominance of BTC.

People keep looking for an alt season referring to price. However, the alts were developing the last few years (and continue to do so). This leads me to believe it will eat up a larger portion of the future crypto-based activity.

Posted Using LeoFinance Beta

Yep for sure it's possible as long as those blockchains have and build use cases. Many like Polkadot and a few others that are side chain I think will be the ones that get adopted in faster than a brand new blockchain.

Still, a long way to go but drop of dominance percentage shows that altcoins are on a massive surge. Likewise, the gap between BTC and ETH was shortened. But unsure if ETH can match BTC soon.

Posted Using LeoFinance Beta

So there are probably 2 different outcomes:

I think 1 is more likely to happen because I think people will chase the high returns and BTC does not provide it.

Posted Using LeoFinance Beta

Or option 3: Both happen.

It could be that all gets diluted but that would apply to BTC also.

Posted Using LeoFinance Beta

less than 50% of the market cap of btc it is very low, i always believe that it was around 75%

but well it is great news for the rest of altcoins

yes the decentralization hepo to feel better kind of security to atack that will come.

well i feel bad when i see ltc because loses the opportunity to bought very cheap but well here are with hive leo and cub that is our little defi experiment,

by the way this morning i read about the possible implementation of social media experiment by aave protol, maybe it would be our competition, it is good because give us the certain that we are make this in good way,

Posted Using LeoFinance Beta

It was around 75% for a long while.

The push down is new. We will see if it continues.

A run up in the price of BTC in comparison to the others can change that quickly.

Posted Using LeoFinance Beta

Like many are saying in the comments I also think bitcoin's diminishing dominance might be a sign of the altcoin season and just part of the natural evolution of the bull market instead of something more profound.

Posted Using LeoFinance Beta

It could be but the problem is, with the idea of an alt season, one is holding the premise that there is just a rotation of money from BTC to alts and back.

That might have been the case years ago but I think we are in a different era. There is money flowing in as well as major development. We are seeing a lot of tokens dropping, some that get major value. UNI and SUSHI are examples of that. Hell there was another token dropped today for those who owned a coin that many seem very high on (I dont follow it so cant really say).

Posted Using LeoFinance Beta

in any case, I want to convert as many shitcoins as I can to tether and get back into bitcoin when it will be on the cheap

Posted Using LeoFinance Beta

You might get there next week at the pace Bitcoin is dropping.

A lot of red.

Posted Using LeoFinance Beta

There is a lot of dropping that must take place until it hits $20.000 :P

Posted Using LeoFinance Beta

That is a really great point about how so many of the alt coins were able to thrive in the shadow of BTC. I have never really thought about it like that before, but that is for sure what happened. Even just the last year watching Hive grow has been pretty awesome.

Posted Using LeoFinance Beta

Yep. All eyes were on Bitcoin since that was the big bear in the room and everyone gravitated towards.

We will see what comes next: there is a lot of development. Anything that starts to pull in people will have the network effect. Bitcoin is experiencing theirs. We will have to see what else can duplicate it.

Posted Using LeoFinance Beta

It will likely be a good handful of projects within the next year I am guessing. I just hope I have my hands in one or two of them!

Posted Using LeoFinance Beta

LEO is probably a pretty good one to be in. Hive also.

We have a lot in front of us that can 10x right before our eyes.

Posted Using LeoFinance Beta

Knew that BTC was losing dominance, but never at so fast a rate! I though BTC had a dominance of about 50% or more, but turns out I was wrong! Goes to show how BTC has become outdated by other younger and newer cryptocurrencies with new technologies to upheave its processes. Do not catch me wrong, BTC is still a great cryptocurrency, I could be exaggerating by calling it "old," (actually is very fast!), but there are much more coming to the crypto world than e-cash transactions.

This is why there is a greater dominance of other cryptocurrencies: e-cash transactions are being challenged by other rising crypto industries (e.g. NFTs, games, entertainment) that are based upon many different type of cryptocurrencies.

Posted Using LeoFinance Beta

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

It is good to see the value spread out to various crypto’s. Hence, the market is creating a wealth effect that lifts all boats. Bitcoin will eventually become a reserve currency for the new crypto economy. Although the legacy system will not acknowledge this notion until after a monumental move has occurred.

Posted Using LeoFinance Beta

Ethereum Hit new ATH and take some of the marketcap from bitcoin

Alt season is starting and I think BTC Dominance is going down and down

Posted Using LeoFinance Beta

I agree as how much BNB will be locked up not on the exchanges as DeFi gets even bigger.$1000 is nothing once this puppy takes off as the demand will drive prices up and up. Lets hope the dominance drops some more and more value flows to the alts. Saw somewhere yesterday that Bitcoin could drop into the mid 30 000 range which would be fantastic for everyone.

Posted Using LeoFinance Beta

Excelente trabajo felicitaciones

Having a lower percentage for BTC is a sign

crypto is fulfilling its dream of empowering

the world.

It will be somethiing to see BTC one day hold 20% of the market and the rest

shares 80%.

Now we are talking about like you mention decentralization.

Posted Using LeoFinance Beta

Many like Polkadot)) and a few others that are side chain I think will be the ones that get adopted in faster than a brand new blockchain.

Posted Using LeoFinance Beta

The leading cypto is wow! ❤️