Everyone loves a good token burn. After all, this can only enhance the value of one's holdings, right?

It is simple mathematics: less tokens out there means the supply is reduced, creating more of an impact on price with the same demand.

This is akin to stock buybacks which the equities' market always loves. So why shouldn't it apply to cryptocurrency?

Source

Therein lies part of the problem. People are conditioned to look at this exactly like they do stock. It is a vehicle for speculation. Thus, the currency element is removed in that incentivization is off the table. Instead, mooning is all people care about.

From this perspective, we can see a major mistake being made. It is, at least in part, why many projects are stalling out.

Certainly, there are many situations where a burn is required. Perhaps the allocation of tokens to start was completely misguided. Some figured having trillions of tokens was a good way to approach things. Perhaps that does require some adjustment.

However, the crypto world is wrought with projects where major progress is monkeying with the token distribution. This is the extent of the development. Just change the inflation rate and we will see things moon. As if that is a magical pill that fixes everything.

Quite frankly, most people in crypto have their heads up their proverbial hind end. They really do not understand the discussion a great deal to begin with when it comes to economics and then compound it by pushing out all kinds of sensible ideas that are basics in business. Hence, since it is crypto, alter the distribution and that fixes everything.

It does not take a genius to figure out why so many projects are flailing. Instead of burning tokens, they should be looking at applying some basic business building principles. That starts with finding a need and filling it. From there, it is developing a product that offers the features that people will utilize. Then we need to add in a bit of marketing to get people using the product. Of course, we should work on branding.

All of this requires, of course, money. Projects need the resources to accomplish these tasks.

"Oh wait, we just burned a chunk of it. But hey, at least our inflation rate mirrors that of Bitcoin."

Does anyone think a country's inflation rate is a problem if the NGDP is double or triple that? For those who understand what that means, the answer is "of course not".

The key is something called growth. An inflation rate of 25% is nothing if the growth rate is 125% annually. The growth will more than eat up that inflation rate. In fact, in that situation, with those numbers, you are likely to encounter a liquidity problem.

"But with a 25% inflation rate, nobody will buy the token."

Let us look at Ethereum, which crossed the $4,000 level. This token distributes 21 million ETH per year. With a present supply of just shy of 116 million (according to Coingecko), that gives us an inflation rate of 18%.

Yet people are still buying it. How can that be?

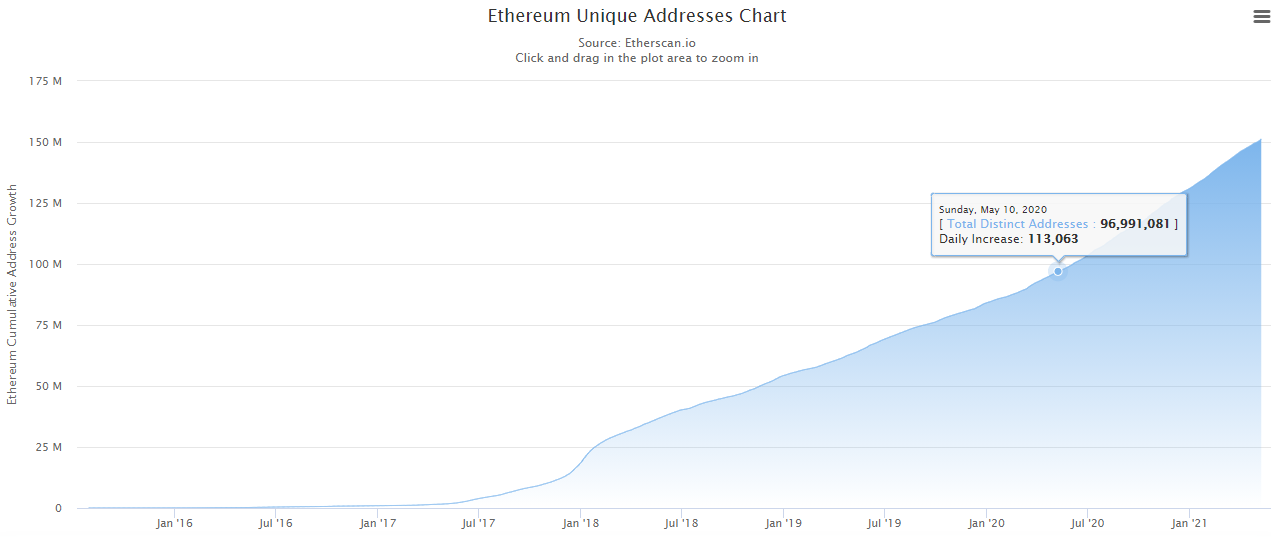

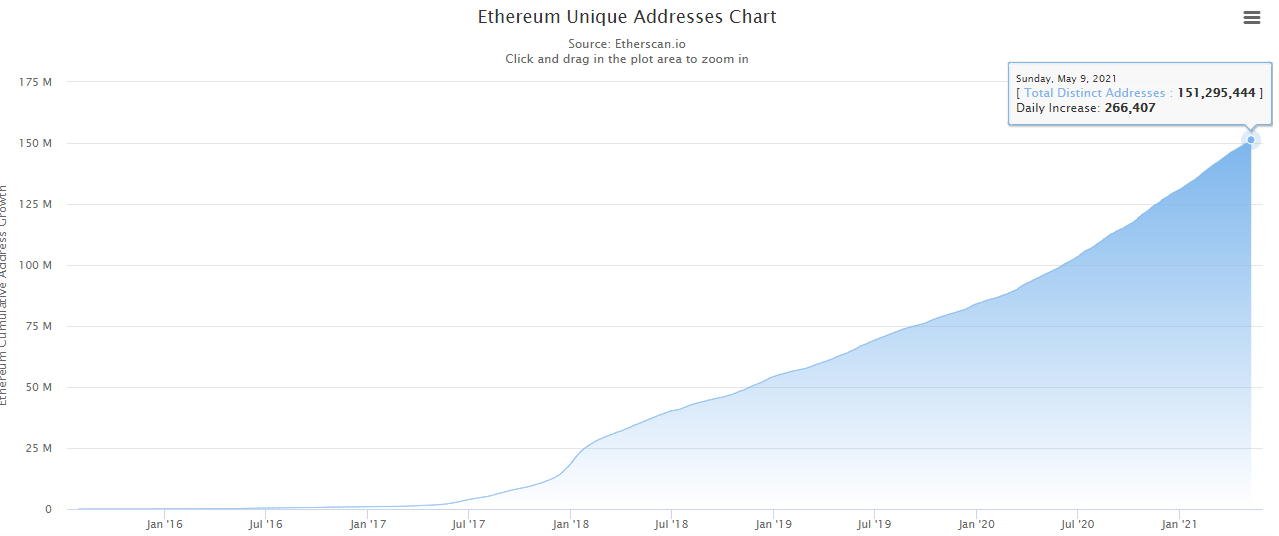

Some might say the shift to PoS from PoW is the reason. That might be true but that factor was known long before this run took off. Perhaps, the following two charts has something to do with it.

This is from Etherscan denoting the wallet addresses from a year and now:

2020:

2021:

That is a wallet growth rate of almost 55% in a year. When you have 55% growth, an inflation rate of 18% is not a problem.

Here we see what happens when building takes place. Ethereum might have some problems but development and growth in activity is not on the list. Here that ecosystem is excelling.

Tokens also can serve other purposes as opposed to being something to speculate upon.

Money is a tool of collaboration. It is also something that can be used to incentivize people. Thus, individuals can be paid for engaging in certain activities.

Tokens are a form of marketing. By their essence, the distribution of them helps to raise awareness of a project. Yet, instead of offering them out to aid in growth, we burn them since, after all, only speculation matters. We want our token to moon and it has to happen now.

We see a lot of token burning taking place and yet projects still are mired in the abyss. Why is that if burns are the magic elixer that solves all problems? The answer is clear: token burns without growth means nothing. In the end, the result is a fantastic token distribution tied to a project nobody uses.

In network economics, we learn that value is derived by the Network Effect. This is situation that operates on an exponential scale. Whether we look at Reed's or Metcalfe's Law, the result is similar. The value of networks grows exponentially as each new user is added. This means 1 new user adds more than that value to the network. The exact ratio is subject to great debate. What is not up for dispute is the fact that linear growth is no part of the equation.

Token burns can be used as part of the growth strategy. We see this in the DeFi world right now. Here, projects offer an insane inflation rate to attract users. Through the staking/liquidity pool process, those individuals are rewarded with tokens.

Of course, the rate is a "teaser" meant to attract money to help grow the project. It is a situation that is intentionally set high with a burn to reduce to the distribution to a more accommodating level. The key here is that it is planned. Token burning is part of the strategy to make the project more attractive.

One of the most revolutionary aspects to the @spknetwork is the introduction of the Service Infrastructure Pools (SIP). Instead of burning tokens, this project is locking them up in, what it hopes is, a perpetually growing liquidity pool. By having the tokens still in existence, they are utilized to generate a return. This return can be applied as incentive for a variety of different activities that the network requires. This is achieving the same result as a token burn in the removal from circulation yet it is still generating more money.

Any project that wants to solve a 10% inflation rate, simply double the number of users each year and that rate will be a non-issue.

Projects that develop and grow will end up succeeding.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

I guess most crypto project burns their coin because it wants to retain value since you don't have a lot of people bringing in the money to buy in these coins, so the Only option is probably to burn the dumps. My opinion though.

Posted Using LeoFinance Beta

Not only people bringing in money but they have no user growth. If it were a business, with no user (customer) growth, what would you say about the prospects of that business?

Posted Using LeoFinance Beta

Well a user base actually brings a certain patency and this will eventually forestall attractiveness, I guess this is why coins like Eth do not need to excessively burn. People give the value a coin has I guess

Posted Using LeoFinance Beta

The growth rate is so absurd, even at the size it is now, that it eats up all inflation. They are continually adding developers, users, and more money. It is an ideal system that epitomized multi-tiered network effects.

Posted Using LeoFinance Beta

Great post, I find that inflation is actually misleading( but recognise it's the generally accepted term) when you think about what it means in the real world, which is the price of goods that can be purchased going up. This means in reality most crypto currencies including ETH are deflationary because over time you can purchase more goods and services with them.

I guess the closest fiat world equivalent of crypto inflation is money supply. ETH as you mentioned is increasing the money supply by 18% a year, that's ok if as you mentioned there is growth. In this case growth is transaction volume growth, and general userbase growth.

High "inflation rates" are fine at the moment as crypto is pulling in more and more people everyday, once the userbase growth stalls, inflation then needs to be reduced otherwise the price may drop.

I don't know about you, but I can't see the growth in adoption slowing down in the foreseeable future so this problem is only a medium to long term issue at which point most crypto would have naturally reduced inflation.

Posted Using LeoFinance Beta

Overall, I agree. The total growth will continue. As for different projects, that is a separate matter. Many are not developing, growing or expanding. In my opinion, they are bound to die off.

When project/community teams start to focus upon this, then we will see something completely different. It is one area where the VC backed projects have an advantage. Those people are forced to think about a growth strategy.

Posted Using LeoFinance Beta

What's Hive inflation rate currently ? If I remember correctly it should go down by a certain amount each year

Posted Using LeoFinance Beta

I think it is about 8%, maybe a bit less. I am not sure what it is exactly, maybe someone else reading this does.

You are correct. I think it is .25 or .5 percent per year. I dont recall which. I believe it is the former.

Posted Using LeoFinance Beta

We need some nice growth to offset that

Posted Using LeoFinance Beta

from what i have seen in the crypto related facebook group, they way of we see the burn is the scarcity of the token or coin, and also less supply means higher price when there is bigger demand.

in some cases those burn might really works well, just like how Cake and BNB are doing, price spike after the burning. that is why we see it taht way, not looking at the growth can really outperform the inflation rate just like you ethereum example

Posted Using LeoFinance Beta

Yes well it is the same thing that gets people excited about stock buybacks. This is following the same premise because it is viewed the same way. The only think people care about is that the price goes up. For a stock that makes sense since there is little to do with that otherwise.

But if one is claiming that a token can be used as a currency as a transfer of value, then there is more to it than just the token price. And unlike a stock, which has revenues and, hopefully, profits, crypto doesnt. So the idea of growth is not necessary.

Posted Using LeoFinance Beta

Very interesting thoughts. I will be honest, I was one of those who are in the camp that just burning a token would help fix the problems. You make some really good points about requiring growth as well. I am in a couple of communities that have a major issue with token supply. I think your ideas about burning and growth would go a long way towards helping that community. Sadly, it may never happen.

Posted Using LeoFinance Beta

They might have major issues with token supply but they have bigger issues with a lack of growth. That is the biggest challenge for any project in crypto (anywhere really).

Businesses focus upon growth and expansion. In crypto, we seem to just talk about price.

Posted Using LeoFinance Beta

It would be nice if they could get their act together! I have a pretty big stake there :)

Posted Using LeoFinance Beta

This is a great post!!!i recommend the team behind cub to read this post thoroughly as it has serious information within. #cub is currently doing well but I think the aspect of marketing I really low. Leo finance as a team has only four thousand twitter followers, that is so low. I think they should up their game on the marketing because they definitely have a use case.

Defi beginners should ask read this. It was a wonderful read

Posted Using LeoFinance Beta

CUB has a built in token burn because it started out with a very high distribution rate. They are offsetting that by burning the token from the fees generated. That was something that was designed into the project from the start. That is a big difference from the idea of deciding to burn since one feels the price is low.

As for Leofinance, they are still at the development stage. When looking at what is offered, there is some stuff to market but most of it is just blogging. The key is to keep building layers that have broader appeal. CubFinance is a start with that although still at its first layer. We will see what the Kingdoms look like once that is released.

Posted Using LeoFinance Beta

Yes if you have enough growth and demand then inflation isn't needed at all. I like the ETH examples and I am sure it is similar for LEO.

I think this is the issue for most communities and projects. After a while, they are having trouble keeping their own members so they aren't even focused on gaining more users.

Posted Using LeoFinance Beta

True. Any project (or business) needs to generate enough new users to offset those lost to attrition.

Posted Using LeoFinance Beta

Whenever a crypto that is not burned, I think of $TRX. It is more leaning negative in my mind.

Guess there is another side of the story. Learning new things everyday.

Posted Using LeoFinance Beta

I would say that TRON has other issues outside of a lack of token burn but that is just my opinion.

Posted Using LeoFinance Beta

Very cool, this new project seems like a seriously huge beacon of hope for hive and will start to bring in more and more people. I can't even tell you how happy I am to see a new front end that is seriously a business. I think the only other one that really does this at the moment on any type of scale is Leo.

Lately I've been seeing "burn" posts and just think what a wasted amount of tokens. Instead use it as a development fund post while still providing value such as updates going on or project goals moving forward and allowing the community to vote that way and raise some funds.

There's so many OTHER options that could be done besides a simple burn. While yes a burn does make sense in some cases in most it would be better spent on those new to Hive or creating DeFi etc around it.

I'm curious would it make sense to build a DeFi project that only uses HIve?

It would make sense but is not possible since Hive has no smart contract capabilities. So, there is no way to DeFi in the sense that you are thinking on Hive. That said, Hive does offer some DeFi capabilities with more being built. The project @klye is working on, @hive.loans, is one such example.

Posted Using LeoFinance Beta

View or trade

BEER.BEERHey @taskmaster4450, here is a little bit of from @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Should grow the number of users. The more token holders mean the more demands.

I am yet to discover this @spknetwork. I'll look up about it.

Posted Using LeoFinance Beta

They have a 57 page "Light" paper. It is very enlightening but not exactly light reading.

That said, very informative and an exciting project.

Posted Using LeoFinance Beta

I'm still uneducated on how the token creation and distribution system works, but regarding the SIP, is that something that has to be baked in from the start or could a pre-existing token be altered to do something similar? It seems like that's something every tribe token should have going forward.

The SIP is there from the start for the 4 tokens mentioned. This will enable trading of the tokens as soon as they are introduced. The second the first LARYNX token (miner) is bought with Hive, that is broke up into the 3 parts and is part of the SIP forever.

I imagine that will be available to every community on Hive. They will be able to create their own SIP with whatever token they have. It will have to be on the Spknetwork I would imagine.

Posted Using LeoFinance Beta

Considering what brofund and SPI are doing it a seems like that would be a natural evolution for those tribes in particular. I really should break down and try to tackle that lite paper.

How has LEO had no delivery? Didnt they just go live with LeoBridge? Didnt they bring out CubFinance?

And did you see the weekly stats? I am not sure you can conclude that based upon the numbers. They appear to be operating within a range.

Posted Using LeoFinance Beta

Awesome.

D ;) iteresting ;))

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 46000 replies.

Your next payout target is 122000 HP.

The unit is Hive Power equivalent because your rewards can be split into HP and HBD

Your next target is to reach 900000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Support the HiveBuzz project. Vote for our proposal!

Funny enough I was thinking along similar lines and was going to look Ethereum up this week as wondered how many tokens they have. Use cases is the ultimate as burning is just too easy and in many ways the lazy short cut to the riches. DeFi has created pressure or some buying demand on tokens like BNB but they are still burning and it has generated huge growth from nothing to over $600 and at some point will no doubt hit above $1000 and looks like they are shortcutting the value growth time.

Posted Using LeoFinance Beta

You said it better than I did (well, except for your lack of any Monty Python references ... 😀).

Thanks!

I never understood the reason for burning tokens, especially when you have low liquidity or even a low circulating supply. That's a false substitute for not enough growth.

Posted Using LeoFinance Beta