It is the Wild West. There are exit scams. It is an arena where one needs to tread lightly.

However, it is also a place where millionaires are being minted on a regular basis.

Bitcoin set off the cryptocurrency craze and, for those who got in early, the opportunity at financial freedom was presented. Many of the early adopters are now millionaires, many times over.

This story is being replicated in the Decentralized Finance (DeFi) world.

As the market cap for cryptocurrency surpassed $2 trillion, and overtook the banking industry, DeFi is establishing itself as a major threat to the traditional financial sector. Many of the banks are aware of this, looking to enter the space as they try to remain relevant.

Of course, this leads to calls for more regulation as the existing financial establishment cannot lose control. Thus, everyone from bank CEOs to regulators will want to get a handle on this.

Whether that happens remains to be seen. In the meantime, we are seeing people make boatloads of money off this sector. Yield farming is now commonplace as the amount of money locked into DeFi platforms keeps growing.

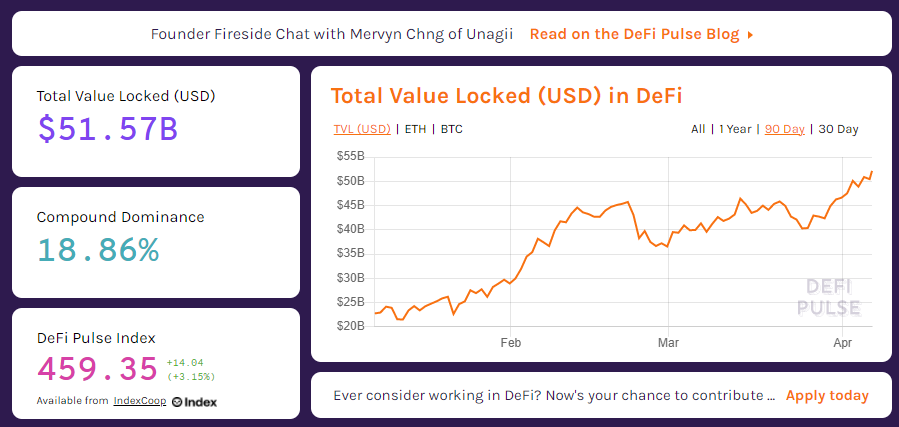

According to Defipulse, the total amount locked is now over $50 billion.

It is important to note this was less than $1 billion a year ago. This also does not appear to include the money that is being locked up on the Binance Smart Chain, which technically does not qualify as DeFi. Nevertheless, due to the lower fees than Ethereum, a lot of money is flowing onto that platform.

The Wild West mentality is surely to wane over time. As we saw with the ICO craze of a few years ago, the mania that takes place usually masks some underlying value that is being created. So while the SEC is sifting through what it views as lawbreakers, the industry keeps evolving and growing.

One of the key elements to DeFi is the ability to generate outsized returns. Through the use of tokenization, the ability to create new currency, platforms can incentivize people to lock their money up. By offering the incentive, massive amounts of funds can be shifted very quickly.

Here is where people can see enormous gains. When there are returns of 1,000% offered for a couple weeks, one can really cash in if enough is put forth. Of course, those who are adept at this keep moving their funds around, getting these types of returns for months on end.

It is not, of course, without risk. There were a number of exit scams that made headlines, as people took off with millions of dollars. Hence, it is an area to be very careful in.

Nevertheless, this new sector is generating a lot of wealth for those who are getting involved.

If we overlook the 1,000% returns and focus upon something a bit more viable, we can see how things can grow very quickly.

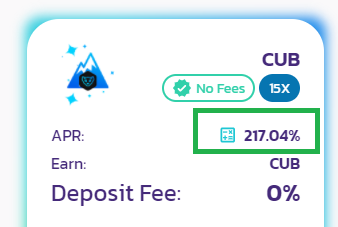

Taking CubFinance as an example, we can see the return on the CUB token is now over 200%. That is a remarkable yield especially when we consider that banks are paying 1% if one is lucky.

A 217% return will amount to a large amount of money over time. How long this particular rate lasts will be determined. However, even if it "falls" to a 25% annual return, that will end up being a compounding machine. After all, Warren Buffett became the richest man in the world some time back by garnering a 20% annual return, over decades.

Cryptocurrency is a lot like playing the lottery. It only takes being right once for the payout to be life changing. With DeFi, getting involved in some of the more upstanding projects can be a terrific way to garner a fantastic return.

What is really fascinating is that the process keeps growing. As the industry starts to unveil more applications, people who are getting the returns have expanded choices. Thus, one is able to take the profits from yield farming and move them into other arenas.

Ultimately, we are going to see an across the board suite of products for people to use. This will enhance their returns to an even greater degree. As the sector fills out, there will be many different risk levels to choose from. Not everyone is willing to roll the dice, trying to get the massive returns. Many prefer lower risk environments with a steady return.

All of this will eventually be available. DeFi is providing the opportunities that Wall Street had access to yet was out of reach for most of us.

Now that equation is changing and we know the present system does not like it. The abovementioned $50 billion is not money that is resident outside the banking system. With the mindset of those who are presently involved in DeFi, it is money unlikely ever move into that realm. As the value keeps growing, this is a lot of money the bankers are missing out on.

Source

The real power that is being erected is seen in the ability to compound returns. For now, the challenge is time, or lack thereof. The power of compounding truly comes from the use of time. As it passes, the amount of wealth generated grows exponentially.

Of course, as noted, a year ago the DeFi world was under $1 billion. While the growth rate over that time was outstanding, it still lacked the benefit of time. A year is not long in the compounding world.

However, each day passes, providing an even greater return. Thus, the growth that will take place going forward will be even greater than it was in the past. We have a lot more money as the basis to compound plus a great deal of time ahead of us.

Collectively, or on an individual basis, the impact is the same. Accounts can grow rather rapidly simply by enjoying powerful returns over time. DeFi is offering that to individuals. For many, this is starting them on the path to financial freedom.

And for a few that are heavily involved, DeFi is doing a lot more for them.

Each day, it is minting more millionaires.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

????

Posted Using LeoFinance Beta

BSC is not a decentralized blockchain so what is built on it isnt technically DeFi.

Posted Using LeoFinance Beta

CUB has so much potential as many other DeFi Projects.

We have already seen some go out of business and other settle as long term players "offering just 25% APY" which means their coin is seen as valuable and there is no easy way to get it at it could have been the case a few months back.

What I like about DeFi is that it rewards early adopter, the one who take the risk to pledge money into a new prokject / team / company ! And these people should be rewarded, this is how finance should work.

Take care and keep farming @taskmaster4450 !

Posted Using LeoFinance Beta

It is great that is an option for people with the potential for explosive growth.

If that can follow what the other DeFi tokens have done, we could have a real winner on our hands.

Lets see what happens once LeoBridge rolls out.

Posted Using LeoFinance Beta

Indeed, I think this and Kingdoms might be the key to onboard huge amounts of TVL on the CUB platform.

Let's be also thankful that most liquidity actually stayed despite ups and downs in terms of CUB pricing. This is a proof that users believe in the platform/team !

Posted Using LeoFinance Beta

There is so many crypto options to invest in but only a few will thrive. Hoping to be participating in the ones that will moon like CUB. Thanks.

Posted Using LeoFinance Beta

We do need to be judicious with what we get involved with.

It is hard to tell which ones will be successful. Thus, when we find one that is likely to excel, we have to remain strong.

It is the lesson from the Bitcoin HODLers.

Posted Using LeoFinance Beta

This is definitely me, especially as far as my bitcoin is concerned.

It's an interesting questions as to what I am and am not willing to risk. I put my DEC into the DEC/BUSD farm because I think I can earn more if necessary.

However, I am less inclined to risk Fiat even though returns in traditional banks are pretty much 0 now.

As I learn more about DeFi it might be fun to set aside a small amount I'm willing to lose and play with it. Just to see how far I could go. However, there will come a threshold where, once crossed, it will no longer feel like playing. I'm not sure exactly where there that is. Maybe I should play the game and find out. 😂

Posted Using LeoFinance Beta

I'm also cautious, not jumping in both feet, but still, I trust the project and have invested quite a bit.

They say profit is for those who take the risk and this is true. Look at how much those, who joined the first day made.

In my opinion you have to be ready for every occasion.

Posted Using LeoFinance Beta

There are way too many opportunities nowadays to be ready for them all. I'm learning to be more discerning nowadays and try and only go for those that fit my long term strategy. Although, having said that, I'm still learning what my long term strategy is. 😂

!ENGAGE 30

Posted Using LeoFinance Beta

Tell me about it! It's crazy how many we're missing out, but then again, we can't be everywhere, can we?

My long term strategy is changing by the minute 😂

Posted Using LeoFinance Beta

😂 !ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtokens.ENGAGEtokens.Like you, I am also on the cautious side @gillianpearce, perhaps as being a smaller investor who simply can't afford a large downside. I will never be an active day trader, nor someone who chases the latest super high yields around.

I need that bit of fiat I hold, in case I suddenly face a large car repair bill or maybe a new water heater at the house. Whereas it is not a fear of putting "skin the the game," it's just not functionally reasonable.

Sometimes I feel like I'm a bit of a stick-in-the-mud among the many "High Flyers" around here!

=^..^=

Posted Using LeoFinance Beta

Me too. No way would I risk my mortgage repayment in crypto even if the fiat returns are non existent. I don't have enough working years left to make it back. 😂

I don't mind being a

if it gives me peace of mind. In the wider scheme of things we're still cutting edge anyway. If I had a penny for every time someone responded to my answers to their questions with "I don't understand but . . ." I'd be very rich indeed.

!ENGAGE 30

Posted Using LeoFinance Beta

ENGAGEtokens.A good way to get a foot in the door is to participate in some Airdrops. With Airdrops you are not forced to invest your own money. If you search around on Twitter for example you will discover some from time to time. It‘s at least a good start for people who don’t want to risk their fiat. Try it out.

Posted Using LeoFinance Beta

That is where each person has to assess his or her own risk tolerance. of course, as more options become available, it will encompass more people since we will see less risky alternatives appearing.

Either way, it is good you are involved with your DEC. That should provide you a nice return.

Posted Using LeoFinance Beta

This is what I'm waiting for before I risk my bitcoin.

Meanwhile, once I've worked out the fees, I'll be saving up my DEC, swapping some for more BUSD and getting more into the farm. This part still feels more like a game to me. 😊

Posted Using LeoFinance Beta

Now you are starting to get the money game. This is what it is to Wall Street. The money is just a way to keep score.

So, in my view, the sooner we get into the game mentality, the better we will be in the long run.

It is much easier when the emotion is removed from the equation.

I hope you make a ton off your DEC move.

Posted Using LeoFinance Beta

Thanks! That would be when it gets interesting. At some point it, if I make enough, it will no longer seem like a game and will start to matter. 😂

I don't know at what point that will be but I'm willing to find out. 😂

Posted Using LeoFinance Beta

LOL and then if you make enough money past that, then it becomes a game again.

Posted Using LeoFinance Beta

OK. So now I have 2 targets . . . play the game to the point where I make enough to start feeling nervous about losing it.

Keep playing until I make so much it becomes a game again. 😂

Posted Using LeoFinance Beta

I really like that perspective. It is all a game, and the money keeps score.

Posted Using LeoFinance Beta

This is completely new for me.

Do you mean Dark Energy Crystals by DEC?

If yes, then what can I do with it to earn more (besides playing the Steem Monsters/Splinterlands game)?

I currently have 3380 DEC.

I'm not sure that DeFi is the best place to earn more as you could end up with more BUSD and less DEC.

Also, unless you have BUSD you'd have to swap half your DEC as you have to have equal amounts of the 2 tokens to be in the farm. And every time your swap or harvest you have to pay fees so you need a good stake to start with.

I'm new to Defi so learning as I go.

One way to earn a little extra DEC is to join a Guild. Maybe check out the Team Possible one. They're very helpful and will advise you of the best way to go.

!ENGAGE 20

Posted Using LeoFinance Beta

Thank you. Then looks like DeFi is not for me at its current state. By the way, I am already a part of the "BuildTeam" guild.

I also know that winning a battle with an Alpha and/or a Gold card(s) gives additional bonus(es) (sometimes I use both, and I get a bonus for both of them).

ENGAGEtokens.I'm very curious to see when and who is going to join DeFi first. Regulations need to be set first, that is true but sooner or later we're going to see them join. The growth rate is absolutely mind blowing.

Posted Using LeoFinance Beta

I think the idea of DeFi is for it to operate outside the realm of regulators.

They can oversee centralized entities but those decentralized, it gets very tough.

Posted Using LeoFinance Beta

Ok, let me explain. When I said regulation is needed, I wasn't referring to DeFi, but banks, regarding how to participate.

Posted Using LeoFinance Beta

We just need to keep chipping away at the banks business.

If we do that, they will be not relevant.

This happens by pulling as much money out of them and putting it in crypto. With less money, there is less than can do.

Posted Using LeoFinance Beta

Well, I have been doing that for some time and after the last stunt they have pulled, I'm not sure I could ever trust them.

Exchanges are also a risk though. Not your key, not your crypto. I'm not holding much on exchanges, but I'd like to trust them.

Posted Using LeoFinance Beta

Exchanges come with the typical 3rd party counter risk. However, some are more reliable than others. It is vital to know who is insured against hacks.

But in the end, it have to be your crypto.

Posted Using LeoFinance Beta

Yes, it's better if it's your crypto.

Is there any way to check which exchange is insured and for how much? I suppose they have to make it public or I just think that because it would gain trust?

!ENGAGE 30

Posted Using LeoFinance Beta

ENGAGEtokens.I really wanna be the high risk person and make 100x but it is hard when I've lost ALOT back in 2017 doing that 🤣.

I find I always go hum this could pump and think but it could dump worse and bam it pumps,

Eventually your losses will flush into wins and you will be ready to invest again.

Posted Using LeoFinance Beta

The returns on CUB are absolutely insane at current, the pairs are great but I had a set goal to reach for the Den first and now working towards pairs.

I wanted to play it safe and have a HODL amount then take a bigger risk. The number in Defi are huge! I keep wondering why we don't have large numbers entering CUB yet but also thankful we don't at current. Gives me time to BUIDL

I would guess because it is not that well known at this point in time. With a bit of promotion, it might be able to grow rather quickly.

LeoBridge could be something that really sets it apart and enhances the value of CUB.

Posted Using LeoFinance Beta

I totally agree with that, which is why I'm buying as much as I can atm before everyone millionairs and I'm left out 🤣

Posted Using LeoFinance Beta

I am inclined to agree with you. I have to get some more. Cant have enough.

Posted Using LeoFinance Beta

I'm not a huge fan of the Uniswap-style defi products.

They're simple and fun which is cool. And there's some nice innovations there. But I'm not convinced they're the future of crypto.

Plus the APRs start to look dodgy if the overall market turns.

I think order book DEXes, where your funds remain in your own wallet, are interesting. Although still a bit clunky.

And decentralised funds/indexes (baskets of crypto) and structured products (e.g. crypto exposure investments with guaranteed minimum returns through smart-contract-linked derivatives) should arrive soon. Lots of potential for innovation there.

Posted Using LeoFinance Beta

Without a doubt, we are in the early stages. It will be fascinating to watch what innovation takes place. We could see things going in many directions, some of which we cannot fathom at the moment.

The future of yield farming is set in my mind, it will be there. As you mentioned, the numbers look dodgy and will likely change. I do not foresee 1000% returns being common.

However, options that offer 20% or even 30% returns seems like especially if they are coupled with innovation comprising of derivatives and other products.

Posted Using LeoFinance Beta

Nice to see you around.

Will you be hosting 50 word stories again?

Posted Using LeoFinance Beta

Hey!

No stories for the moment. I'm all buidl for the time being. And trying to make the most of the bull market!

Posted Using LeoFinance Beta

I have stayed away from DeFi to date but the DEC/BUSD pair has a low chance of impermanent loss, not as large in comparison but still huge APR and is run by a team I am willing to trust enough to put a reasonable figure in

Posted Using LeoFinance Beta

It all starts somewhere and you have to be comfortable.

Good luck with the DEC farming.

Posted Using LeoFinance Beta

I never put the compound into perspective. The statement about Buffet and 20% I was worried when the CUB den dropped below 200% - HAHA. The biggest risk would be CUB price dropping, but if you CDA into CUB I think that limits that risk. The next risk would be the project folding. I think the risk/reward is worth it.

Posted Using LeoFinance Beta

Yes well when people realize what the returns are in the present financial system and what is making people rich, it should put things into perspective.

Hopefully we see the returns far outpacing what is given in the traditional realm and keeps attracting returns.

Posted Using LeoFinance Beta

Defi and expanding alts should keep us busy for a bit.

Aware of impermanent loss one could easily choose the best pairs to set its amm defi farm either on a short or long term. But the exponential grow of a collateral like bnb make it difficult to keep APY calculated in $ significant and worth the risk.

There are also other options.

So yes that has to be factored in but there is a lot more that can help to generate a return.

The DEN for example still pays a good APR.

Posted Using LeoFinance Beta

Sorry for my late question, what is DEN ?

"The shelter or retreat of a wild animal; a lair"

It does not seem related to hive ? Do you mean https://den.social/ ?

Yeah, I feel like I'm probably missing out on some pretty big gains with all of this defi stuff but it's very uncomfortable to get involved with. Lot's of moving stuff around. And then the rug pulls... Cub has definitely helped me learn the ropes. Hopefully Kingdoms can increase the knowledge and I never actually need to go anywhere else.

Posted Using LeoFinance Beta

You hit the nail on the head. Being able to do things safely is paramount. It is no good to have an outstanding return then to have the rug pulled.

What that amounts to is 100% loss.

Posted Using LeoFinance Beta

One just has to look at the top 20 to see how big DeFi really is. Many of these tokens are not even 1 year old which is a tell tale sign of how quick and big this has become. There is so much more to come as I am seeing launchpads opening up all over on various block chains.

Posted Using LeoFinance Beta

That is also very true. The DeFi money is going rapidly.

Hopefully CUB will follow suit and shoot up the charts.

We will see what the future holds.

Posted Using LeoFinance Beta

Without a doubt, it is a very exciting industry and fortunes are being made every day.

From a personal temperament and risk profile perspective, much of that water is a little too hot for my comfort zone. Maybe that's related to being a much smaller investor and really not being in a financial situation where any kind of significant downside is acceptable. "Never invest more than you can afford to lose," as the saying goes.

The thing I find interesting — to say the least — about the whole DeFi craze is that people are out there chasing yields in the hundreds (if not thousands) of percent and yet so many look at inflation as the giant bugaboo that will kill everything. There's something about the disconnect between the two that's a little dodgy, to me. But maybe I'm missing something...

=^..^=

Posted Using LeoFinance Beta

Most people are clueless about inflation. They simply keep espousing stuff they read online and think they have some idea about the economics of it all.

You are absolutely correct, the payouts for these projects are coming from inflation yet people over look that.

Yet when the Fed prints money, they are screaming to high heaven.

Posted Using LeoFinance Beta

I can't wait to notice the compounding in my Den. So far its slow going..

It is a slow process. I think it is important to keep in mind the compounding is going to be reflected in USD also. Hard to see when the price of CUB is going down. That will not always be the case, hopefully.

Posted Using LeoFinance Beta

Funny, but DeFi is minting millionaires same way as the FED is printing dollars. Out of thin air. Crypto seems much more palpable and trustful though.

Posted Using LeoFinance Beta

Peter Schiff just compared the inflation rate of crypto to fiat. He is correct. That doesnt mean that gold is the only answer like he says but does show how misunderstood inflation is.

Posted Using LeoFinance Beta

I just checked to make sure after seeing your screenshot. CUB Den returns have actually gone up! I was honestly expecting these to slowly get into the double digit rates. But they have actually gone back over 200% These are some amazing things you can have on LEO (and HIVE).

S17 Jive Bunny for Easter.PS: If you are interested, @risingstargame has some great deals in their NFT market. The latest is their limited edition

Posted Using LeoFinance Beta

Not sure why that happened but I noticed that too. Perhaps there was money pulled out of the some of the other Farms.

Or maybe it has to do with the drop in price, if the price goes down in USD, the amount of CUB produced provides a greater return.

I am not sure how it happened although not complaining.

Posted Using LeoFinance Beta

I checked some of my old screenshots. They changed the multiplier from 10X to 15X. Earnings have only increased ~40% during the last two weeks. If it wasn't for this change, the APR would have gone much lower. It's really clever what @leofinance did. My post on this will be published soon.

And here we are, those of us who invested time in the Leofinance Team, participating for free.

Posted Using LeoFinance Beta

The value locked in CUB will get many to the moon in about 2 to 4 years.

Posted Using LeoFinance Beta

I agree as long as the development keeps taking place. If that happens we are going to see a massive jump in the price and value.

We see it with other applications of this nature. If the TVL jumps a great deal, we will see a lot of value there.

Posted Using LeoFinance Beta

I hope so..

Posted Using LeoFinance Beta

I'm waiting for more defi projects build on hive or related to hive. I'll be much more confident to jump in then

Posted Using LeoFinance Beta

I would think that HSC will lead to that once we get that released.

Are you involved with @brofi at the moment? That is DeFi on Hive Engine.

Posted Using LeoFinance Beta

I'm trying to accumulate more random hive engine tokens before jumping into brofi

There are only a few tokens it seems worthwhile to send to @brofi.

The rest dont seem to pay a return.

Posted Using LeoFinance Beta

that's good to know

Posted Using LeoFinance Beta

Very interesting article. DeFi will continue to grow and provide more investment vehicles once cross-chain protocols are in place. It's my belief that the next major expansion in DeFi follows interoperability between the various chains. Thank you.

Posted Using LeoFinance Beta

Interoperability is vital. We are starting to see some progress on that end.

Being able to cater to users regardless of their area of comfort i.e. blockchain, is important.

That is going to be what I believe the next year will be about; filling in the holes between chains.

Posted Using LeoFinance Beta

I couldn't agree more!

Posted Using LeoFinance Beta

And if interoperability can be accomplished in a cost friendly way the entire system will benefit.

Posted Using LeoFinance Beta

2 trillion ya wow that's a big number,

It seems that this world is finally here to stay and it is already making a dent in the system, so I think that this is revolutionizing finance as we know it.

Of course that is the reason why banks are quite concerned that the business is getting out of hand,

They are already trying to regulate it but as we say it will cost them

Yes, I never understood this about yield agriculture, but when I see exhorbitant interest rates, I believe that that is what the banks are seeing and it is calling their attention that they are losing profits, so they are going to go away because of taxes, that is for sure.

jaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaa anyone would be happy to invest.

Well I think we will not be millionaires but at least we can be among the lower middle class in these terms or who knows the turns that life takes.

Posted Using LeoFinance Beta

It is a different realm.

The best thing we can do is to keep pulling more money out of the banking system and putting it into crypto.

This is how we bleed the banks.

Posted Using LeoFinance Beta

Very true it is a good option since in truth we will be receiving 1% we are never going to double our capital, while around here in the crypto space that will not happen it is true, we will always obtain good performance at least for now, maybe when it is overcrowded it decreases a little but for now we can take advantage of this momentum.

Posted Using LeoFinance Beta

I really wish I had the funds to get into some of these early like some others did. The numbers of Cub that some people are pulling in on an hourly basis are nuts. I can't even imagine I will ever be at that level. It is pretty awesome for them. Something to aspire to I guess.

Posted Using LeoFinance Beta

Well even getting in with what we are being rewarded with is a good starting point. Whatever you have in there is going to enjoy a nice ROI.

The key in my opinion is just to get started. Get the compounding started to work for you.

Posted Using LeoFinance Beta

Yeah, I am working on that. I just seem so Busch league compared to some of the people on here. It is very humbling.

Posted Using LeoFinance Beta

You can only start from where you are at.

And dont worry about other people. Just focus upon the return in your account and the percentage you are getting.

A 200% gain will add up a great deal over time. It doesnt take too many years like that to have some serious money.

Posted Using LeoFinance Beta

Yes, that makes sense. I guess I just got carried away in the excitement today. I am sure tomorrow I will have a cooler head.

Excitement is good. Nothing wrong with getting overly excited about all that is taking place here.

Posted Using LeoFinance Beta

For sure!

Really though, any profit that you make is still profit.

Things in crypto move so fast that we can't keep looking over our shoulder for what we missed, we just have to be prepared at where the next one is coming from.

Posted Using LeoFinance Beta

Get in the game no matter how it is done. If that is the case, we will see returns appearing.

Posted Using LeoFinance Beta

Yeah, that is a great point of view to have. I was just alerted to another missed opportunity today. I am sure as heck going to make sure I am ready for the next one!

Posted Using LeoFinance Beta

I tend to be a bit more careful when it comes to investment so I also prefer the safer investments. Why? Because if you lose 20% of your investment, you need 25% to get back to break-even.

This is why choosing your investments wisely is a good idea. Even if something has a 1,000% APR, if its value drops by 100x then you will lose money. But yes if you get into good Defi Farms, then you can easily earn 100x your initial investment.

Posted Using LeoFinance Beta

That is definitely real math that you are spewing.

I would not go into defi with anyone except the LEO team.

Posted Using LeoFinance Beta

Yea you definitely need to do a bunch of research before deciding where to invest your funds. There are just as many scams out there because of the money involved (since they can just spin one off open source code).

Posted Using LeoFinance Beta

Yes, the Defi has made a real revolution in the world of finance and has placed banks in front of a difficult challenge, as you mentioned a return of 200%, 1 or 2%

Crypto betting remains the best for the time being

Posted Using LeoFinance Beta

how much will I need to put into CUB ;)

More.

And Soon.

And make an announcement to announce that you will be announcing what you put into CUB.

Posted Using LeoFinance Beta

already did that! Waiting for the comments on my announcement

I am glad because Leofinance introduced defi to Hive, defi was all an abstract idea late last year as I couldn't participate in it because of the high eth fees.

I am glad I can also mint some small money through staking Cub in the cub defi dens ...I just increased my stake today to 31 Cubs, hope to keep increasing it weekly

Yes! Defi went from being an abstract idea, to something I am able to explain.

Posted Using LeoFinance Beta

Even better it is now something you can show.

Posted Using LeoFinance Beta

It all grows over time. That is the key.

DeFi, when properly done, is powered by compounding.

Congratulations on achieving the level you did.

Posted Using LeoFinance Beta

I don't know if I will win or not

but I know that today I am part of it.

I Love this post.. Love this idea ...

This is awesome . .

I am new on this platform , I like your post so much .

I request you to give me some tips to be successful on this platform .

Success is not going to come from begging, patronizing, or anything else of that nature.

Get involved, engage, and add to the interaction.

Posted Using LeoFinance Beta

Thanks a lot ..

Keep me in prayers.

Defi is the future, I'm currently all in on cub

Good post, have a nice day dude!

Posted Using LeoFinance Beta

Crazy and beautiful - both at the same time!

Posted Using LeoFinance Beta

haha, love the metaphor of Defi minting millionaires!

Defi will be worth trillions in a matter of years.

This bull run will be the catalyst - hopefully, we won't experience the same retracement as the last time.

Posted Using LeoFinance Beta

DeFi is eating Wall Street

Posted Using LeoFinance Beta

DeFi does for sure provide awesome opportunities to make great returns on the capital invested.

But with great returns, there always comes risk.

That's why I stick to trusthworthy projects, and CUB-Finance for sure is one of them!

Posted Using LeoFinance Beta

what strange and interesting times we live in, a good read, cheers!

Posted Using LeoFinance Beta

I really got in small, since I am not a bigtime investor. I locked up about 170$ in the CUB-BUSD farm and move the cub earned to the DEN, it is a nice way to make a little bit of extra on the side, and I wish I had more to put in there. I love CUB and after this fantastic audit I think more money is going to be locked in this project. I will just keep on harvesting my small amounts and compounding them, occasionally adding additional funds. One day we will all be millionaires. Hive and Leo are not mainstream yet, but @nathanmars is already doing a great job with twitter marketing and even I was able to get 12 users to sign up in only 2 months. If we go mainstream we are going to the moon or mars or beyond :)

Posted Using LeoFinance Beta

Read and liked! I agree especially with the part that states year long returns of 20% will make you a very rich man!

Posted Using LeoFinance Beta

Info yang bagus