In this article we are going to look at the relationship between the Hive Backed Dollar (HBD) and $HIVE along with how most seem to get it all wrong. This is going to counter much of what people know although they discuss it regularly. Even on Hive, we have the situation where people selectively apply what they want when it comes to money.

And as always, things get botched up because of the complexity of money.

One of the inspirations for this article was a post by a witness. In it, this individual described a decision to reduce the APR on HBD savings from 20% to 18%. The post is littered with inconsistency.

So, let us dive in and explore what is taking place.

Following Governments

We will start with this line:

Governments all around the world are already discussing slowing down the hike on interest rates, some have stop raising interest rates, and some (such as Brazil) started discussing lowering the interest rates.

Here we already head off the rails. Why would anyone on Hive do anything in following governments? Show me one that has not excelled in fiscal mismanagement to the nth degree. At the same time, monetary policy has proven to be just as much of a train wreck. Yet this individual is taking a cue from governments.

Then there is the part about governments discussing lowering interest rates. This is a sign of a bad economy which most are projecting. Once again, the idea that lower interest rates are a sign of good times is misguided.

With lower interest rates, stocks, and more risky investments, will become attractive again, and HIVE needs to stay attractive to back those HBD.

This is true although the logic is flawed. $HIVE, along with all cryptocurrency, is a risky investment. It is part of the risk-on trade. We know cryptocurrency is not a safe haven when the sentiment away from risk takes hold.

Hence, right off the bat, in my view, we are using misguided notions when it comes to HBD.

Inflation: More HBD Helps $HIVE

For some reason, people feel that more HBD takes away from $HIVE. How can this be? Do people not understand inflation and its impact.

What is inflation?

Simply it is an expansion of the money supply. So when HBD goes from 10 million to 20 million, the money supply inflated. $HIVE presently has an inflation rate of around 7%.

Of course, people misuse the term to mean higher prices. It is true, massive expansion of the money supply can drive them up. However, price increases can come from different areas and do not necessarily apply to money. For example, supply and demand often factors into this, especially if there are shocks to the supply chain.

So what happens if the supply of HBD is increased? Aren't we told that, if enough of it is created, it will lead to higher prices?

Which brings up this point:

But a high interest rate on HBD, that could possibly put a sell pressure on HIVE.

How is this even considered? More HBD does not lead to sell pressure on $HIVE. Instead, it actually leads to buy pressure.

What can you purchase with HBD? Outside a few locations around the world, not much. The one thing we can buy with HBD is $HIVE.

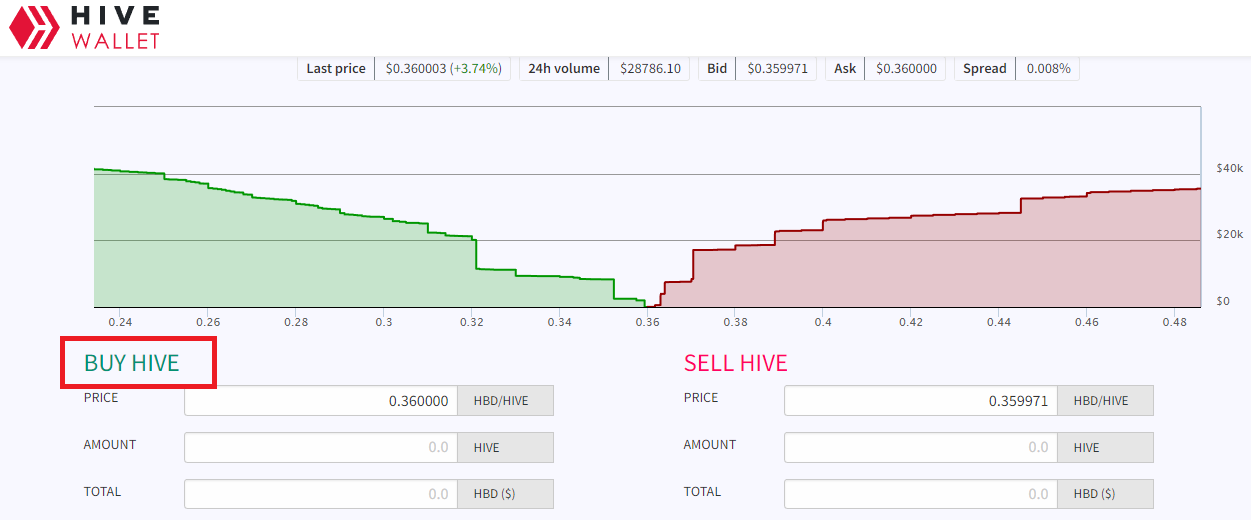

In fact, this is shown clearly on the Internal Exchange.

How do we conclude that more currency which can buy a digital asset, which $HIVE is, results in lower prices? Here we see ass-backwards thinking.

If more money printing leads to asset pricing going up, and $HIVE is really the only asset people can buy with HBD, then it stands to reason that $HIVE will go up in price in that situation.

But what if people buy $HIVE on the Internal Exchange and then sell it on Binance? Outside a bit of potential arbitrage, what is the difference? You have a purchase on one exchange and a sale on the other. The net is basically zero (although we will see a bit of trade volume increase on both). It is akin to wash trading.

The Threat To Hive

Is there a threat to Hive from HBD?

To answer this question we have to look at the gold standard. Many believe in this, including some who are running witness nodes. So let us see how this all works.

Under the most recent gold standard, the US dollar was backed by gold, pegged at $35 an ounce. Many feel we need to return to this because it is a better system and does not have the flaws of fiat currency.

What is happening here is a blind eye is being turned to what really took place. With the gold standard, each dollar could be redeemed for gold on demand. This is the idea of an asset backed security, it can be swapped at anytime.

Unfortunately, there were ones who sought to take advantage of this. In August 1971, Charles de Gaulle sent a warship to New York Harbor to get the gold from the Federal Reserve Bank of NY.

This was not the only country that did this. The net result is the United States was watching all of its gold leave Fort Knox.

Isn't it ironic this fact is overlooked when screaming for a return to the gold standard. Yet, this is the main concern when it comes to HBD.

Since each HBD is backed by $1 worth of $HIVE, many feel there is a similar threat. There are a couple major differences.

To start, because of the haircut rule, exposure is capped. HBD is actually a collateralized loan backed by $HIVE with a 30% loan-to-value ratio. Once that is exceeded, steps are taken based upon the code to alleviate the situation and bring it below the target.

Another factor is $HIVE has a free floating exchange rate. Unlike gold which was artificially pegged to $35, $HIVE can go up and down in USD terms. This is the constant unit between HBD and that coin. As the price, in USD increases, the amount of $HIVE converted for each HBD diminishes.

Of course, if more of Hive's currency, i.e. HBD, is being printed AND going towards the purchase of $HIVE, then market demand means the price will increase.

The conversion mechanism is no different than the gold standard. What ultimately should happen is the value on HBD is such that people either utilize it (have a need to hold it) or exchange it for $HIVE. The only reason to use the conversion feature is for large transactions where the liquidity is just not available.

HBD And The Economy

Unfortunately, the entire discussion of money supply and inflation is senseless without incorporating the economy into it. Nothing operates in a vacuum, with many variables affecting economic matters. The complexity of any system if this nature is greater than most admit.

HBD is a tool for the expansion of the Hive economy. In short, it takes money to grow things. This is what commerce, investment, and funding is all about. When the money supply grows, if there is the ability to convert it to economic productivity, then we see increases in things such as GDP.

At present, the Hive economy is almost non-existent. We are dealing with small levels of activity relatively speaking. As stated, with HBD, the single biggest use case appears to be buying $HIVE. Naturally, we have to factor in that there is very little HBD, hence we see minimal impact on the market price.

For a currency, the ultimate value does not come from the reserve backing. It all boils down to the economic output it is tied to. When you add in depth, liquidity, and sophistication to something that is widely distributed, then you have value on the currency itself.

We know there is little tied to HBD. This is why the linked post makes little sense. If the only real use case is to buy $HIVE, how is that going to make that asset unattractive? The opposite is what will happen.

Once again, we tend to simplify monetary matters and end up confusing the entire situation by not acknowledging the complexity and factors that affect how things unfold.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

While the overall Hive inflation is roughly 7% as mentioned, I don't consider it truly 7% with many of us being pathological hodlers of HIVE. Much of it goes into HP and never comes out.

That is true although that is off the total float, including HP. So if we just based it upon what is truly on the market, the amount of $HIVE created each year is higher than 7%. However, HP is part of it so we do not back it out of the figures.

And the inflation rate is dropping, I believe, every 250K blocks.

Posted Using LeoFinance Beta

really thank you for these articles! It really is always a pleasure to read and learn from you :)

reblogged with pleasure ;)

I believe hbd can drive the price of hive up and it just matter of time before we see this changes

Posted Using LeoFinance Beta

I saw the post and was undecided about what to make of it, reading your point of view helps with enlightenment, I think the more discussion we have about HBD the better.

Posted Using LeoFinance Beta

I think we should pump it up till we see the first signs of smoke. Put DeFi on a Blockchain like this and we go parabolic.

Well I am not sure a pump is the best idea. While it would garner attention, it would likely bring the inevitable dump. We are building which is promising.

The amount of HBD could help to feed into sustainable price action by using it to buy $HIVE.

Posted Using LeoFinance Beta

As always you have your eyes on the money. I was in the meantime thinking of users and defi applications. Active users that are part of the ecosystem is basically the only metric that is Alpha to me. You take the Hive supply and divide it by X users' HP and that's the squeeze that sends the price.

Yes yes, that is what I was thinking.

The mechanics would have to be taken into consideration as well.

Nice post, I always thought that printing money would reduce its value as it does in the financial sector in all economies and that wash trading might be harmful to the market...

The idea of printing money, when it does happen, sends the price of things up.

What can you buy with HBD? $HIVE.

This is where we see a difference. Plus this is in the digital world so wait until we get HBD buying NFTs and whatever else people create.

Posted Using LeoFinance Beta

Okay...I see where that can be a win.

Is there a service that lets me lock HBD and provides me with liquid Hive as reward yet?

Not that I know of.

Posted Using LeoFinance Beta

would be interesting, would be interesting

HBD interest held pretty well and the HBD Stabilizer did its job. Not only that, but with the economy around the world having high inflation, the HBD 20% APR was more appealing to me than ever. Thus it can only act as a solid marketing tool and bring more investors, thus helping the entire Hive tokenomics.

Posted Using LeoFinance Beta

Your first point about following governments is spot on. They're the ones that got us into this mess. Frankly, our economies have to make money in spite of our governments, not because of them. It seems they keep doing everything they can to suck the money out of it to pay for...you guessed it...more government.

As for the rest of your arguments...I'm still trying to wrap my brain around them. I read all of your articles on this stuff and I'm slowly grasping bits and pieces. Just keep writing them. I'll get there eventually. 🙂

Posted Using LeoFinance Beta

It is amazing that people trust governments, any of them.

Posted Using LeoFinance Beta

I'd be okay with them raising he interest rate on HBD savings. Probably not for the reasons you mentioned tough. At least not directly. Indirectly for sure! This was a great overview. Thanks for the explanation!

Posted Using LeoFinance Beta

If you tell people they are going to earn 20% APR by holding HBD, then you change it because of something completely unrelated with HIVE, then you lose the trust of the investors who expected a 20% return.

Leave the interest rate alone, it should be a set rate unless there is some financial problem with maintaining 20% interest then it should remain as is. Otherwise the HBD interest rate was a scam, offered 20% to get people in then dropped the interest rate once the money was in. That's false advertising, and scamming people.

~~~ embed:1615437842460672001 twitter metadata:Mjc3MDY0MzZ8fGh0dHBzOi8vdHdpdHRlci5jb20vMjc3MDY0MzYvc3RhdHVzLzE2MTU0Mzc4NDI0NjA2NzIwMDF8 ~~~

~~~ embed:1615571717622996993 twitter metadata:MzEzNzMyOTY4fHxodHRwczovL3R3aXR0ZXIuY29tLzMxMzczMjk2OC9zdGF0dXMvMTYxNTU3MTcxNzYyMjk5Njk5M3w= ~~~

The rewards earned on this comment will go directly to the people( @taskmaster4450le, @seckorama, @tadesaurius2323 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Thank you very much for this very interesting article. I want to learn more deeply about it.Thank you very much friends, have a nice day.

This is very interesting article , I enjoy reading through

This post was shared on Reddit by ( @seckorama ). Register with @poshtoken, sign up at https://hiveposh.com.https://reddit.com/r/hivenetwork/comments/10eloyi/higher_hbd_interest_rate_help_hive/

I think the inflation is fine so long as it's not having too high of an effect on the inflation of Hive itself and it's not an issue right now. So I am in support of expanding the supply.

Posted Using LeoFinance Beta

I think the Hive price drop was prevented due to the ''HBD 20% interest rate''. People bought Hive from central exchanges to get HBD. And they sold the hive in the internal market. This sale did not hinder the hive price in the global market. But we must not forget that all this is in a bear market. When the bull market starts, no one who understands the financial markets wants to take advantage of the 20% HBD interest. Therefore, they will turn their HBDs into hive in the domestic market. They will want to sell their hives on centralized exchanges and buy other cryptocurrencies. Naturally, this will put selling pressure on the Hive and it will be in a bull market. If we do not take the necessary precautions, the hive may not reach the value it deserves in the bull market. For this reason, we need to reduce the HBD interest rate by 1% every month starting from July. I think 12% is enough.

HBD 100% APR :D

Credit: dynamicrypto

Earn Crypto for your Memes @ HiveMe.me!

lolztoken.com

But not as fast as his brother Sudden Lee.

Credit: manuvert

$LOLZ

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(7/8)@taskmaster4450, I sent you an on behalf of @uveee