We stated on a number of occasions that one of the value propositions for $HIVE is that it is an access token. To engage with the Hive blockchain, one needs to have the base layer coin staked. This means we need a growing amount of Hive Power created.

For those who are new, $HIVE powered up is turned into Hive Power. This allows one access to resource credits. This is a backend non-tradeable "token" that quantifies activity on Hive. Each has a value, denoted in RC, which needs to be available in one's wallet. For most, this is not a problem since a couple hundred HP tends to be enough.

Collectively, we can see how an increase in the user base could change things. The only way resource credits are created is by expanding the amount of Hive Power. That means, outside the inflation, someone needs to buy it and power up. It cannot happen any other way.

For that reason, monitoring how much Hive is staked is important. The base layer coin can tell is a great deal about what is taking place.

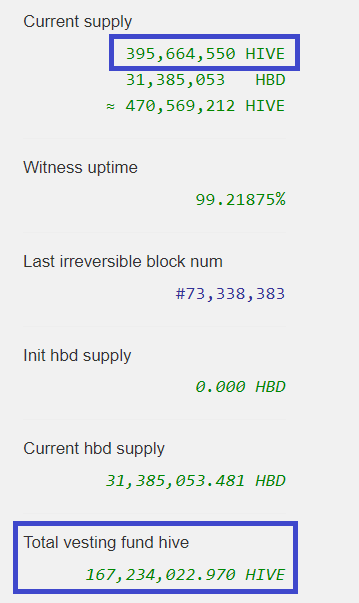

The information from Hiveblocks tells us all we need to know.

Hive Power Versus $HIVE

Looking at the latest numbers, we see there is roughly 395 million $HIVE in total. This is a number that can fluctuate based upon a few variables. Conversions to HBD, as an example, can actually turn $HIVE deflationary.

We also highlighted how there is a bit over 167 million Hive Power in existence. This is $HIVE locked up for 13 weeks. Like the total, this can also move around.

Doing some simple math, we can see that we have 42.2% of the $HIVE is locked up. Stated another way, 57.8% of all $HIVE is liquid and on the open market.

According to these numbers, we have 228 million $HIVE floating in circulation.

So what does this tell us?

In isolation, to be honest, not a great deal. We really do not have any correlation to apply these numbers to. Nevertheless, it looks like we can start to envision how things will unfold.

Demand Pushing The Percentage Higher

We are in a state where we have more than enough Resource Credits to cover the activity. However, in the future, will that always be the case?

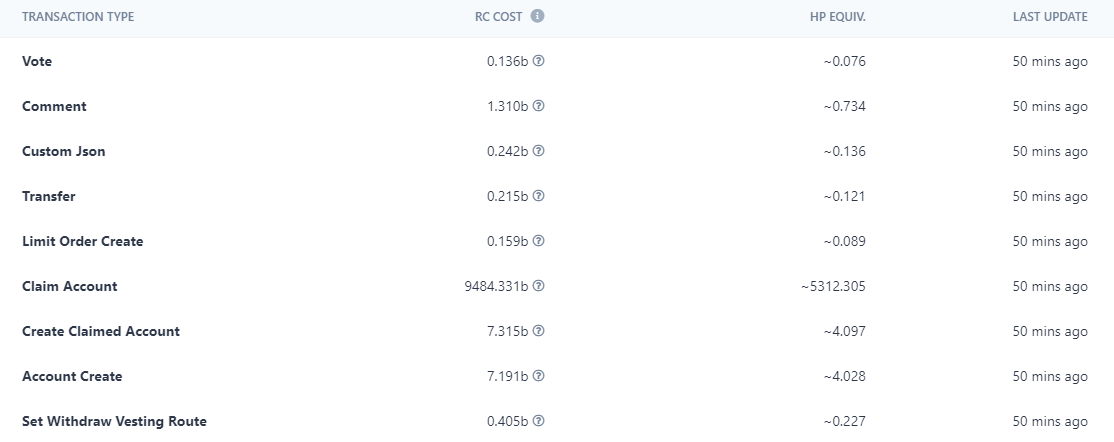

People have asked what is the tipping point. This is a difficult question to answer because there are so many activities and a large spread. Here is a partial list of what activities cost in terms of RCs.

It is clear that an activity such as claiming an account equates to a lots of comments. One must have the equivalent of 5,312 HP to claim an account. Yet, we can make a comment for .734. These number change frequently but we get the point.

Another factor is we know these recharge each day. This is how Hive can be touted as a feeless blockchain. One does not pay transaction fees yet is charged the appropriate amount in RCs. As long as the wallet houses them, we can engage.

This is how $HIVE operates as an access token.

Transactions Of Utmost Importance

What is the future of Hive?

This can be summed up in transactions. It becomes clear how more activity will require more RCs. This fundamentally translates into the need for more Hive Power. Whether it is applications, investors, or individuals staking, someone has to do it.

At what point does the percentage start to move up? When does it get to the point where the amount powered up begins to affect the market?

Again, this is something we really cannot answer. What we can state is that, as the percentage increases, pressure builds. Of course, the inflation rate must be taken into account although that might be offset by the desire for the Hive Backed Dollar (HBD). We are watching how demand on that end can affect the amount of $HIVE available.

The power of Hive is that it all leverages against itself. It all comes back to these basic numbers. Wherever there is growth, more RCs are being used. That is going to necessitate the need for more HP over time. It matters none if this is Custom JSONs made by Podping or Splinterlands or account claims by Leofinance. This all feeds the same trough.

What we need is things to move into the millions.

We discussed the idea of HBD as a payment and transfer system. What happens if millions of transactions are taking place using HBD? This might seem outlandish now but consider the numbers done by USDC or Tether.

Then we have Custom JSONs. Leothreads using this feature for its polling. Couple that with games and Podping, what happens when that gets into the millions?

Of course, there is the Splinterlands, Part 2. A couple years ago, they were creating accounts like crazy. Looking at the RCs needed, claiming is a costly proposition. Yet, we know that many applications are looking ahead understanding they will need more going forward.

On-Chain Activity Matters

The bottom line is on-chain activity is crucial. We need as many transactions as possible. Cutting to the core is where things become clear. The essence of Hive, and its future, is right here.

Down the road, we will likely get to the point where we need to decide what data is posted on-chain. The real estate here might become too valuable. That said, we are a long way from that point.

For now, it is a matter of increasing the numbers. Why do we not garner attention? Simply because the numbers are poor. Yet, fundamental to this system is the fact that $HIVE is required to engage. This is why on-chain activity matters so much.

It will be interesting to watch how this metric changes over the next few years. Once breakthrough application or game could mean that we are looking at someone needs to acquire a vast amount of $HIVE.

Just consider what happens if we ever reach the point where this ratio is 75%-80%.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the people( @taskmaster4450le ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Dang, I need to start collecting some more account creation tokens. I think I have over 100, but if they are going to be that valuable, I might want to get some more.

Posted Using LeoFinance Beta

Might as well. They will have value and what else are you going to use your RCs on?

Posted Using LeoFinance Beta

Yeah, good point. I have more than enough to keep me going on a daily basis.

There is a lot of potential in custom JSON and Layer 2. I’m looking forward to that SQL smart contract feature. Maybe it brings some new apps on this chain. I’m confident that there are many opportunities for immutable ledgers in all kind of transparent bookkeeping and free trade applications.

There are a lot of things that can be done. It will be interesting to see what the smart contracts are.

Posted Using LeoFinance Beta

Great insights, @taskmaster4450! You've explained the importance of the Hive Power percentage quite clearly, highlighting its potential impact on the Hive ecosystem. As you mentioned, the percentage of $HIVE locked up indicates the balance between supply and demand for resource credits in the ecosystem, and any increase in demand will require more Hive Power.

It's interesting to note that on-chain activity plays a significant role in determining the future of Hive. As the blockchain witnesses more transactions, applications, and use cases, the demand for resource credits will grow, leading to an increased need for Hive Power. This, in turn, will create upward pressure on the $HIVE price, making it an important metric to monitor.

The scenarios you mentioned, such as increased HBD transactions, adoption of Custom JSONs by various applications, and account claims by platforms like Leofinance, all contribute to the demand for Hive Power. It would indeed be fascinating to observe how this metric evolves over the next few years, especially if Hive witnesses the emergence of breakthrough applications or games that require substantial amounts of $HIVE.

Once again, thanks for the detailed analysis and shedding light on the importance of Hive Power percentage in the context of Hive's future growth.

On chain activity means more RCs that are needed.

It is a very powerful premise if you ask me.

Posted Using LeoFinance Beta

Their is definitely more to learn and understand when to comes to hive, that why I see everything here as an advantage to grow more in the community

Posted Using LeoFinance Beta

I'm fully understanding that more frozen HIVE (like HIVEPOWER) means more resources (higher RC); but I don't understand how the capitalization could be affected exactly beyond the value of the applications that are being developed and making use of HIVE and HBD as means of payment in their ecosystems.

Of course, the greater the number of developments, it is logically to be assumed that the growth of the Hive Market Cap would be exponential; but I think we would need more exposure via Web 2.0 through paid advertising, so that people understand the virtues of Web 3.0. That would be what I call, using your enemy to destroy your enemy; so Web 2.0 would serve to catapult HIVE. Ironic, but practical, the way I see it.

Posted Using LeoFinance Beta

More apps with more people means more RCs required. At a certain point, I dont know the percentage, we will have to achieve in terms of HP versus the whole to see a massive push in price.

Time will tell on that one.

Posted Using LeoFinance Beta

Doesn't HBD start to get a harder haircut or something once 30% of it is equal to the total value of hive or something like that? I caught a glimpse of it somewhere but honestly all of that I've never been able to make sense of or piece together yet.

Anyways out here stacking hive like crazy!

Posted Using LeoFinance Beta

HBD production stops once the haircut level is reached. That means no conversion or HBD post payouts (that pays liquid HIVE).

After it gets back under, it will revert back to the norm.

It is based upon the market cap of HBD versus the virtual supply.

Posted Using LeoFinance Beta

It is unsurmountable to see how Hive gets to this point generically. It is slow but acceptable. We are growing at the speed of time.

Hope for the best since we understand it.

!PIZZA

Posted Using LeoFinance Beta

Whattttt 😱

Posted Using LeoFinance Beta

The mere mention of Tether and USDC is enough to cause salivation. $USDT alone is worth $79B & $USDC is worth $33B. Combined, that's $112B, and that's a little more than 10% of the total cryptocurrency marketcap, while $HBD barely breaks $30,443,501.87 in marketcap (based on the figures you cited). We have a very long way to go, but the future is bright. I just saw another update from Hive Cuba about further growth in use of $HBD for paying bills, heading over to that account to read up!

Posted Using LeoFinance Beta