Yes you read that correctly. We are heading towards a point where money printing will lead to deflation.

I know this flies in the face of everything we were taught. Over the years, we were all fed the line that more money printing will lead to inflation.

There is only one problem: the last decade showed it did not happen. Yet, still, we hold onto that belief like it is oxygen.

Isn't it interesting that medicine, engineering, and psychology all change over time but with economics, the concepts from the 1930s are still held just like they were then.

So how can money printing lead to deflation? How is that even possible?

In a world of technological progress, we see the effects all over the place. There is no doubt that, with continued expansion, we will only see more of this.

Let us look at a few example of the world around us.

We can start with entertainment. This use to be subject to inflation. There was a time when we purchased (or rented) physical discs of music and video. We also spent money on devices to play these items on. They were acquired from a physical location that employed people. Today, all of that is gone.

The same is true for long distance phone service. We use to spend an insane amount of money to communicate with someone outside our physical area. Now, we can do it for free and in what was considered an advanced form.

Did you realize there are close to 1.5 trillion photographs taken a year? Do you know what the cost of most of them are? Zero. They are taken on devices where the camera was included. Contrast this to a time when people not only had to buy the cameras but also pay for film AND the development of it. Of course, if you wanted grandma to have the pictures too, this required another set made along with physically mailing them at a cost. All of that is gone these days.

Can you see the trend that is firmly in place.

Let us look at space, which is quickly becoming one of the hottest areas. The cost of rocket launches is dropping like a stone.

NASA’s space shuttle had a cost of about $1.5 billion to launch 27,500 kg to Low Earth Orbit (LEO), $54,500/kg. SpaceX’s Falcon 9 now advertises a cost of $62 million to launch 22,800 kg to LEO, $2,720/kg. Commercial launch has reduced the cost to LEO by a factor of 20.

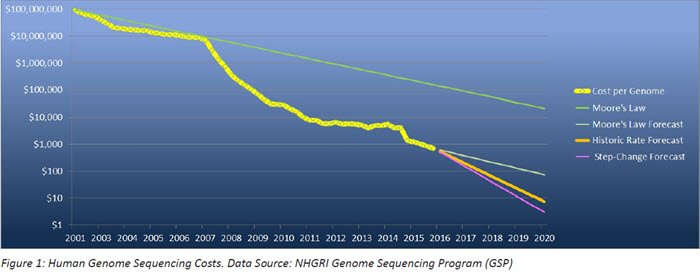

We know medicine is a large field. Many believe that the sequencing of our genomes is going to be a central part to medical treatment going forward.

Here we see the cost chart of this technology.

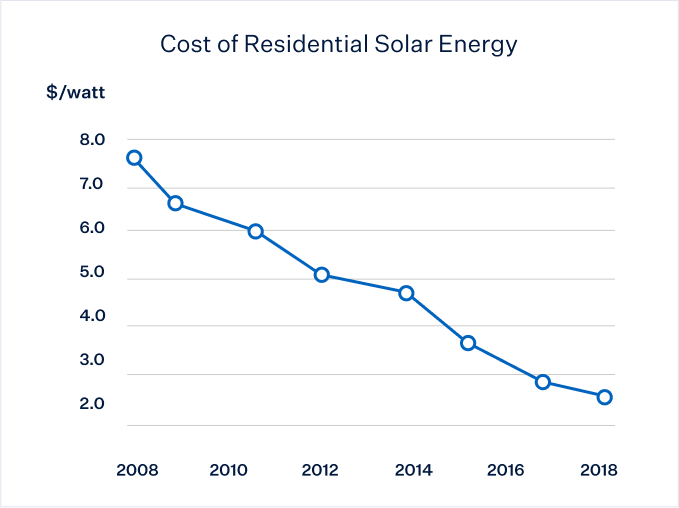

Energy is another area that we see significant price declines.

The list goes on and on. What is interesting to note is that, as time passes, it is a list that gets longer. The number of areas where we see similar charts is expanding.

It is something that is moving into all industries. Manufacturing, education, medicine, construction and transportation are all starting their own curve. All of this is extremely deflationary.

So what changed?

Decades ago, we operated in a world where technology did not have a great impact in the short-term. Thus, the development of products did not change greatly from year to year. This was not a problem unless there was large increases in the money supply. It is here where we saw the too much money chasing too few products enter the picture.

However, things are totally different today. Putting more money into the fields I just mentioned do not create outcomes that are apt to inflate. In fact, the exact opposite happens. As more money flows in, the net effect is a less expensive outcome.

Virgin Galactic is offering seats for $250,000 apiece. The reason for this "economical" price is the fact that rocket technology has come down in cost. However, do you think this price is apt to go up in the future? It is likely that we see, within 5 years of the start of the service, this amount cut in half.

The more money that is invested in that arena, the quicker the prices will drop.

No longer are technological fields of research relegated to the tech or science pages. Most people are aware of endeavors such as quantum computing, extended reality, CRISPR, autonomous driving, EVs, robotics, artificial intelligence, and renewable energy. We are seeing hundreds of billions of dollars a year dumped into these areas.

Yet in spite of all that money flowing in, costs are coming down. It is a total switch from the paradigm we use to operate under.

As we delve more into the "As-A-Service" world, the impact on personal spending changes greatly. If one has more money, he or she might buy a new phone. It is possible this individual might even scale up. However, that person is not going to buy 5 phones and certainly isn't going to take out multiple plans with the carrier. The same goes for Netflix, Disney, or Pandora subscriptions. People are not going to sign up for multiple ones simply because more money is available.

Consider what happens when we get to the point where transportation is a service.

Technology is a hungry animal and it takes a lot to keep feeding it. As we progress into more advanced technologies, the appetite, along with the numbers, keeps growing.

It is a trend that was firmly established over the last few decades and only seems to be accelerating in its pace.

We might be at the crossroads where more money printed actually equates to deflation.

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance

Seems like they have it managed pretty well for now. I expect it to mostly stay in the stock market and housing. They might go negative on rates which should help housing.

A better explanation is that money creation is inflationary, but is countered by technological deflation. Without the insane amounts of money creation over the last 40 years, we'd be suffering from massive deflation.

A point lost on most people. And we might be looking at a couple of decades where the impact of technology is being pushed to a greater degree.

Posted Using LeoFinance

A few years from now, the cost of traveling to the Moon on a tour will almost be like leaving Europe to "tour" in some South American country. Technology advances by doing its best.

Posted Using LeoFinance

It might be a bit more than a few years from now but I get your point. 😁

Posted Using LeoFinance

Enjoyable read and good points. In the world of working this can be seen, people had jobs now machines have

Deflation is also happening due to dec demand on products which based on the supply and demand graph leads to a deflation....

Thanks for the metrics and informative article. :) Love your stuff.

Having paid of my mortgage years ago my main costs now are heating and car fuel. I hope you are right for these as well. ;)

In order for the cost of spaceflight to go down, there would need to be an increase in competition offering spaceflight with upgrades like business class and hot towels.

good read, thanks for pointing this out!

It's hard to take this stance 100% seriously when you make no mention of hyperinflation and act as though it is simply a theory that's never actually happened. Hyperinflation happens all the time, so how can you write a half dozen posts like this without addressing how/why it happens and why that wouldn't happen to USD?

In my view, the reason why we are experiencing such massive deflationary pressure is due to way less people spending money. Velocity is hitting all time lows because people are afraid the system is going to collapse. Unemployment is at record highs. Everyone is HODLing USD so the value goes up. The supply of products goes up because less are buying them. It doesn't matter how much the FED prints because no one is spending it and all that debt is simply owed back to the FED anyway.

There should be a point where the fishtail swings back and a lot of that velocity gets pumped back into the system at an alarming rate. While the deflationary pressure of technology is exponential, it is also constant and predictable. The situation we are in is anything but constant and predictable. Your focus has always been on technology, but tech is only one of a thousand variables in this economic simulation.

Tech has nothing to do with the violent thrashing fishtailing we see happening in the economy right now. Rather, it's being caused by absolute corruption at the top of this pyramid-scheme and the need for those greed-monsters to try to preserve their wealth.

Money printing does not lead to deflation. Yes we have money printing. Yes we have deflation. It is the technology advances, debt explosion and fear psychology which is causing todays deflation. When the latter finally reverses we will see what real inflation looks like. Humans have short memories and will continue repeat the same mistakes.

Historically technology development took place regardless of what was taking place. In fact, an economic crash would likely accelerate things even more since companies will look for even more ways to cut costs i.e. labor.

Posted Using LeoFinance