We have long discussed the potential of the Hive Backed Dollar (HBD). This is a powerful component to the Hive ecosystem. It is also something that many are overlooking.

The cryptocurrency market diverted from the original vision of Satoshi for various reasons. A lot of these were covered in videos over the last couple years.

One of the major shifts was in the area of medium of exchange. Satoshi was trying to create electronic money that would operate similar to the US Dollar. He (she/they) wanted something outside the traditional banking system that was free from the manipulation of governments, central banks, or bankers themselves.

He failed at this quest.

This is something the industry noticed to. For this reason, we have stablecoins. They are now being recognized by more people as something crucial to the global economy.

In this article we will discuss them as a proxy for the USD and what that means.

Stablecoins: A Dollar Proxy

One of the keys for something to be a medium of exchange is price stability. Here is where the idea of Bitcoin replacing the dollar fails.

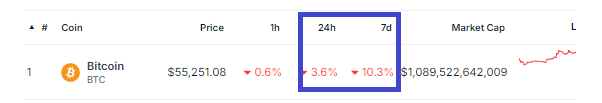

The problem is volatility. Let us look at the largest cryptocurrency from CoinGecko:

In the last 7 days, the coin has dropped 10%. It has gone down 3.5% in the last 24 hours. As a medium of exchange, this is horrific.

Consider the idea of being a merchant and gone for a week. You accept payments online, allowing them to accumulate.

Upon returning from your vacation, you notice the price move. This means the sales from a week ago were effectively 10% less than expected.

In short, this simply does not work for commerce.

Enter stablecoins.

They are designed to not fluctuate as much. By tying itself to the US dollar, these tokens have the ability to tap into the largest network effect in currency. The volume of activity that is tied to the US dollar is mind blowing.

There is a reason why, in spite of calls for its demise, the USD keeps getting stronger.

With stablecoins, we have the unique position of having something global that operates outside the banking system. This means we are dealing with a dollar proxy, a fact that can have enormous implications on the global economy.

Central Bank of Bolivia

The Central Bank of Bolivia tends not to make headlines in the financial media. It is safe to say that few are watching the moves it is making. Along the same lines, even less are paying attention to what the president of the bank is saying.

However, we have a situation where he targeted a very important topic.

Rojas Ulo also referred to stablecoins, tokens whose value is pegged to the value of another asset or foreign currency. He explained that dollar-pegged stablecoins like USDT, present different advantages to users that lack access to U.S. dollars.

Rojas Ulo stated that using stablecoins was “as if one were trading in North American currency, although what one is doing are operations with these digital assets.” In a recent op-ed, Bitcoin.com News touched on the difficulty that Bolivians had to access U.S. dollars, and how the adoption of crypto could help Bolivinas alleviate this situation by using stablecoins.

This does not apply to only those in Bolivia. It is true for much of the global population.

Getting US dollars, especially in digital form, is near impossible for most. In many countries, there is a black market for physical USD banknotes, something that carries great danger.

By having a stablecoin that is pegged to the USD, we now have a digital asset that can be accessed by anyone. The only requirement is to have a wallet.

There are many other countries where the central bank could make similar statements as Bolivia. This is why accessing those nations is vital to the growth of crypto.

Hive Backed Dollar (HBD)

Not all stablecoins are the same.

So far, we have basically seen two types of stablecoins.

The first is asset backed, i.e the value of the coin is supported by another asset. Citing the two most popular, USDT and USDC, these use U.S Treasuries as the asset to back the currency.

In this regard, the coins are still a part of the banking system. They are under government regulation and control. We see centralized companies that are behind the issuance of the coins, meaning their decisions could impact anyone holding it.

When we look at the second, these are algorithmic stablecoins. These are no backed specifically by an asset. Instead, they are based upon a conversion to something else. With HDB, this is the other blockchain coin, $HIVE.

With this type of asset, the blockchain is coded to convert each HBD to $1 worth of HIVE. There are no dollars involved since it is nothing more than a unit of measure.

The net result is decentralization. There is no centralized entity that is operating behind the scenes.

Another factor here is this operates completely outside the traditional banking and financial system. With an asset backed currency, the reserve is held by a custodian. Here is where we see third party risk entering.

Therefore, we effectively get the ability to expand the supply of dollars to those countries around the world that do not have access. While they are not dollars in the sense they were created by the US commercial banks, they do carry similar abilities since it is a proxy.

From my perspective, here is the killer app for cryptocurrency, at least up to this point.

Find a need and fill it. When it comes to the global economy, providing billions of people with access to USD equivalents is a major step forward.

Posted Using InLeo Alpha

The question that comes to my mind is whether HBD has the potential to ever be more than a tiny niche on the fringes of the stablecoin market.

Yes, I'm playing the skeptic again, but right now HBD is tiny in the greater scale of things. But let's assume an "imaginary world" in which HBD has a $billion market cap... wouldn't it (and Hive, in general) suddenly find itself squarely in the sights of regulators? We may be decentralized and "there's nothing they can do," but they might not need to "do" anything beyond make Hive extremely difficult to trade.

I mean, I live in the US (Washington state) and I already can't access 90% of the CEXs, and using DEXs is often a complicated mess... not saying anyone can stop Hive/HBD, just that the "complexity factor" would make most users choose a path of less resistance.

=^..^=

Totally get what you're saying. Most folks will choose what's easiest for them, even if it means giving control to a gatekeeper. I'm of the opinion that for blockchain tech to be adopted by the masses, it will have to be in the backend with a shiny easy-to-use and familiar name on the front end.

Yes Hive's hbd is a valuable tool in our arsenal. Especially with 20% interest for saving. It's a hidden gem.

Definitely going to stick to HBDs wow, I was a fan of USDT but I'm kinda like HBD now. HBD's stability and interest perks are definitely game-changers. I'm seeing it's not just a digital dollar substitute, it's smart financial tool for everyone.

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 75500 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

It would seem better to me if HBD currency were easier to trade on its own, since it is so closely tied to HIVE.

At the very least I would like HBD and HIVE to be more dependent on each other, to be stronger on their own

To my mind it would make it more attractive to people in the commons........

For now, I think having the two types of stablecoins is good. The dollar backed stablecoins offer a simpler and easier to understand option for people that don't know crypto. Once they eventually realize that their governments can seize their assets or if they get more knowledgeable, they can switch to HBD.

In June I decided to begin writing daily again and deposit all my HBD in savings. It is nice to see the fruits of my labor compounding daily!