Many in the cryptocurrency community are salivating over the fact that the Fed, along with other central banks, are printing money like there is no tomorrow. The belief is that we are going to see all kinds of bad things from this such as the collapse of the USD or hyperinflation. Of course, this all leads to the conclusion that Bitcoin and other cryptocurrenies will soar in value.

The only problem with this outlook is that it is unlikely to happen. That is not to say that Bitcoin cannot appreciate greatly. I take no exception with any estimate put out there on Bitcoin's potential price. It is all possible. However, it is unlikely to come from hyperinflation.

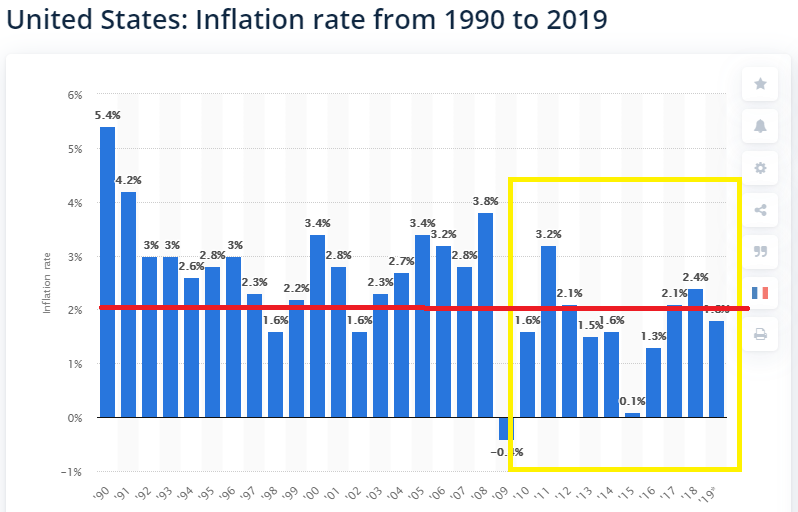

Here is a chart of the inflation rate over the last 60 years.

The first thing that jumps out is the fact that we are in a deflationary super cycle. We witnessed the rate drop over the past 40 years. This coincided with the move in interest rates, which were double digits in the early 1980s to zero (and negative in many cases) today.

Throughout this time, we saw a massive amount of "money printing" as national debt levels exploded.

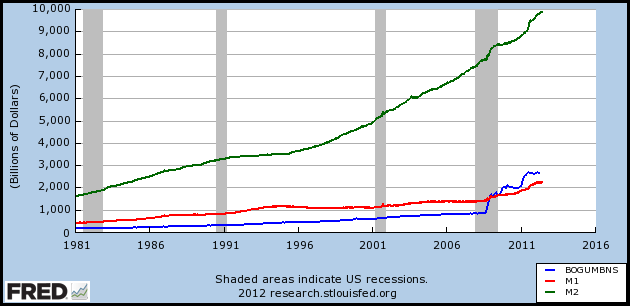

Here is a chart that shows the money supply.

Of course, this was a situation that was mirrored throughout the world. Most countries expanded their money supply over the past few decades, more than the United States.

Yesterday, we see Chairman Powell testifying in front of Congress. He was answering questions pertaining to its balance sheet and the outlook for the future.

This is what he had to say:

“Longer-term inflation expectations have remained fairly steady. As output stabilizes, and the recovery moves ahead, inflation should stabilize and gradually move back up over time. [...] Inflation is nevertheless likely to remain below our objective for some time.”

Of course that is the case. Inflation, or the lack of, has baffled the Fed for more than a decade. The idea that inflation will remain below its objective is just a continuation of the last ten years.

This chart shows the inflation rate with the 2010s boxed off. I also highlighted the Fed's mandate of 2% inflation.

Notice how they missed their target more than they hit it. And this was during a time when the central banks of the world printed $23 trillion in an effort to stimulate their economies.

It was also a time where the global economy was coming out of a recession, i.e. an improving economy.

This flies in the face of what Bitcoin bulls like Max Keiser and gold bugs like Peter Schiff have been saying. They like beating the drum that the money printing is going to cause inflation, thus the only place to be is Bitcoin or gold. While Bitcoin is one of the best investments over the past decade, it is clear that is not the result of hyperinflation. There obviously must be other forces at work.

Which brings us back to the central premise of why is inflation tracking down while money printing was massively accelerating? After a number of decades, there is a solid trend in place.

Perhaps understanding the economics of technology would help greatly in this matter. Either way, whether Powell knows the reason or not, the bottom line is hyperinflation is not likely to result this decade anymore than it did in the 2010s. In fact, central banks are going to spend the 2020s wagering a war against deflation.

And anyone who understands the economics of technology knows that the other side keeps getting a lot stronger.

The new normal is that central banks are going to have to keep printing money and expanding their balance sheets at an accelerating rate just to keep pace with what is going on.

Ironically, I see this as bullish for cryptocurrency since it is unlikely the central banks will print enough, requiring even more money from other sources. This is the hole I foresee cryptocurrency filling.

Where the central banks fall short, cryptocurrencies can make up for.

The future is bright from this perspective.

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance

It should be kept in mind that financial asset price inflation and consumer price inflation are two very different things. It seems that either the cost of producing things is dropping fast thanks to automation and computers or that very little of the QE money is trickling down to the real economy or both. But it certainly seems that financial assets are increasingly divorced from the real economy.

Bitcoin bulls and gold bugs will be happy regardless of whether the real economy will benefit. In fact, financial asset price inflation and the lack of consumer price inflation represents the best of possible worlds for crypto investors.

Gold will likely do well in the next few years, in my opinion, simply because we are looking at a commodity run. With the supply chain being cut down, we are going to see the supply-demand equation flip.

This will put upward pressure on commodities...likely 2021-2023.

Posted Using LeoFinance

Beautiful post! As far as the macroeconomic framework is concerned, the employment rate and wealth distribution must also be taken into account. There are also other factors to take into account, Japan an EU are two case studies.

As far as cryptocurrency is concerned, I agree with you.

Great article as always.

How do you think the stimulus distribution and the illusion being perpetrated with the stock market playing into this?

Or is the technology sector's growth making up for the shutdown losses, as far as capital and finance?

I think stimulus helps the mindset of the market...until it doesnt.

Eventually I think it is going to reverse and reflect what is happening.

Technology is going to come into play more in the future in the sense that we will see a recovery that includes less people. This is what happened in the oil industry half a decade ago.

The stimulus right now, by the way, is not reaching the economy. Even though the Fed doled it out, much of it is sitting in the banks reserve funds.

Posted Using LeoFinance

I do agree and I have the same view... I am always optimistic so let's have our fingers crossed

The trend is that cryptocurrencies may benefit from this. With banks printing so much money, I don't even want to see the bottom of that hole they're digging.

Posted Using LeoFinance

Hiperinflation is something frightening for countries. It will cause multiple crisis from economic to politic. When the hiperinflation can be avoided there will be bad things that happened to poor citizens. The whales or rich in the countries still can earn living peacfully. I heard that Venezuala has suffered from hiperinflation. The number of poverty increases and some citizens migrate to neighbooring countries. Can cryptocurrency answer the problems? In my view cryptocurrency is a solution to unbanked people to acces world economic opportunities. However, cryptocurrency is not addopted leggaly by governments that is the problem.

A common sense approach to this topic at last ... thank you!

You always go deeper in your analysis. I love it

You really should learn how money supply works.

CBs printing m0 agregate to compensate m1+ agregates shrinking.

No one wants to borrow money, and broad money supply is deflating faster than FED prints out base money supply. Velocity of money drops. But when the trend changes, wee'l see a massive inflation and panic.

Deflation often comes before the hypperinflation.