For decades we heard about the demise of the US dollar. Unfortunately, for those who were betting on this, that has no occurred.

Those who believe this to be the case miss a number of important variables that changed the game completely. We are in the 2020s, not the 1920s. Like everything else, the world of money changed a great deal since then.

We will dive into what is really taking place and how crypto, specifically stablecoins, are only going to enhance this.

The Network Effects of the US Dollar

With the advent of central bank digital currencies (CBDC), we hear a lot about the digital dollar, euro, or yen. The idea is to bring out a digital version of the traditional currency.

This is a viewpoint that overlooked one important factor: these currencies are already digital. We only have to look at the transactions by volume to see that. Each day, people look at their bank account balances, all which is digital. Of course, that can be converted into physical currency is below a certain level. Surpass that and the bank doesn't have enough cash.

The flipside is what are people going to do with it. In most instances, things such as rent and mortgages cannot really be paid using cash. People mostly conduct these transactions online. That is not a physical world any longer.

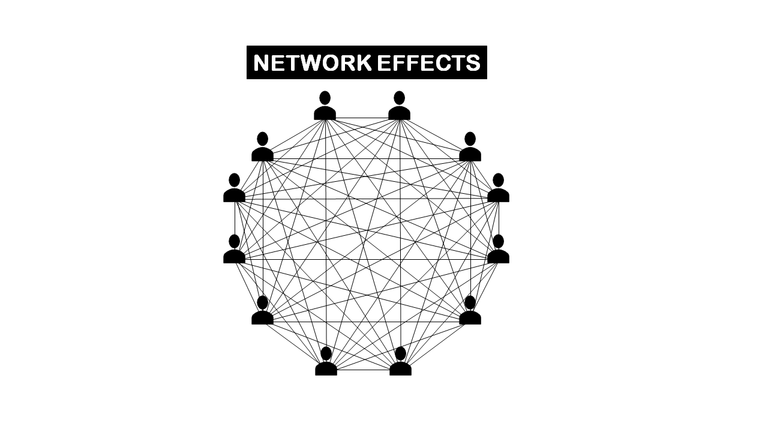

Once we enter the digital realm, we are dealing with another set of rules. Fundamental in the success of any endeavor is the network effects achieved.

Before getting into it, this is how Venice.ai described network effects:

Network effects refer to the phenomenon where the value or utility of a product, service, or platform increases as the number of users or participants in the network grows. This can create a self-reinforcing cycle, where more users attract even more users, leading to exponential growth and increased value for all participants.

Network effects can be seen in various types of networks, including social networks, communication platforms, marketplaces, and more. For example, a social media platform becomes more valuable to each user as more of their friends and acquaintances join, because they can connect with a larger number of people. Similarly, a ridesharing platform becomes more useful to users as more drivers join, because it increases the likelihood of finding a ride quickly.

The key word is network. This is a major point when it comes to currency.

Digital = Network

I like to use the example of Visa. This is categorized as a financial services company. What does that really mean?

Visa is the market leader in its field. Why is this? It all boils down to the network. Visa conducts millions of transactions per day, all via the digital realm. It has one of the most extensive computer networks in the world. Thus, it is actually a computer networking company that moves data around the globe, no different than other networking entities. The difference is Visa's data represents financial value.

Of course, this is what commercial banks are. They are no different from Visa other than they have physical locations and do handle non-digital assets such as cash or checks. The latter, while not digital, is ledger based, another important component.

In other words, for the most part, currency is nothing more than data that is housed on ledgers that run on networks.

This means it comes back to network effects. If we are talking about currency, nothing surpasses the US dollar in this area.

The Rise of Stablecoins

If we look at the first paragraph from Venice, we see that exponential growth is realized due to a self-reinforcing cycle which attracts more users.

The stablecoin world is about to see a massive explosion, which is actually going to expand the monetary base of the US dollar.

Bank of America is the latest to publicly state they have plans on offering a stablecoin once US regulation is clear. This is another example of a sector of cryptocurrency that is going to explode.

We already see a market, dominated by USDT and USDC, that is $230 billion. When the commercial banks enter, it will reach into the trillions.

The fascinating aspect to this, with asset backed stablecoins, is the change in dollars from the users perspective.

When a USD stablecoin is generated, a swap of the token for a dollar is made. The token, say USDC, can be used for financial transactions. Wherever it goes, it carries the ability to settle transactions (payments) for a dollar.

The tendency is 80/20 with 80% of the dollar brought in by the issuer to be held in US Treasuries (T-bills). This means the dollars are not locked up since they are paid to the firm selling the T-bill. That company can use the dollars for rent, payroll, marketing, or whatever other expenses it has.

These are similar to reserves from the central bank. They are not legal tender, thus not part of the money supply. However, unlike reserves, this is general economy money, meaning it is in the hands of the general public.

Here is where the network effects come into play. It was announced that USDC surpassed $20 trillion in transaction volume. We have to remember this is the second largest stablecoin. The largest, USDT, is in a different realm.

According to this article, the 2022 volume outpaced both Visa and Mastercard with over $18 trillion in transactions.

USD is a Measurement

The US dollar is now a measurement. As the number of stablecoins grows, we will see transactions that are operating outside the money supply.

We are already seeing trillions of dollars in transactions that are being done without any currency that qualifies as legal tender involved. In other words, there are no dollars changing hands. With the expansion of stablecoin we will see the amount of US dollars outside the commercial banking system explode.

This really is brought into focus when we look at non-asset backed stablecoins which has no dollars involved. Instead, the USD is simply a measurement where a stablecoin can be converted to $1 in some other asset.

We can already see the network effects in these early stages. If my forecast is correct, and we see thousands of stablecoin emerging, most of which are USD denominated, the network effects surrounding the dollar will explode.

No longer will the United States commercial banking system be the only network system that provides USD to individuals. In fact, what we will see is going to resemble the Eurodollar system which conducts trillions of dollars per day in transactions yet has few dollars involved.

This will only increase the network effects the US dollar enjoys.

Posted Using INLEO

Interesting insights on the evolving landscape of digital currencies and the resilient network effects of the US dollar! Your analysis of stablecoins and their potential impact on the monetary base is thought-provoking. It's fascinating to see how traditional financial systems are being reshaped by digital innovations. Looking forward to more of your insights on this dynamic field!

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 5700 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

I don't think the dollar is in danger as the world's currency of reference. That won't happen until the United States' power in the world falls. All empires fall sooner or later, but I don't see that end being near.

As we witness the growth of this network, it’s essential to consider the implications for monetary policy and economic stability moving forward.

!BBH