An industry in disruption stays in disruption.

Okay you have me. I made that saying up. It is a twist on Newton's second law of motion. However, it is no less true.

The global payments market is estimated to be $3.16 trillion in 2025. This is a large sum of money moving around, although it is dwarfed by finance. Nevertheless, there is enough money in this industry that a fight is breaking out.

It is also one of the areas where cryptocurrency can enter. We see the rise of stablecoins, marking the advancement of tokenization. While the numbers are low, relative to the whole, it is something that probably will outpace the overall growth of the industry.

Of course, crypto is not the only force looking to disrupt. In fact, that isn't even on the radar at this point.

Web 3.0: Payments Industry Already Being Disruption

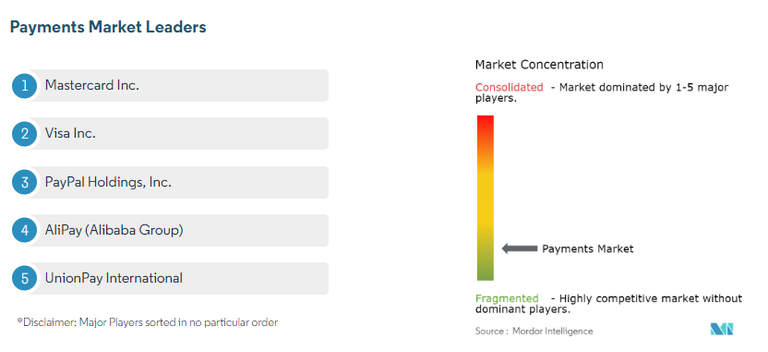

This is an industry that was long dominated by Visa and Mastercard. We also have PayPal with online transactions and Alibaba in China.

With the expected growth, this is going to be a realm that only gets more crowded.

A couple of the reasons are as follows (I will get to a major one in a bit):

The global payment system is rapidly changing from cash to digital payment. Payments are becoming increasingly cashless and supporting the development of digital economies and innovation in payment infrastructure. Contactless payments are increasingly becoming a preferred payment method in various countries worldwide. Contactless payment systems at the POS, such as facial recognition, Quick Response (QR) codes, or Near-field Communication (NFCs), are changing the payment landscape across the globe.

According to Global Payments, consumers are more comfortable navigating the world through a digital lens after two years of shifting habits to working and shopping significantly online. Statistically, over half of the consumers from the company consider themselves more digital, with 39% shopping from a smartphone daily or weekly and 23% saying that they shop online at least daily.

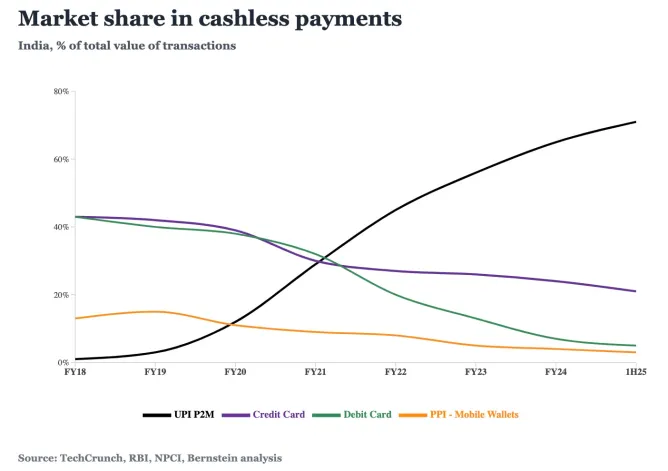

The last name on the list is causing some disruption, at least in India. It is a 9 year old company and is seeing market share jumping.

The UPI network now processes more than 13 billion real-time transactions monthly — that’s about 71% of all transactions in the world’s most populous nation — and accounts for 36% of all consumer spending in the country, according to an analysis by Bernstein.

A big part of this move was due to the rising fees charged by the incumbants, a common tactic.

Payments are obviously big business, especially in the digital world.

Digital Payment Explosion

There are a couple points that we must touch upon.

Even though companies like Visa and Mastercard will be considered finance, they actually are not that. They also are absent from the money game.

When it comes to payments, we have to look at it through the diigtal lens. These are networks. Hence, they are subject to the same characteristics of any other network.

This is fortunate because blockchains are networks. They are structured a bit different with regards to control but they do the same thing: register data. That is all these payment services do.

We are not dealing with entities that send bags of cash around the world. It is nothing more than numbers on a screen. In fact, that is what the most currency's money supply has turned into. When they settle, the banks move numbers around to fulfill the payments.

Blockchains mirror this. The major difference is the lack of an intemediary. When it comes to the digital payment explosion, a lot of this will be driven by AI agents. Here is where the traditional system is facing massive headwinds. The fee structure is simply not designed for this type of activity.

One of the components to transactions by agents will be micropayments.

Let us look at distributed computing. If someone processing is used for inference, they might receive a percentage of a cent from a user (agent). How does Visa account for that?

It is impossible.

Hence, cryptocurrency networks with low-to-no direct fees are going to reign supreme.

AI Agents

Another aspect to this is the payment explosion as a result of AI agents. When things are automated, the numbers go through the roof.

If we look at the United States stock market, this epitomizes what takes place. That said, we see the same in other financial markets, including FOREX.

With the introduction of autonomoy, i.e computerization, volumes skyrocketed. Look at the volumes in the 1980s compared to today. We have companies that exclipse the total volume of some exchanges.

Much of this is trading activity. However, with the digital world, we are seeing a shift.

Much of what we are going to see boils down to payment for services rendered. Consider what computers are capable of rendering, at least with regards to speed. When we frame this against a backdrop of billions of agents, we can see how the volume of payments explodes.

This is where Web 3.0 enters. The traditional financial system is not going to be involved. It simply cannot compete. Fractions of pennies are not part of their mechanism. Their systems are too costly to operate.

With blockchain, those running the system are incentivized in different ways. Here is where running a network node actually becomes a money maker for the one providing that service. It is not the case for these financial firms. Their networks are expeses, a cost of doing business.

The history of digital is established. When things are automated, the numbers explode. It is something that we see happneing repeatedly.

Even with generative AI, look at the amount of data that is being created through chatbots. This is still a primitive technology and the tokens generated are massive.

Payments will follow the same trajectory.

Posted Using INLEO

@taskmaster4450, your post highlights an interesting transformation in the payments industry. As Web 3.0 gains momentum, traditional financial systems like Visa and Mastercard may struggle to keep up with blockchain's efficiency and low fees. What are your thoughts on how blockchain can address security concerns in global payments?

Hive has many inherent strengths to enter the digital payment sector. I wonder how AI agents can be integrated into Hive. Is it a future direction that developers here are considering? Or is it already a present reality on Hive?

!BBH

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 2400000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPNice content