For 30 years I have heard the same misguided ideology from goldbugs and economists. The unfortunate reality is we keep hearing stuff from people such as Peter Schiff and Jim Rickards that is completely wrong. In addition to missed forecasts, they pass along information that is categorically incorrect. A bit of research is easy to disprove what they say but few are willing to do it.

What those two do is of little consequence to me. Where I do have a problem is with this mindset entering cryptocurrency. These people do not understand money, finance, capital flows, and how things work. Yet, they keep promoting the views like it is fact even when proven wrong.

Probably the biggest lie they tell is about the Fed (or most other central banks) printing of money. They act like this is 1880 and we are dealing in banknotesThe reality is the Fed, or any other bank under fractional reserve banking, has little impact on the money supply. To say the Fed expands by printing dollars is simply not true.

Instead, it creates reserves which are financial instruments that are put on the balance sheets of commercial banks. This is not legal tender, cannot be used to do stock buybacks, pay salaries, or compensate the copier tech for fixing the machine. It can only travel between other depository institutions, mostly for settlement.

How often does the Church of Schiff talk about the Fed's money printing and inflation? How does something inflate prices when it can't enter the general economy?

Of course, even the idea of inflation is misguided. What is the $HIVE inflation? 7%? 6.75%? Whatever the number, notice it has nothing to do with prices. It is an expansion of the money supply (not the monetary base). Yet so many people try to say that it is a rise in prices.

Price escalation can be a result of an increase in the money supply. They can also come from a variety of other facts such as supply issues. What they do not result from, as Japan proved over 20 years, is the central bank creating reserves and placing them on the balance sheets of commercial banks. The world's third largest economy was mired in a 30 year deflationary cycle that was only broken when the global economy shut down.

This in spite of 10,000 (or whatever it was) quantiative easing programs by the Bank of Japan.

As an aside, the inspiration for this article is from one written by @welshstacker. Give that one a look, it is well written and exemplifies the traditional thinking that is carried by those with this viewpoint.

Thanks to @edicted for this one.

The Death of the Dollar?

The above image is true. I did get educated in their pseudo-science so I understand where economists, especially those sitting in their ivory towers and living in the land of theory, come from. They fail to understand how things work, instead sticking to their textbooks that are 50 years old with theories that go back 100.

Unfortunately, these are not the only ones who have a false view of how things work.

Let us delve into the above linked article.

We start with this:

For me, and from my perspective, sanctions placed on Russia, by the "West", have only sped up the death of the US dollar. The Russian sanctions may now force the hand of its allieces and its close relationship to Brazil, India, China and South Africa (BRICS) to speed up thier own de-dollarisation. Making up 40% of the worlds population, these 5 countries alone registered a GDP of $24.5 trillion, parable to the US ($ 25 trillion) and more than the EU($16.6 trillion.).

This is a popular opinion and one that has been around for 30 years (more but that is when I started hearing about it). The dollar is dying.

Now it is BRICS getting together and stop using the dollar. Really?

Adding up their GDPs is a nice touch to make the readers believe this is practical. It is not. To start, China does over $600 billion per year in trade with the United States. Most of that, about $450 billion is exported by them. Do you think they want to lose that business? Who is going to make up for it?

Does anyone really think China is going to stop taking dollars?

The same holds true for the rest of the list. The US has the largest consumption based economy in the world ($16.1 trillion). Just US consumption is larger than any other economy except China.

Then we have this notion that they are going to move from the USD to something else? To what?

Do people realize what it takes to have a legitimate international currency? This is something I have been mapping out for HBD and I can assure you it is a mammoth task. For a currency to have any viability, especially on a global stage, it requires depth, liquidity, sophistication, resiliency, and infrastructure. On the last one, how long do you think it will take the BRICS to build somehting viable? Software takes time as we all know.

Even the euro, which is over 25 years old, is just a regional currency, with little ability to operate in most sections of the world.

The Myth of De-Dollarization

China holds approximately $1.09 trillion in US dollars.

Many seem to believe the some parts of the world are de-dollarizing. What is happening is these countries are being de-dollared. With the exception of Russia who made a decision to get away from US holdings, the other countries need dollars.

Keep in mind, in addition to trade, we have nearly half the world's debt denominated in USD. This means there is almost $150 trillion in debt that has to be serviced. Guess what the companies holding this debt need: dollars to pay back the loans.

How do they get a hold of US dollars? This has to be provided to the banking system by the central banks. That is why Japan, Britain, China, etc... have a lot of Treasuries. If they do not, defaults will occur.

In reality, since the Great Financial Crisis there is a dollar shortage. The entire Eurodollar system has suffered under balance sheet constraint. This is the arena where global trade is funded. This can include the Repo market yet involves a karge number of bilateral transactions. The total size can only be guesstimated.

To give us an idea of how big this is, the Repo (and RRP) trade $4T-$5T daily. That is 4x-5x the amount of Treasuries the Chinese are holding and this is done daily. The bilateral agreements are projected to be of similar size.

Now heres a scenario - Imagine if you would, a time where China no longer requires to hold USD, and an alternative method of payment between somenof the fastest growing nations emerged. Without fear of financial sanctions plaved upon the CCP by the USA for the invasion of Taiwan, notjing can or could stop the Chinease from fulfilling their one-china policy.

$1,090,000,000,000 dollars flooding back to the US, from China alone would send the USD into comllete meltdown. The States would face a hyperinflation like never seen before in the history of "money".

Here is another idea posed yes has a meltdown under scrutiny.

To start, we have to say that hyperinflation is 50% increase per month. People like to throw that word around yet it is impactical except in some outlier situations.

Secondly, the presumption that China would sell the Treasuries and the money would immediately end up in the US is highly unlikely. The market for US Treasuries is global as countries have dollars flowing through them.

Thirdly, understanding capital flow is important. The idea that a trillion dollars flowing into the US would cause hyperinflation is laughable. Look at the capital flow over the last 5 years.

Since the start of 2018, there was a $10 trillion inflow into the US. This averages to $2T per year. Notice in 2021 and into 2022 there was a $2 trillion outflow over the course of a year. Did price collapse in the US? Not in the least. Of course, the NIIP is showing a resumption of capital flowing back into the US over the last quarter or two.

Hence, even if this money flowed into the US directly, it would not cause hyperinflation. US asset prices would get another boost but that is nothing new. That is why people chose the safe haven.

Finally, we have the idea of collateral. This is something the goldbugs and mainstream economists fail to mention. What is the pristine collateral? High quality?

Right now, US Treasuries are the only thing you want to be playing with in the international financial markets. Show up with Treasuries and you get the best interest rate along with the least overcollateralization.

And people claim that Treasuries are being dumped?

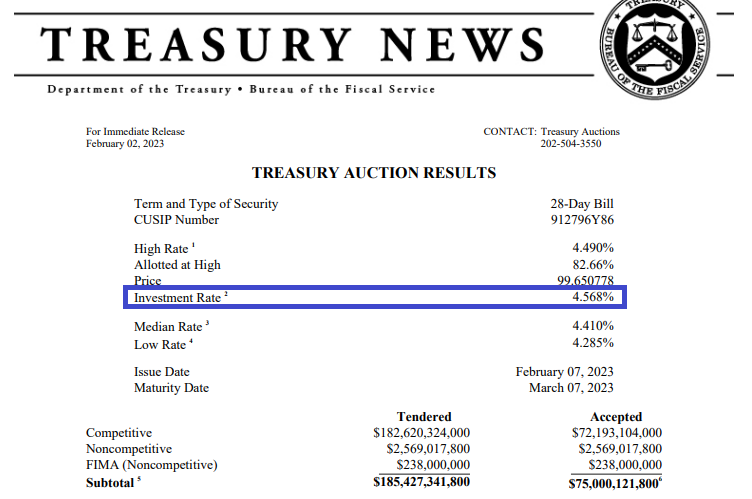

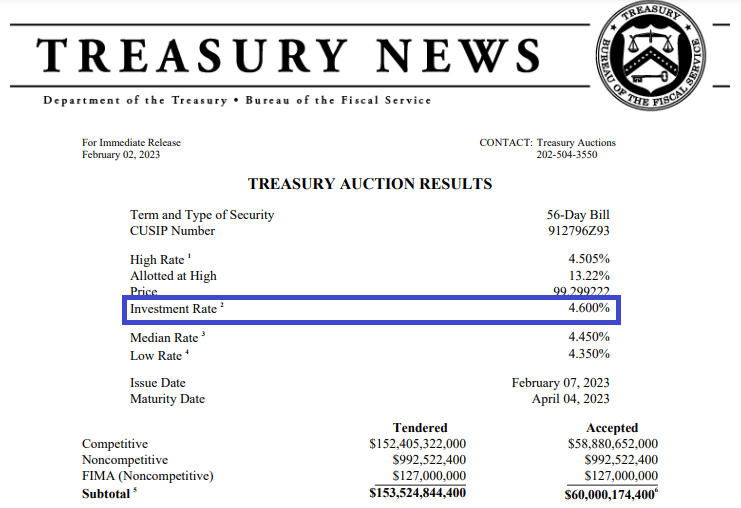

Let us look at the most recente T-Bill auctions.

Highlighted is the US Treasury rate. Notice where the auction took place at. Both assets say the bidding below that level. Why would a bunch of banks bid up the price of a bill, lowering the return when they could just accept the Treasury rate?

The answer lies in the fact this is pristine collateral. On a balance sheet, this is the best of the best. Of course, this is a situation that has persisted for a long time now. Treasuries are future dollars and there are not enough of them.

In Conclusion

This is the problem: most people do not look at what is going on or the data. To say that China dumping Tresuries would cause hyperinflation in the US is not based in reality. Looking at the capital flow over the past decade make this obviously clear.

The Chinese dumping 1 trillion in Treasuries into the market? That is nothing. Depending upon exact make up of the securities, these will get swallowed up in no time. The system is starved for these assets.

Finally, there is no mentioned of what the monetary system. Here is where one has to believe that the BRICs will have a network to rival the USD. It simply is not going to happen for a long time.

As always, people think they know about money but, in the end, it is nothing more than ideology base in fiction.

If we are going to change the financial system, we best understand how it works. Promoting the nonsense of the likes of Peter Schiff is not going to cut it.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Hello taskmaster! You have discussed an interesting topic concerning the monetary system. I understand your concerns about the misinformation that some individuals promote about money, finance, and the monetary system. In fact the lack of understanding about these topics can lead to confusion and misinterpretation of facts.

It is quite unfortunate that it is people like Peter that have the loudest voice, it is no surprise that they fit perfectly into the bracket of those they call “empty barrels” as they make the loudest noise.

Posted Using LeoFinance Beta

Yes. Dont get me wrong, he is a smart guy. I believe he understands a large part of the system. He, however, chooses to ignore it because he is making money selling gold to people who use his sites.

It is a good gig but still not accurate. Forecasts are one thing, we never know when the price of something will go up or down.

However, there is still a lot to holding the view of something for decades when proven wrong. Peter knows the Fed doesnt print dollars, or at least he should. Yet he talking about that all the time.

Posted Using LeoFinance Beta

That’s just not cool

We can agree to disagree on a few things. I can completely understand and take all youve said to be factually accurate. I personally would still rather air on the side of caution and prepare my finances for the worst. If nothing happens then ill continue to happily play the little fiat currency game and continue to diversify my portfolio for the sake of my kids and any possible future grandkids.

What I can instantly take from you blog are two things:

You give a lot of thought to what you write. You habe great passion for what you belive and can back it up with a well written and fully comprehensive post, without getting angry or starting a slagging/shouting match.

My spelling, mis-typing and grammer is awful. I really should spend more time proof reading before hitting the "post" button.

Depends upon what you want to convey. The message is important although these factors can be part of how that is received. Some prefer to get ideas out there. I do it with my videos. They are not professional, edited, or include neat graphics. It is just film and post.

Some have to make every email 100% accurate others simply type and let things fly.

Posted Using LeoFinance Beta

Will the countries that dump treasuries suffer more when they have to buy them back? I understand them selling off the treasuries to prop up their own fiat though.

Posted Using LeoFinance Beta

I dont think they will suffer more in the sense of loss. Where this is a problem is in the having to sell to start. When a central bank needs to unload the UST to get USD for their commercial banks so repayments of loans can be made, that is a problem.

Yeah evidently the BoJ loaned US Treasuries to the commercial banks and they sold them to prop of the yen.

To be a fly on the wall during that conversation. LOL

Posted Using LeoFinance Beta

~~~ embed:1630089406357938177 twitter metadata:MTQwNTIwMjI4MHx8aHR0cHM6Ly90d2l0dGVyLmNvbS8xNDA1MjAyMjgwL3N0YXR1cy8xNjMwMDg5NDA2MzU3OTM4MTc3fA== ~~~

The rewards earned on this comment will go directly to the people( @taskmaster4450le, @manniman ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

An amazing article, thank you for writing these publications that enlighten us more about these cryptothemes.

USD denominated stable Coins have been taking over the Crypo space too, it's wild.

I had to read it through more than twice.

Enlightened.

Posted Using LeoFinance Beta

Some great points. I understand Peter belongs to the Austrian school of economics and the definition of inflation is the total supply of money. Whereas in modern monetary theory, Keynes et al, inflation is defined as an increase in prices .. the Austrian school of economics says this is an effect of increasing the total supply of money.

I think the Austrian School doesn't differentiate as to if it has entered circulation or not.

Posted Using LeoFinance Beta

why keep global currency?

it can be bilateral terms. countries in the East can think about trading in bilateral agreements. like India and Russia can think about trading in INR. They can jointly operate a bank to make it viable. India can purchase gas from Russia for INR and so on.

Posted Using LeoFinance Beta