Warren Buffett is known as the "Greatest Investor of all time". He was once the world's richest person. The performance of his Berkshire Hathaway holdings is legendary. His annual reports are studied in business programs around the world.

Known as the Oracle of Omaha, Buffett amazed the world with his steady returns. This generated billions in wealth, making him a household name.

Wouldn't we all like to be like Buffett? The reality is that now we can, at least in terms of the returns he got.

Consistent returns over many years equates to big numbers.

This is the power of compounding, something few in the cryptocurrency world are presently focused upon. Most want the mooning and Lambos. Of course, Buffett could afford a lot of Lambos if he wanted.

For this reason, those who are hunting yield are going to keep growing within the cryptocurrency realm. On Hive, we got a taste of this in the last 24 hours with the increase in interest payments on HBD in savings. We are not sitting at 20%.

That is a figure to pay attention to.

Warren Buffett's Return

These days, with bonds paying very little (or negative around the world), getting a reliable return is difficult. In the traditional markets, it seems like investors have to take on more risk to find a return. The equities market is on fire due to a continue flow of capital. We also see junk bonds gaining in popularity since safer bonds have no yield.

Buffett, over more than half a century, was able to achieve outstanding returns, far outpacing the S&P. What did he achieve?

Warren Buffett's annual letter to Berkshire shareholders was released on Saturday, and as usual the first page compares the annual performance of Berkshire against that of the S&P 500 (^GSPC) since 1965.*

Berkshire shares have seen an average annual return of 20.0% compared to the S&P 500's 10.2% gain during that period.

Notice the return he was able to average? 20%. Where did we see that?

That shows what a powerful opportunity this is. With HBD, we can get the return that the legendary Berkshire Hathaway investor was able to achieve. In other words, we all can be like Warren Buffett.

It is easy to overlook how big a deal this is. At present, we have the tools at our disposal to realistically grow a massive amount of wealth. This is not going to happen in a day or a week. That is not how compounding works. However, over time, if the rate stays the same, we could see enormous portfolios built in a rather risk averse manner.

HBD in savings has very little downside. While this is not risk free, the potential pitfalls are being removed.

Compounding Our Way Through Life

Most only know compounding by being on the short end of the equation. They feel the effect of compounding by looking at their credit card statements. While they get further behind when paying the minimum, the bank, who understands compound very well, is making a ton of money. It understands how the numbers can get rather large over time.

How does this look when put into practice?

Let us have some fun with numbers. We will do $100 at 20% APR for 20 years.

Year 1 $120

Year 2 $144

Year 3 $172.80

Year 4 $207.36

Year 5 $248.83

Year 10 $619.17

Year 15 $1,540.70

Year 20 $3,833,76

In 20 years, at 20% interest, $100 will turn into $3,833 without adding anything else in. We also do this when compounding annually. With HBD, we can do it monthly.

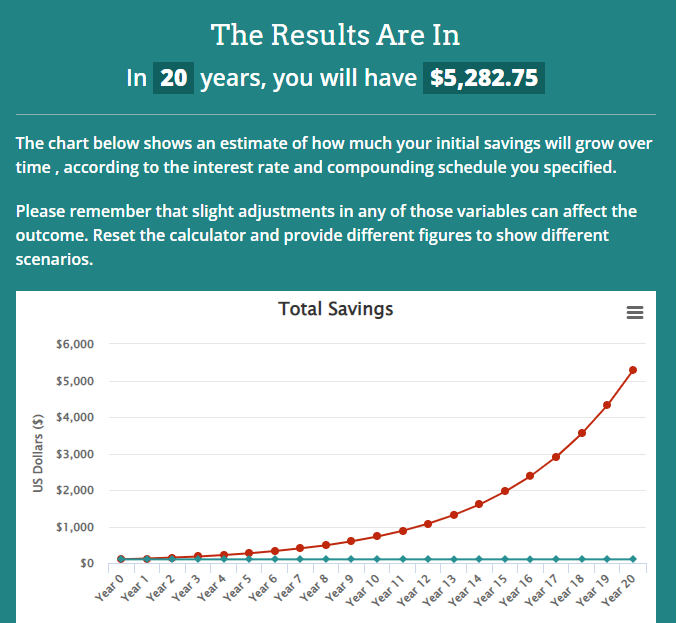

Let us see how that looks.

We put in $100 today, let it earn 20% per year, compounding it each month, and we will have $5,282 after 20 years.

Let us do one more. How do these numbers look?

Results created using this compounding calculator

This took the same conditions as above yet added in $10 per month. As we can see the value at the end of 20 years is over $36K. Anyone who is 40 or under should take this to heart. I can assure you, this will beat most retirement accounts.

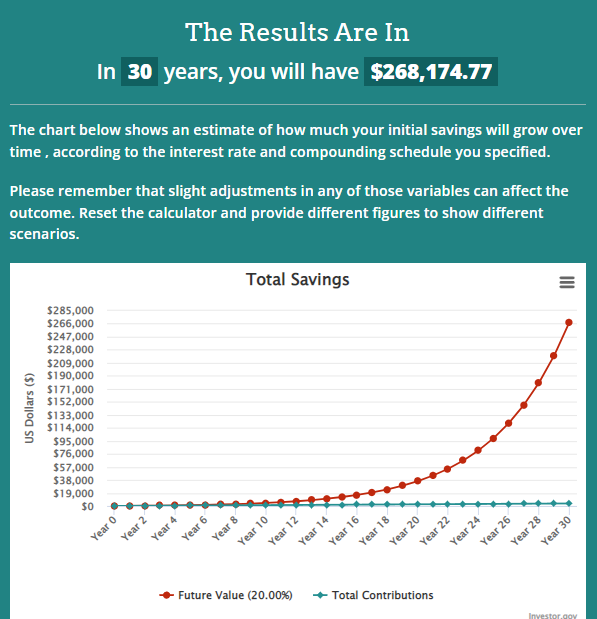

For those of you who are 35 or younger, here is a special treat for you. Everything is the same, including the $10 per month. The only difference is we are looking at 30 years instead of 20.

Notice how that extra 10 years makes a huge difference. The key is, when looking at the chart, to hang in there long enough to allow for the compounding to take hold.

The tools Are Being Handed To Us

Anyone can play with the numbers. What if you started with $2,000 as compared to $1,000? Or, instead of putting in $10 per month, one put in $20? Or $50?

Simply be adjusting things upward slightly, we get much larger numbers. Taking the last scenario and adding $20 a month will give someone over $800K at the end of 30 years. Who says that Hive will not make you rich?

Simply doing little things, consistently, over a long period of time delivers enormous results. For those who are young enough, wealth can be in your future if you want it. Hive is starting to deliver the tools.

Amazing what a steady, yet high return will net out to over a long period of time.

That is why the savings rate on HBD is so powerful. Now anyone can be like Warren Buffett.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

This old fart is scam ... I not follow this old man words 👎

An investors mindset you've got. It's an interesting approach and good to take a long term outlook. Wealth is never created in a day! These things take time!

of wanting to have and make excellent investments, we all want a little. Surely with #HBD at 20% it is one of those investments with which we can begin to see our future with a different face thanks to #Hive.

" those who are hunting yield" .... thats me :)

Posted Using LeoFinance Beta

Smart move.

Posted Using LeoFinance Beta

This is the perfect way to get really rich. The way you showed is really great, I will work on it and create my own plans. Thank you so much.

Posted Using LeoFinance Beta

It is rather straight-forward. We simply need to start working the plan and give it enough time. Thirty years is a long time but to anyone in their 50s, we know it goes very quickly.

Best to be earning 20% as the decades roll by.

Posted Using LeoFinance Beta

I have some assets in a fund that's being managed by this guy. He's pretty good and was able to average 14% last year which is not bad at all in this economy.

But now Hive gives me more than that, for free! I might transfer some resources over

Posted Using LeoFinance Beta

Yeah and I question whether they can produce those results, year in and year out. Most cannot.

And 14% in an up market is doable. How about when the bear truly takes hold?

Posted Using LeoFinance Beta

Now that HBD is at 20% and we can get fairly good returns, do you still think we might need Hive Saving bonds? I think the 20% itself is powerful and I don't mind adding to my position so it will work for me a few decades from now.

Posted Using LeoFinance Beta

Yes Hive Savings Bonds are essential to collateralization and really making Hive at the center of the new financial system. Most look at just the base layer stuff. We really need to build those things required to go after the international banking system.

Posted Using LeoFinance Beta

HBD has just become a potential retirement account and a great hedge against inflation as well.

Posted using LeoFinance Mobile

It certainly did. When you look in the US, people can put, I believe it is $6K yearly into an IRA. If they did that with HBD and the savings, where would things be in 20 or 30 years. I know I never got close to 20% in my retirement account.

Posted Using LeoFinance Beta

B20. Where was Hive when I was 20...rhetorical question)

Posted Using LeoFinance Beta

When I was 20, there wasnt even a public internet. Hell the Web Browser was still a few years away.

Posted Using LeoFinance Beta

I think our lead characters need to be younger now. The man mentioned is good, but it is better to follow different paths and people to guarantee us a better future

This is awesome. Now can save on HBD and get a great rate. Every month you just claim the interest and let it compound. The rates do change sometimes. But then if it's consistent, this can potentially be the best savings planner !

That seems to be what is offered. If people are willing to take the long term view of things and keep pumping money in, in a couple decades they will have a nice nest egg.

Posted Using LeoFinance Beta

This is insane when put into perspective like this. Setting a clear long-term goal is hard for many people, especially when we talk about 30-year time frames but damn, this post should change a lot of people's minds.

Putting $10 into saving every month is so easy you can't find an excuse not to. And that is why I'm gonna start doing just that.

Thanks for the inspiration chief.

Posted Using LeoFinance Beta

I linked the compounding calculator. Play with the numbers and see what you get. They do not lie.

Everyone heard the power of compounding yet it really isnt driven home until some clear numbers are placed. Plus we have the 20% APR available to us now. It is right there.

Posted Using LeoFinance Beta

Compounding is very powerful and one the best way to save is having compounding mindset.

Posted Using LeoFinance Beta

Warren Buffet is an icon worth emulating. He proved that you don't need the wisdom of King Solomon to be wealthy neither do you need the programming knowledge of Bill Gate. He proved that you don't need the strength of Alexander the great neither sweet voice of Beyonce.

Buffet proved that with common sense and an understanding of +-×÷(addition subtraction multiplication and division) one can become wealthy.

Information is key and that is what you @taskmaster4450le has shared. We need to take advantage of this information inorder to smile, look back in years time and appreciate this very moment.

You are a wonderful fellow

Thanks for sharing

Cheers.

That is all true although Buffett is not a stupid guy. He does understand high finance with the best of them. The guy is just very particular what he invests in. He understands the advanced financial products, he just wont touch them.

Sometimes simple is better.

Posted Using LeoFinance Beta

SAVING is sexy again. I have posted a post with this title many moons back. It is true, once again, with the introduction of this new APR. I have funds with Anchor enjoying that sweet return. I need to redirect some of that fund to HBD staking.

Posted Using LeoFinance Beta

This is a grand idea.

You might want to update this post since we are linking it to help the SEO. Give it a but of an amend to let the search engines think it is new, but old.

Posted Using LeoFinance Beta

Ah yes, the power of compounding! I also remember "the rule of 72" from college days: 72 divided by your interest rate is how long (in years) it approximately takes to double your money.

I love the idea of putting money into something, and just letting it do its own thing... the cool think here is that someone could put in $1,000 when they leave college, forget about it, and have a nice nest egg by age 60.

Of course, we have no idea what inflation in the greater system will do.... but it's definitely a sweet idea!

=^..^=

Posted Using LeoFinance Beta

Yep. It shows how getting wealthy is rather straightforward. That is why putting some money out of each check away is a good idea. Many grasp it, few do it.

In a technological era, I wouldnt worry about it. That coupled with the demographic nightmares the developed countries are facing over the next few decades, inflation is going to be craved.

Posted Using LeoFinance Beta

I'm 54 so my time frame is shorter but it's pretty fantastic from that aspect of not having to chase yield. I'm speaking from the perspective of someone who isnt and expert in defi. I will fomo on the pool for if I dont participate but will lick my wounds with 20%. Poor me.

Posted Using LeoFinance Beta

I hear you. Crossing the 50 mark means there is a lot less time to compound. It also means we have to put in bigger numbers.

Yes I hope you can get over having to live with 20%.

Posted Using LeoFinance Beta

Part of my age means I have to learn how this all works to make the right decisions. I have no clue why its so hard. I always guess wrong on all the projects so being punished with 20% is something I deserve. And now at least I will have some hbd strategy after my payouts. I usually never even think about my hbd. I'm just glad its there. Now it is working for me.

Posted Using LeoFinance Beta

20% is a fabulous return no matter how it is broken down. Fortunes were made on a less annual return. Time to keep filling the bags at an accelerated rate.

Posted Using LeoFinance Beta

View or trade

BEER.BEERHey @taskmaster4450le, here is a little bit of from @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Congratulations @taskmaster4450le! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Yay! Let's all be not just buffet but a better and smarter version of him! :) !PIZZA with !LUV

(1/1) gave you LUV. H-E tools | discord | community | <><

H-E tools | discord | community | <><

HiveBuzz.me NFT for Peace

PIZZA Holders sent $PIZZA tips in this post's comments:

(1/5) @dlmmqb tipped @taskmaster4450le (x1)

You can now send $PIZZA tips in Discord via tip.cc!

It is the simple things that are the most difficult. Saving HBD10 per month for 20 or more years is simple. The difficult part is sticking to it!

The rationale for regular savings is what made life insurance companies the biggest asset owners globally. It starts small but then snowballs into the big numbers you mention @taskmaster4450le.

The important consideration for us savers will be the viability of the 20% return on HBD over the next however many years!

Buffet started off by buying undervalued companies and rock bottom prices. Once had too much money under management he had to change that approach by making his own opportunities, i.e. buying "off-market" and benefitting from incentives provided by the companies in invested in.

Will HBD ever be in that position, I wonder? And if so, what will actions will we then take?

Posted Using LeoFinance Beta