The Fed made news with their most recent statement regarding their outlook on rate. This is watched by many in the markets. They believe the Fed gives insight into what they are going to do.

Here is where problems arise. What the economists at the Fed typically see is not quite what happens.

At the core of all this is the fact that the Fed Funds Rate returning to "normal". Many, including those at the Fed, believe that they will get rates back to 3.5%.

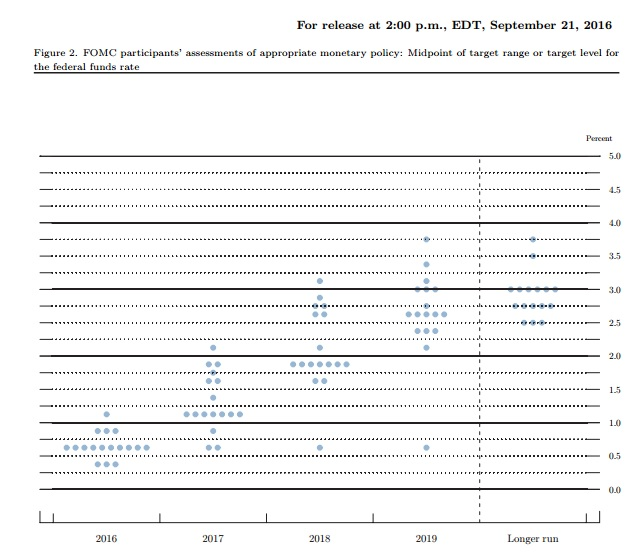

The Fed puts out a dot chart which denotes where the different participants believe things will go over the next year.

Here we have the latest chart from the Federal Reserve Website.

That looks pretty daunting. Obviously, it is unanimous that we will not see any rate increase in 2021. After that, we see a split. However, what is evident is all agree that they will increase them in "Longer Run". Before that happens, many see rate hikes in 2022 and even more believe it will happen in 2023.

This certainly has impact on the markets. A lot are watching inflation as the reason behind this rise. It only makes sense that if inflation is going to be a long term problem, the Fed will take the opportunity to raise rate. After all, if things are heated, rate increases are how the Fed can slow things down.

Anyone who reads these articles regularly knows that this is not an idea supported. In fact, it is evident that the Fed is going to have to keep easing regardless of what they say. Simply put, if those at the Fed think they can raise rates, they are delusional.

At this point, the Fed is simply guessing at something it hopes to have happen but will not. Of course, this is nothing new for anyone who watches the Fed. Their economists come up with the same recycled stuff that is not applicable in today's world.

Here is the dot chart from the September 2016 meeting. Notice anything similar?

At that time, the belief was that the 2016 was going be the end of near zero rates and they would head up. The "Longer Run" view was that we would see between 2.5% and 3.0%.

The advantage to looking back 5 years is we can see where their forecasts ended up. Obviously, we are in the "Longer Run" territory right now.

So what took place?

The Fed Funds Rate did drift higher over the ensuring years. The economy was expanding (so we are told) so it made sense for the Fed to let rates go higher.

Here is the chart of what took place.

.png)

Notice how the last two charts match. To their credit, the first few years mirrored what was forecast. However, something happened in 2019. The rates peaked and started heading lower. Remember, this was 9 months before COVID. It was also about 3 months before the crisis in the Repo market arose.

Obviously, the economy could not handle the rate increase, something the Fed learned. When COVID it, the rate already dropped a point to bear 1.5%. Why would this be happening when the economy was growing?

The reality is that, by most any metric, the economy (both US and global) is nowhere near what it was even pre-COVID. All the moves over the last 12 months are an economic recovery, not an expansion. This means we are still trying to return to the longer term trendlines, which were not that terrific to begin with.

Personally, it appears that Powell is just paying some lip service. His term comes up next year and he is not about to jeopardize the potential of being reappointed by tightening in a weak economy. Of course, the rhetoric out there on the Street is inflation so he had to do something.

Consider this just a major PR move that will likely be backed away from. Any tapering will crash the equities market, something that will not enhance is standing with President Biden. He is going to have to do all he can to keep himself in the good graces there.

By September, we will likely be looking at an entirely different storyline. There are already some indicators that are worth watching. The bond market, for example, is not real optimistic about what is taking place. It foresees headwinds in the present dialogue meaning there is a chance that it completely breaks down.

Source

As we can see the yield on the 10 year peaked (in this recent cycle) in March. It came off the low as the recovery started to hit high gear. However, it suddenly reverse direction and is off more than 30 basis points.

What is this telling us?

Simply put, the bond market is not optimistic about the economy going forward. Remember, as bond yields go down, the prices of the bonds go up. This is likely an indication on the prospect of the economy and the equities market. When the bond market is rising, it is saying that the fixed return is preferred to the uncertainty of equities.

Finally, we have the gold and copper markets, two areas that many consider to be barometers of what is taking place. Both have turned over in the last month.

Source

We will have to see if these are just temporary pullbacks on a larger path higher. As we can see from the chart, gold is apt to fluctuate. King Copper, however is a much greater concern because that is considered an indication on construction.

There is a lot to watch as we progress through the second half of the year. But if we have all of this in play, along with a few others such as the push towards automation, then we are going to find the Fed have a tough time tightening.

It simply will not be in the cards. In short, in the "Longer Run" of 2024, we can surmise that the Fed Funds Rate will not be anywhere near 3.5%.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

The Fed already doesn't have much they can do. As it is right now, they need more people to borrow as it would probably alleviate many of the problems and the government isn't really planning on more cash injections to citizens. So at the current rate, I definitely forebode some bad things for the market.

Posted Using LeoFinance Beta

View or trade

BEER.BEERHey @taskmaster4450le, here is a little bit of from @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.The Fed has painted itself into a corner. Sure, by changing the Fed Funds Rate they have a lot of control over short-term interest rates, but they have essentially no control of long-term rates. If long-term rates start rising significantly in credit markets, the U.S. Treasury could quickly have trouble servicing the national debt.

If he was smart, he would not try to get reappointed. Move to the private sector and land a cushy job on Wall Street for a year or so. Then retire. Let some other sucker take the fall and blame when things implode.

Posted Using LeoFinance Beta

We want the rates to rise because that will be the end game. Of course the FED will do its best to prolong this by keeping rates low and even negative. When interest rates need to rise to meet actual inflation the debt will be so heavy to deal with that basically the FED needs to absorb it all creating a worthless dollar. As long as stock market continue to rise we are getting closer to that point, if markets fall the FED basically bought more time to operate. We need the stock market and asset prices to basically go exponential for the system to basically fall apart is what I think will happen. Many people have explain this in detail but it has yet to happen. Hoping this time it is different. !LUV and !PIZZA

I don't think the rate will go negative or even if it does, it won't stay there for long. I think the policy behind the Fed and also since it is the world's reserve currency is the reason why but its been a while since I last heard a bond bull I follow say the reason.

Posted Using LeoFinance Beta

I agree but Fed will try to push it here. Push it I mean making it bond bullish. The atmosphere is setup for this to happen since reopening won’t create the demand that people are expecting. What will be the nail in the coffin is the lost of reserve currency in which will likely destroy the country in itself. A lot of people believe that won’t happen for a very long time but technology has a way of accelerating the process. !LUV and !PIZZA

$PIZZA@jfang003! I sent you a slice of on behalf of @mawit07.

Learn more about $PIZZA Token at hive.pizza (2/10)

@jfang003, you were given LUV from @mawit07. About LUV: https://peakd.com/@luvshares http://ipfs.io/ipfs/QmUptF5k64xBvsQ9B6MjZo1dc2JwvXTWjWJAnyMCtWZxqM

$PIZZA@taskmaster4450le! I sent you a slice of on behalf of @mawit07.

Learn more about $PIZZA Token at hive.pizza (1/10)

Quite the interesting outlook on the situation.

Posted Using LeoFinance Beta

Doesn't look like those rates will move much for the next few years with the rate at which things are progressing. Feels like the FED is up to FUD as well now which dropped the markets the last few days because of these headlines of "possibly" increasing the rates

Posted Using LeoFinance Beta

Congratulations @taskmaster4450le! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!