Loan companies and apps have become so popular in recent times because of how swift they give loans to their customers even those without any prior transactions with them. They've gained so much popularity as they've helped alot of people in urgent need of money and the easy accessibility to many of them with no collateral. But after yesterday, I'm not exactly sure if I would recommend anyone to any loans. Personally I've been staying away from these loans apps especially because of their high interest rates but now, I do have a good reason to stay completely away from them because of how they breach their users privacy when trying to get their customers to repay loans.

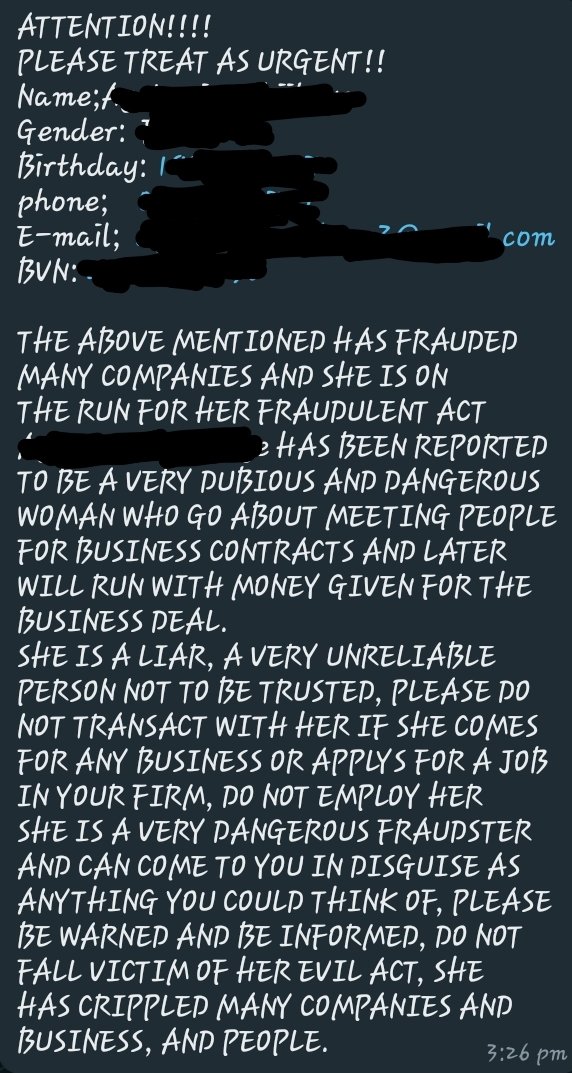

I had no idea this was a thing until yesterday when I got a whatsapp message from an unknown number calling my attention to someone I knew as a fraudster, a scam and thief. Here's the message I received.

So I messaged the person's sister first because I was more acquainted to her and told her about the message the message I received and asked what was going on because it did seemed pretty serious. The sister said she received the same message and when she asked her sister who the message was referring to, the sister said she had borrowed money from a loan app and the loan was due for repayment. She had delayed in the repayment bit had no idea the loan app could do this. Unfortunately the message was sent to atleast 300 contacts from her phone. I was surprised at how a loan app could get her contacts and even go to the extent of ruining a person's reputation because of a loan of less than $20 and had to read a bit on this matter.

I realised this has been going on for a very long time in the country but no one has been success in making these loan companies pay massively for defamation due to the corrupt and highly demandingjudicial system as well as the complex nature of most of these cases. Apparently, the users of these loan apps from the onset have given the company the right to access their contact list right from the registration stage ans a part of their terms was to do whatever it takes to get their money back if the debtor delays payment. Sadly, many people don't go through the terms and conditions for most of these loans and click on "accept" just so they could get the loan.

This event was quite traumatic for the person in question as so many people reached out to her to know what was happening. I understand the company is trying to get the loan repaid but the step taken by the these loans apps to recover their funds is pretty harsh in my opinion and I do not support it at all. I've never been a fan of loans and this just makes me hate the idea more.

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.