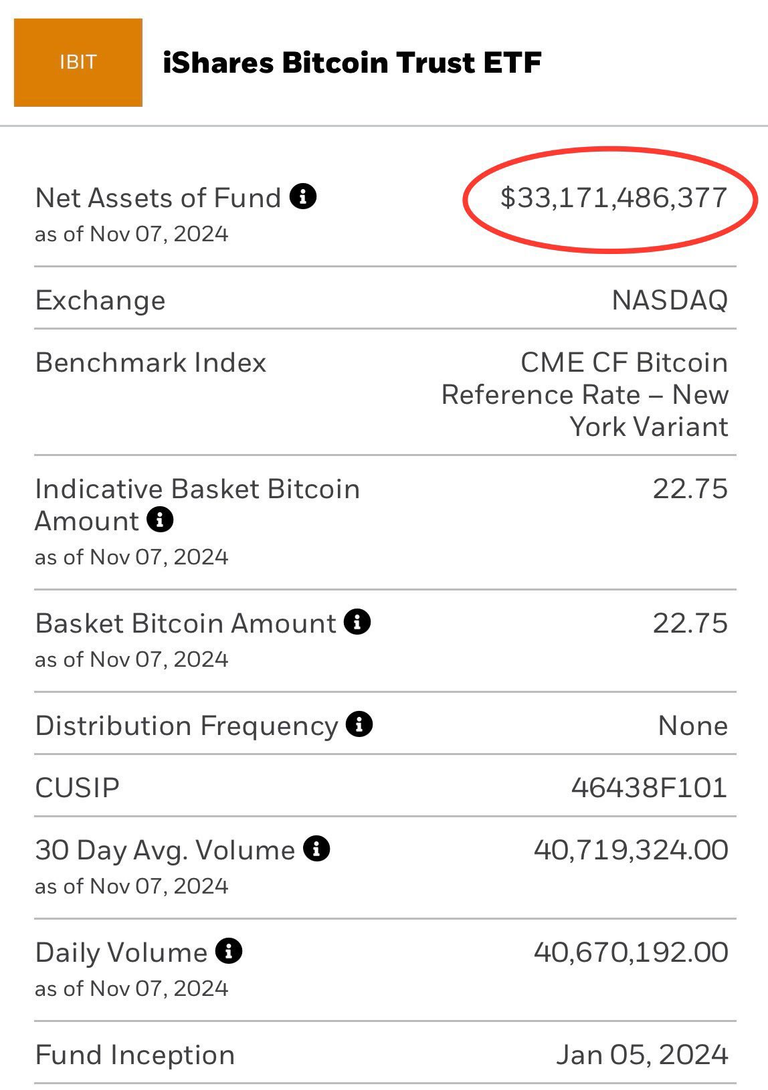

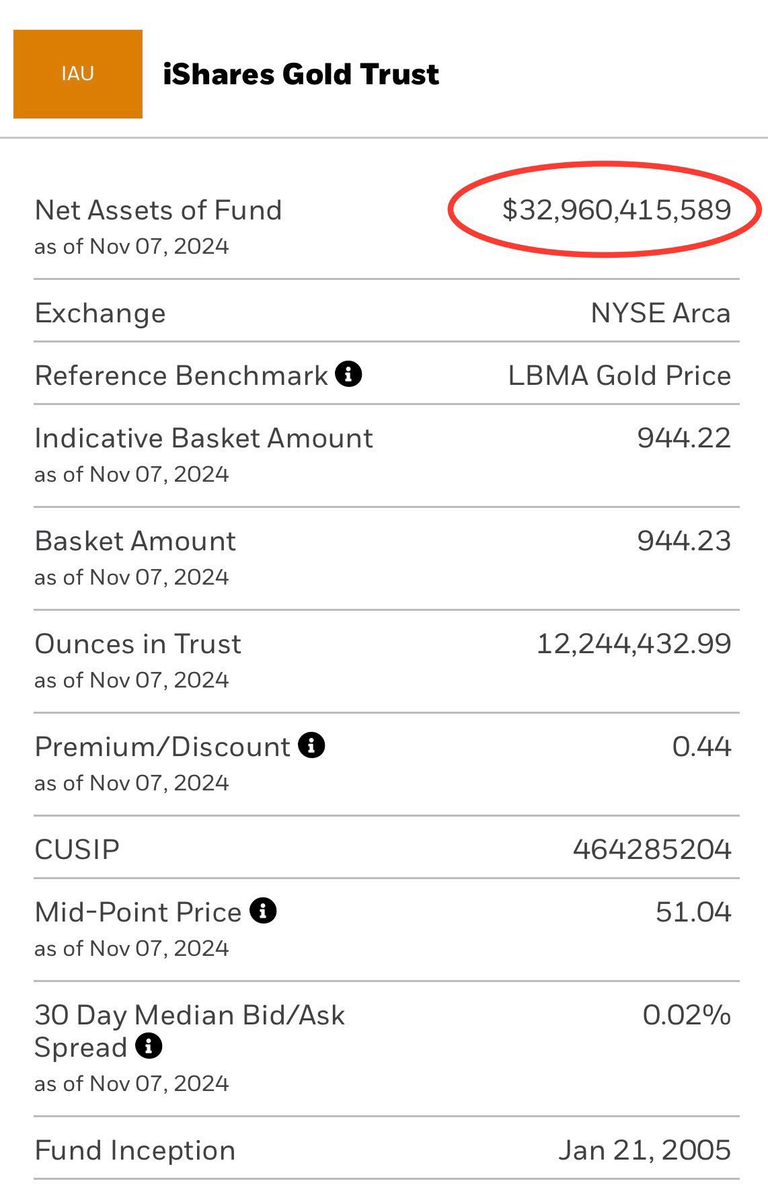

BlackRock's iShare $BTC ETF just surpassed Gold's ETF in net assets!

Peter Schieff must be so pissed off right now.

Gold might be rare, but bitcoin's supply is limited to 21M, while gold's supply is not, plenty of gold out there in space. Whenever the price of gold rises, the miners start minining more, while on Bitcoin they can't do that.

It was only a matter of time before this happens. Bitcoin will be the global SoV, and soon the global medium of exchange between the two factions that are slowly starting to appear... The west and BRICS.

Globalization is probably ending and Bitcoin will be the best thing for both sides to use to transact with each other. It's fast, easy to transport, and has value all around the world.

people are still sleeping

The giant is coming

I'm just waiting for Thor to finally unlock more loans on their lending protocol so I can go leverage on some more crypto.

This next bull will be massive! We will finally see the game theory behind the end game of Bitcoin where countries will have to start buying up some of the supply to put in their own reserves.

I was under the impression that they weren't going to do loans anymore due to potential risk.

Khal said the same thing, I might have to take another look into this.

I know it has risk, but I thought they limited the borrowing amount to limit the risk, and if the token's price increased they also increased the limit, but I need to check up on this.

AFAIK they aren't going to open more loans. The loan protocol is essentially deprecated on Thorchain

This is my understanding, unless something has changed

It sucks because I would have also used it heavily. I am still using Sky (formerly MakerDAO) on ETH in the meantime

From what I've researched 2-3 months ago, because the product has risk, they need to contain the risk, and that means putting caps on the borrow amount, just like they currently have, but if $RUNE increases in price, they should and will be able to increase the cap

But my knowledge might be outdated, need to investigate it a little better.

Sky still has the liquidation risk, don't want to see the market going against me and me having to chase a losing position, that's why I haven't used it...

I've been taking a look at Alchemix, they have a self repaying loan protocol with no risk of liquidation, which is very interesting, might use them, just need to see if the smart contract risk is worth it.

PS: That whole MakerDAO rebranding was so bad... they lost a bunch of community DAO members.