Let's begin this topic with understanding DeFi , it is an abbreviation for Decentralised Finance which is a system where financial products become available on the public decentralized Blockchain network. The main goal is to remove intermediate parties in financial transactions.

In decentralized exchange such as pancake swap or the unicorn swap, there is a lot of liquidity-related challenges, to solve this DeFi liquidity pool was created. " Liquidity Provider's" or in other words people who provide liquidity to a liquidity pool form a smart contract and lock their funds for a certain duration.

Usually, in a centralized exchange there is like this Trade book where it maintains a record of who bought or sold token at a certain price. In decentralized exchange buyers and sellers come to an agreement on the price of the asset based on the supply and demand.

"The working with robiniaswap token example!"

.png)

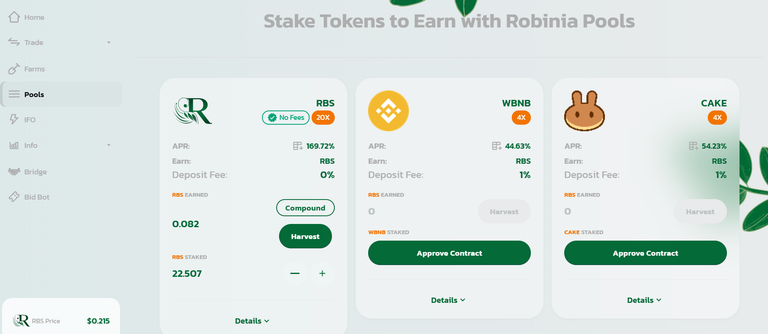

So here we have two assets one is the steem coin we own and the other is the RBS token that we need. Here basically we want to trade bsteem for RBS, usually, on a centralized exchange we would have to first wait for someone to match our trade price and then the trade occurs but In a liquid pool, they can do this by just depositing their funds (bsteem) and then they are rewarded over time based on the amount of funds deposited. In case if you want to withdraw from a liquidity pool you burn the tokens and then withdraw it from the stake but i would advise to look at the bigger picture and actually compound the investment. It's a nice way to make some decent passive income usually without any loss other than the gas fee.

This process depends on the fact there are enough buyers and sellers to maintain liquidity, its the market makers' job to ensure that there is always people who meet the demand and another task would be to keep the price fair.

It is kind of similar to mining where we verify transactions and are given a small amount of the token as a reward. The token reward is usually of the same crypto they are mining.

Benefits

✓ It benefits the decentralized exchange in maintaining the liquidity of tokens.

✓The Liquidity providers receive profit from holding the crypto in the pool.

✓Some pools even offer additional rewards to liquidity providers so that the token pool remains large and there is less chance of slippage.

.png)

Risks

✓If the size of the pool is small there is a larger chance of slippage.

✓ The whole system works on the basis of a smart contract, there are times when the smart contract may fail.

If you want to get started investing in liquidity pools check out my previous blogs on how you can transfer your steem to a robiniaswap pool!

This is by no means financial advice but a blog with the goal to educate everyone on the topic "liquidity pools"

Hope you learned something new, Let me know your thoughts on liquidity pools in the comments :^)

Useful Links:

WEBSITE: Robiniaswap

Discord Channel:RobiniaDiscord