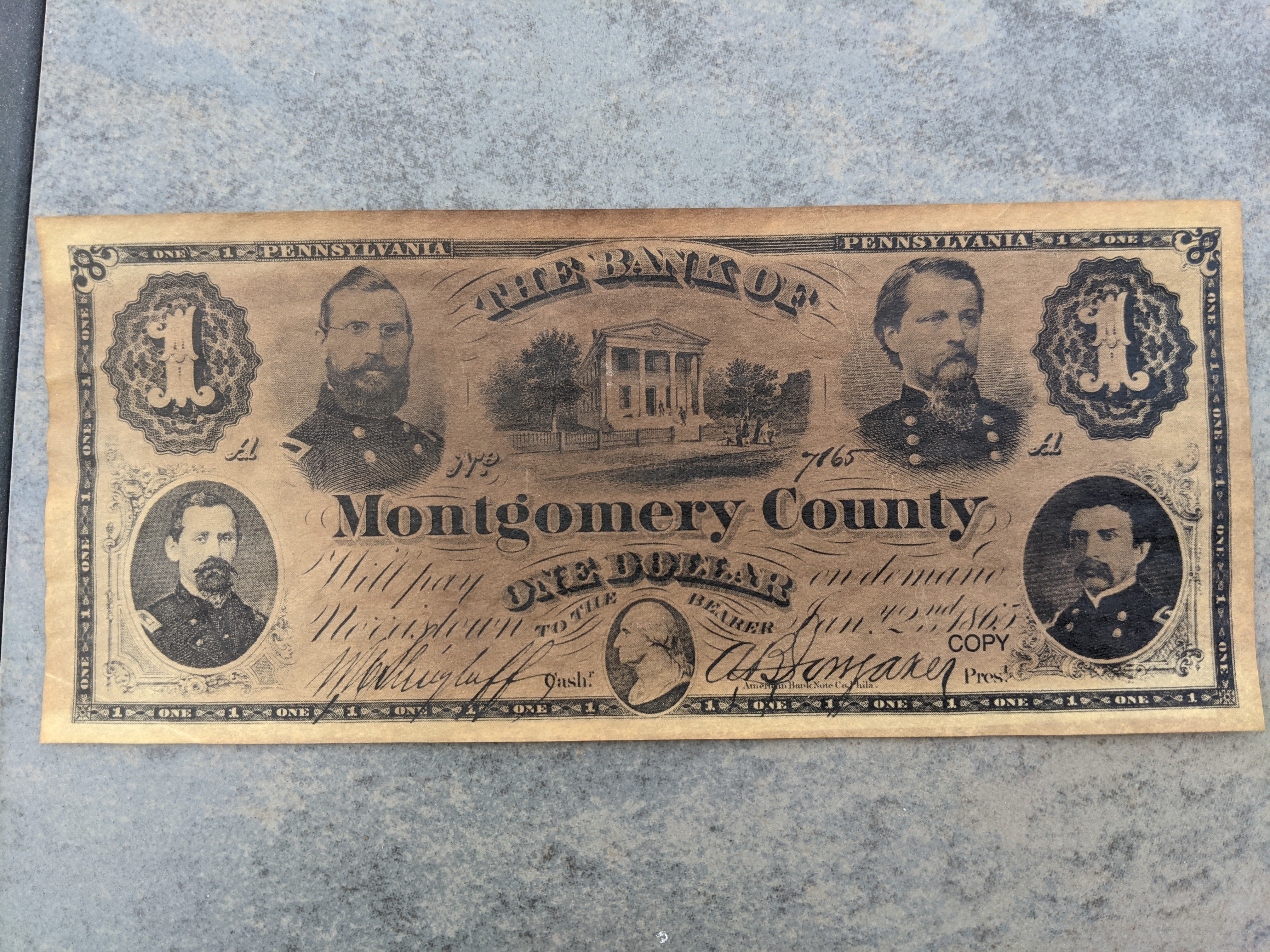

Where are these currencies from?

They are from the United States of America and there were thousands of these. Different states, counties, towns, and private banks would all have their own currencies:

Where did I get them from?

I bought these replica from a museum. I spent most of the day looking at dinosaur bones and on my way out I bought these at the gift shop. All of these currencies are extinct now just like the dinosaurs.

Did an asteroid kill the currencies?

No

These banks went bankrupt over and over. Banks were born, then died, then more were born and then they died.

How did this problem get "fixed"?

Central Banks

--

I want to start by saying that I am a proponent of blockchain technology and cryptocurrencies. If we want cryptocurrencies to succeed we should learn everything that we can about why decentralized currencies fail. We can also learn from the weaknesses of central banks. This will allow us to "build back better". You can't just "repeal" the central bank without a "replacement".

What problems did the United States Central Bank (The Fed) solve?

Solvency: They are there to help member banks in a crunch and it reduces bankruptcy

Inflation: They can contract the supply to control inflation. This is the first part of the "dual mandate" of The Fed.

Liquidity: They can expand the money supply in situations when the economy needs stimulus or the job market needs a boost during high unemployment. This is the second part of the "dual mandate" of The Fed.

What does this mean for crypto?

Some blockchain ecosystems do a good job of solving the above problems and some do not. The ones that don't will become extinct and be memorialized in digital museums as NFTs, (Nonfungible Tokens).

Decentralized money is not new and in fact the history of money usually starts as decentralization and moves towards centralization. People usually prefer decentralization because it easier to start that way. The example that I gave above is from the United States from hundreds of years ago, so let me give you a modern example.

Modern History of Decentralized Banking -- The EU and the EURO

Each EU member already had their own central bank and then they came together and built another centralizing layer on top of that. It's like they have feds within a fed like a dream within a dream.

Why did they do this?

This is economies of scale applied to money. There is an efficiency advantage to centralization. It reduces transaction cost between different countries. If I am a French business trading in 8 different countries / currencies in Europe then I expose myself to conversion cost for converting currencies and I expose myself to currency risk in all of those 8 countries. I have pay money every time I convert back to Francs (FF) and I am exposed to different inflations or currency fluctuations in each country.

As a business I might also be buying raw materials from these different countries and I need to easily compare raw materials across countries and making the conversion can introduce errors into your accounting processes or can just be mentally taxing having to think in different units all the time.

We already see the above happening with Cryptos. Too many different wallets, too many exchanges, too many transfer fees, and too many conversion fees. This is why some consolidation can lead to efficiency gains.

The centralized EU trade laws along with the Euro currency reduced transaction cost and trade barriers. This added layer of centralizing is not without problems. Some believe that the Greek Debt Crisis highlighted some of the weaknesses and strengths of the centralized currency. I won't go into more detail about the European Banking System, but I think I hit some of the highlights.

The key in the new crypto economy will be to learn from both the strengths and weaknesses of these centralized currencies so that we don't make the same mistakes. The questions we should be asking is in which cases would centralizing and consolidation be better for the users and the broader ecosystem and in which cases would a proliferation of more competition and choice be better for the ecosystem.

I look forward to hearing your thoughts. Please leave comments or questions below.

Posted Using LeoFinance Beta

If you want to see the full set of pictures that I have of decentralized money then go here:

https://leofinance.io/@therecantonlybe1/pictures-of-extinct-decentralized-currencies-from-the-united-states

Posted Using LeoFinance Beta

All these were centralised money issued by authorities of smaller scale than the federal US scale, but still centralised money.

Posted Using LeoFinance Beta

Some of the currencies like Farmers and Merchants were little trade organizations in small towns. They were just groups of Farmers and Merchants who came together to create little lending pools. That's pretty decentralized.

Ethnic communities, in the United States still create little underground lending pools like this, today. These "unbanked" people get a group of 10 people together and they get pen and paper and they create a "ledger". Each of the 10 people all create their own ledger and everybody is "witnessing" it, so nobody can cheat each other. That creates "consensus". Its like a blockchain on paper.

There were literally thousands of currencies in the United States. How much more decentralized does it need to be to be considered decentralized? Centralization was born out of centralized governments. Prior to centralized economics there had to centralized politics. Think of all of the tribal governments who were decentralized all over the world. Most of these tribes were so small that they didn't even use money because they used "I owe you".

Which should remind people that debt was born before money and even debt was decentralized. For example, I would remember in my brain how much I owed you and you would remember in your brain how much you were owed. Just like blocks needed to be validated by the network to get a consensus. If I owed you money and you and I disagreed how much each owed. Then we might go look for a witness who observed the handshake deal. Again, we are looking for consensus and validation of the ledger. This works when there are very few transactions, but it doesn't work at scale. You can't run a modern economy in your mind.

Even the new blockchains are moving a way from full decentralization because it takes too long for each node to validate every single block in the entire chain. The newer blockchains are moving toward partial validation of their "corner" of the chain. These are "trust" nodes or validators. Again, the blockchain is repeating some of the mistakes of traditional money system and they are implementing similar solutions.

I am all about rebuilding the world in crypto. We just need to build back better and learn from the mistakes of the past.

Posted Using LeoFinance Beta

I think you totally miss the point here.

If there is a unqiue point of failure then the currency is not decentralised.

At least this is the meaning of the word "decentralised" in the blockchain world.

I understand you give the the word "decentralised" a different meaning. That's why we can not communicate.

Posted Using LeoFinance Beta

I think the miscommunications comes from the black and whiteness of central vs decentral. There are currencies that more centralized and there are currencies that are less centralized.

Almost no currency systems, crypto or paper, have a unique point of failure. Even the original decentralized banks didn't have a unique point of failure. The truth is these banks fail for the exact same reason that some blockchains fail and that is through consensus.

Just look at historical examples of 51% attacks on blockchains and you can see a similar mechanism play out on traditional banks. If a certain number depositors agree (consensus) that the bank can't be trusted and they decide to withdraw then they can cause the bank to become insolvent. The safety for traditional banks is their reserve ratio and the Feds.

Historically, there were crowds that would rush the banks and withdraw everything all at the same time that caused failure. If everybody tomorrow refused to accept or trade Bitcoin it would also fail. It only has value through consensus. Blockchain technology is the modern way of improving consensus and building trust, but technology only goes so far.

There are already coins out there that have superior consensus protocols to Bitcoin, but have less value. In fact all of the coins have less dollar value per coin as well as total market cap. This shows that technological superiority alone doesn't equate to value in exchange for dollars. This implies that social consensus still holds higher weight for value.

Even Bitcoin itself has forked a few times. This implies that it wasn't perfect. The lack of consensus just wasn't enough to destroy the coin.

Posted Using LeoFinance Beta