“Compounded interest is the 8th wonder of the world.” ― Albert Einstein

I was fortunate enough to hear about a new staking service, HODLNaut, and decided to throw a little digital gold up for collateral to see how it compared to similar services.

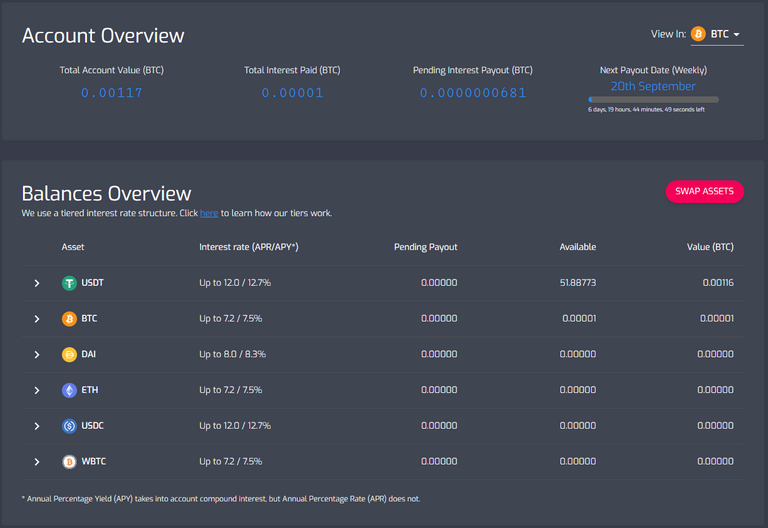

With HODLNaut, you are granted varying APR/APY rates for the type of currency you are staking (putting up for collateral). Interest is compounded daily, and dividends are released weekly. I opted to swap into USDT, which pays out 12.7% APY, an impressive return for a stablecoin, especially since you can choose what you are paid in between a handful of supported top crypto assets.

I went with Bitcoin (BTC) for staking rewards, but I was on the fence about Ethereum (ETH) as that will likely have a greater percentage return given the current market climate.

For the sake of easy understanding, I felt viewing everything in Bitcoin / Satoshi’s would make for the easiest read and overall understanding of the site.

You can see a list of their supported currencies and their APR/APY rates below:

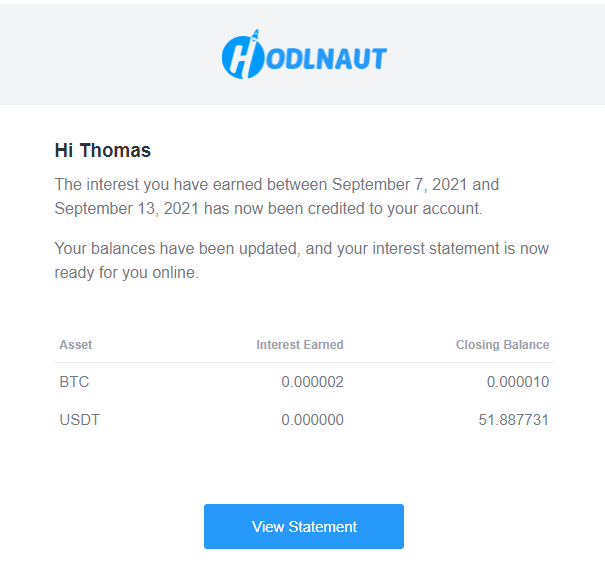

One thing HODLNaut points out I feel everyone who works the markets should know is the difference between APR (Annual Percentage Return) and APY (Annual Percentage Yield). It’s quite simple, as they put it, “Annual Percentage Yield (APY) takes into account compound interest, but Annual Percentage Rate (APR) does not.”

Additionally, you’ll notice many companies advertise APY, while banks or other forms of lenders tend to advertise the APR to make themselves look more appealing.

In layman’s terms, the compounded interest is simply your staking rewards or dividends from putting up collateral. This added interest amounts to 0.7% in addition to the 12% APR, making it 12.7% APY. Where the choice of payout becomes interesting is similar to mining in the sense that you must make a determination on which currency is going to perform the best in the future for the best return, so 0.7% returns can result in much larger gains over time.

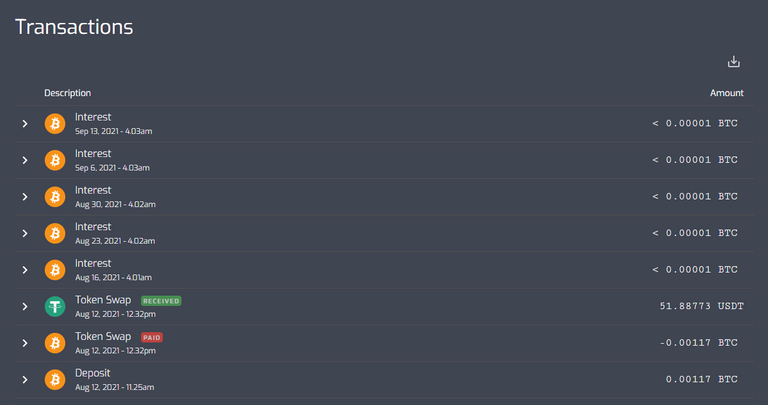

Of course, if you put more assets up for collateral, your rewards will be greater; this was meant to be an informational service test on my end, so I didn’t put much in to start.

If the currency you choose goes down in price, it will reduce your returns, but it also increases the size of your dividends when using a stablecoin for collateral - so don’t be terrified of dips. Staking is a HODL’ers game, but with an added incentive. The beauty of using USDT is that I do not risk losing my initial investment and have the highest available return percentage.

Currencies projected to grow in the future and have larger transaction fees tend to offer a lower APY. Still, interestingly, DAI, which is also a stablecoin like USDT, only pays out 8% APR or 8.3% APY. USDC matches USDT in returns, so the choice was clear for me on which stablecoin to use.

I must note that, like most Ethereum supporting websites, USDT is in ERC-20 (Ethereum Chain) and therefore has a large withdrawal fee, amounting to $10 USD; Bitcoin charges even more with a current rate of 40,000 satoshis for a withdrawal fee, valued at around $17.80 USD at the time of writing this article. All stablecoins charge $10 USD equivalent.

Most people who use these types of services are long-term holders, and thus the withdrawal function isn’t often abused because the point of the service is to watch your money grow gradually, not withdraw it whenever, although you can if you need to. Withdrawals are processed in batch every 24 hours or less, and I’ve heard some withdrawals are processed very fast.

USDC is Coinbase’s native stablecoin, and I am a large fan of USDT (typically TRC-20) transactions to save on fees and time. I am not a fan of Coinbase due to constant crashes and the worst support I’ve ever encountered; KuCoin for the win!

Outside of Coinbase Earn freebies, I try to use their exchange as little as possible; the threat of having large sums of money or assets trapped on their exchange for months at a time is too real.

You can swap your assets on site instantly without a fee. I found the entire experience to be seamless, and the site is not too flashy or annoying. Email updates are sent out with each weekly dividend, and reports are generated to show your staking rewards.

It is entirely possible that staking the other available currencies, Bitcoin, Ethereum, and WBTC (Wrapped Bitcoin), could yield a greater return, but only if those currencies grow in mid-market price.

HODLNaut has an article covering their rates and tiers that can be found here. They previously only offered 10.5% maximum APY, marking a recent increase of 2.2% APY, which makes them far more competitive to other staking sites and coins.

I’ll note that in stocks, many people invest in the S&P 500 index fund, which equally distributes your investment among the top 500 companies in stocks and has historically been shown to only reach an average of 10-11% APR since its fruition as the composite index in 1926, and remains a very popular choice for stockholders under its new name.

This historical fact is an excellent example of how cryptocurrency investments can instantly hold an advantage over traditional stock investments in ROI (Return on Investment).

My conclusion is that while HODLNaut is like many staking sites in the scheme of things, their rates compete with Nexo, and I find it far more light and effortless due to their minimalist approach in the site’s UI (User Interface).

The UI has an overall feeling of not trying to bait you and being real for what it is, unlike the competitors of the site, which employ multiple strategies to keep you cyclically baited into new investments that may not pan out.

I plan to continue using HODLNaut and toy around with staking USDT for Ethereum prior to their PoS (Proof of Stake) switch from PoW (Proof of Work), which is anticipated to happen in January of 2022, and I imagine withdrawal fees will go down when the switch happens.

As always, comments & suggestions are highly encouraged.

Stay smart & Stay safe.

-Thomas Wolf

Pronouns: He/Him/His

DISCLAIMER

I am not a certified financial, tax, or legal advisor, analyst, or planner. The above information should not be considered advice but as an opinion intended to share information and ideas for entertainment and independent research purposes. I am not responsible for any losses or damages incurred due to misinterpreting my personal opinions for professional advice.

Sources:

https://hodlnaut.com/

https://www.hodlnaut.com/crypto-guides/tiered-interest-rates-explained

https://www.inc.com/jim-schleckser/why-einstein-considered-compound-interest-most-powerful-force-in-universe.html

https://www.investopedia.com/personal-finance/apr-apy-bank-hopes-cant-tell-difference/

https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp#:~:text=1%20According%20to%20historical%20records,approximately%2010%25%E2%80%9311%25.&text=The%20average%20annual%20return%20since%20adopting%20500%20stocks%20into%20the,through%202018%20is%20roughly%208%25.

Posted Using LeoFinance Beta