Until recently Hive had a liquidity problem

Not that it couldn't be better (especially on the DEX side), but ever since the floodgates opened in December 2024 and Hive saw like a dozen of new listings, the liquidity issue has drastically improved. While most of these listings were futures, we also got a couple of big spot listings like Bitpanda and Bitget (Tier 2).

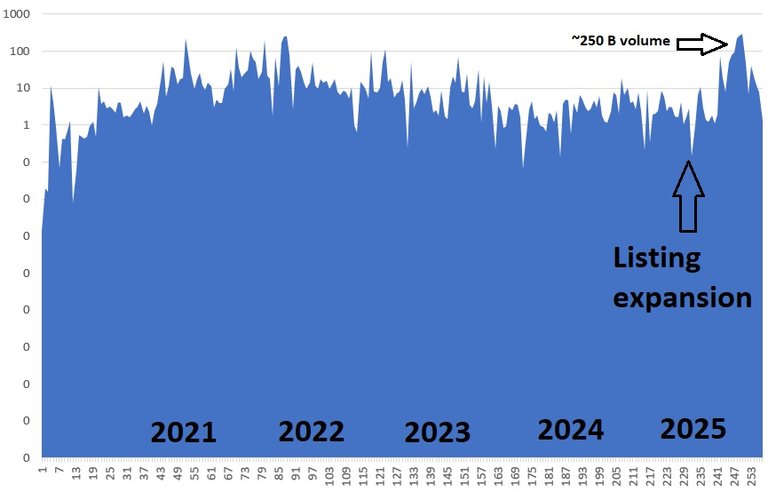

We can see here that the weekly volume has had some big swings (even more evident when plotted linearly, but this shows the trend better). In 2021 and 2025 we have seen around 250 billion Hive traded within a week on all of the exchanges (excluding the biggest one: Upbit). Volume increased manifold since the "listing expansion".

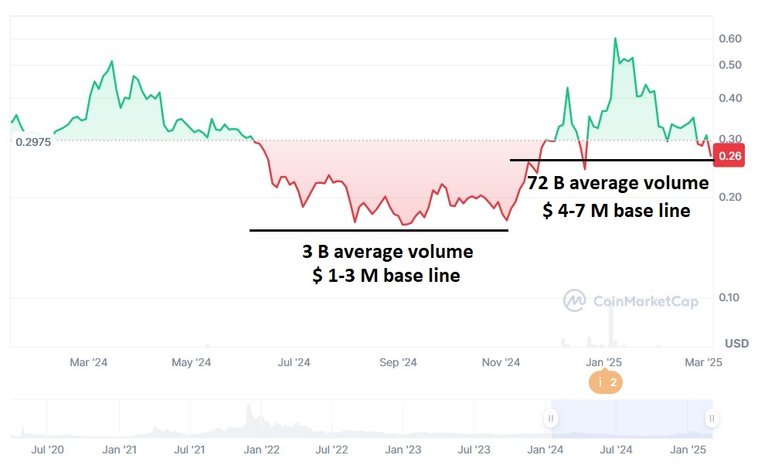

Zoomed in, we can also see (a bit poorly unfortunately) that the base line has increased quite a bit as well. In summer and fall of 2024 the average base line was around $1-3M per day. Then starting in December we got to around $4-7M traded per day. This of course doesn't include the volatile swings which saw hundreds of millions of dollar traded on a daily basis. But my point here is that the minimum daily volume increased by two or three times.

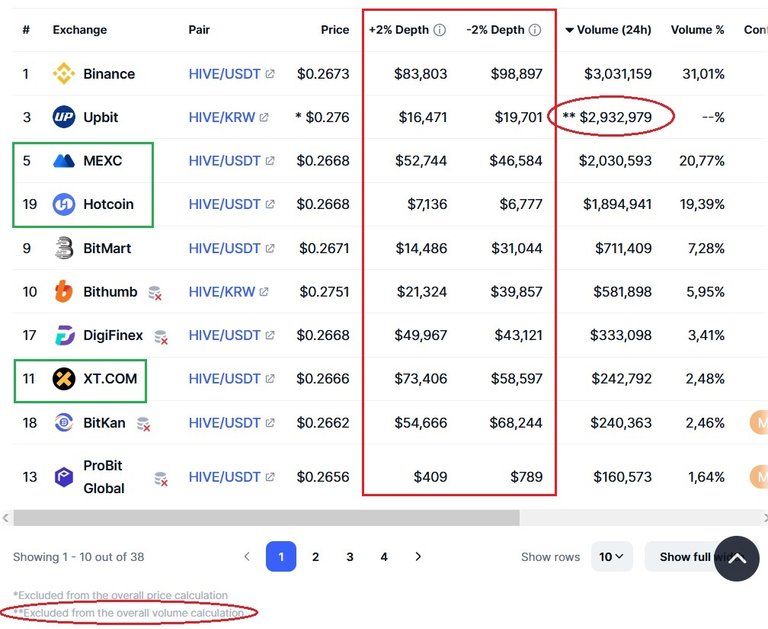

We can also see this evident on today's look at the exchanges. We have had over $10M traded (it is important to note that Upbit is excluded on coinmarketcap so it is in actuality quite a bit higher (around $3-4M)) and this is almost on the low side of things. Liquidity measured in the +/-2% depth is highest on Binance where it would take almost $100k to move price. But this doesn't account for the fact that there is heavy arbitrage which would take this number up considerably.

These are numbers that we haven't seen for a very long time (if ever). Especially, considering that they are so consistent and not just for a pump day. Also, the exchanges highlighted in green are exchanges that do no require KYC. That is of course a really nice bonus.

Conclusion

Until recently it wasn't easy to pick up a lot of Hive or sell it. With Hive's volume and liquidity now fairly well established, the situation has improved markedly. Having access to some of the bigger exchanges no even needing KYC, the barrier to Hive is quite low as well. What we still need, however, is the DeFi connection. Any day a CEX can KYC or delist Hive and Hive's future undoubtedly lies in DeFi and hopefully @vsc.network can bring us there soon.

As a general reminder: Please keep in mind that none of this is official investment advice! Crypto trading entails a great deal of risk; never spend money that you can't afford to lose!

Check out the Love The Clouds Community if you share the love for clouds!