Recent blockchain developments have primarily focused on performance aspects such as enhancing throughput and reducing transaction costs but lack innovative economic strategies to make the most of this efficiency.

Berachain promises to tackle that challenge with its innovative approach. This article is an overview of Berachain, and its Proof of Liquidity mechanism. Readers interested in more details and technical aspects of the project should read their whitepaper for additional information.

Berachain and Proof of Liquidity

Berachain has two main goals for its new protocol and approach.

First, it seeks to better align the value proposition between all agents of the network: users, validators and applications.

Second, Berachain seeks to create a chain that derives its value from the applications built on it, not the other way around.

One of the main issues they see with Proof of Stake L1s is that rewards for validators are largely dictated by a preset curve, where only the staking rate meaningfully affects the outcome.

Berachain believes that a chain should mechanically adjust validators' rewards according to the demand for economic security by users and applications. As it is, if the demand for economic security is low, validators are overpaid.

To illustrate this further, let me borrow the same example Berachain uses on its whitepaper:

Imagine a new chain that launches with a $5 billion FDV, $250 million of TVL, and a 10% staking rate. The chain is issuing $500 million a year in inflation to underwrite the security of $250 million of assets, effectively paying out $2 to secure $1 worth of assets. Noting that chains require both security and liquidity to effectively scale, this imbalance speaks to the lack of effective alignment between these two factors at the network level.

While there is an argument that overpaying for economic security in the early days could help solve cold start problems, Berachain believes in a more efficient way to distribute incentives.

Proof of Liquidity - Two Token Model

Unlike most PoS blockchains, which often use a single token for governance, gas and economic incentives, Berachain uses a two-token model to facilitate Proof of Liquidity: BERA and BGT.

BERA is the gas token and it's also used to activate validator nodes.

BGT is a non-transferable token with a few use cases:

Governance: users who hold BGT can vote on proposals for the chain directly or delegate their voting power.

Burn: BGT can be burned and redeemed 1:1 for BERA. However, BERA cannot be converted back to BGT

Economic Incentives - Users that boost a validator with their BGT are eligible to receive incentives from that validator, based on the validator's commission rate and ability to convert their BGT block rewards to application incentives.

The only way to earn BGT is via staking BERA as a validator, or by staking a PoL eligible receipt token into a reward vault.

Potential PoL extensions

Berachain supports all the common blockchain applications, such as AMM DEXes for liquidity pool creation, Real World Asset tokenization and Layer 2 chains.

Project leaders, developers and users looking for a more detailed understanding of how Proof of Liquidity enhances these applications are encouraged to read session 4 of the Berachain whitepaper.

Governance

As previously mentioned, on-chain governance is controlled by the BGT token. The full scope of this governance is:

The token to be whitelisted (address).

Parameters on the PoL smart contracts.

Full governance over the application that makes Berachain.

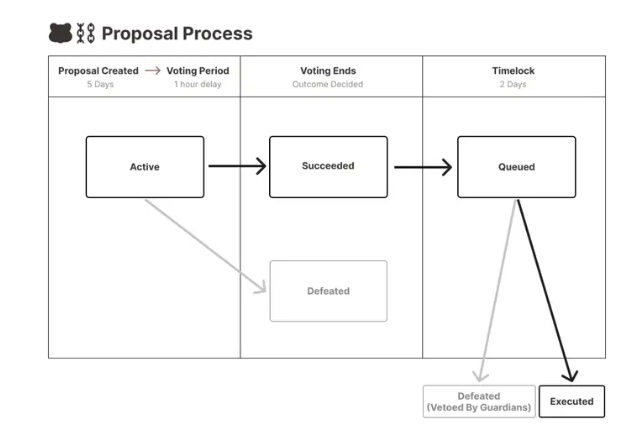

Here is an overview of the proposal process:

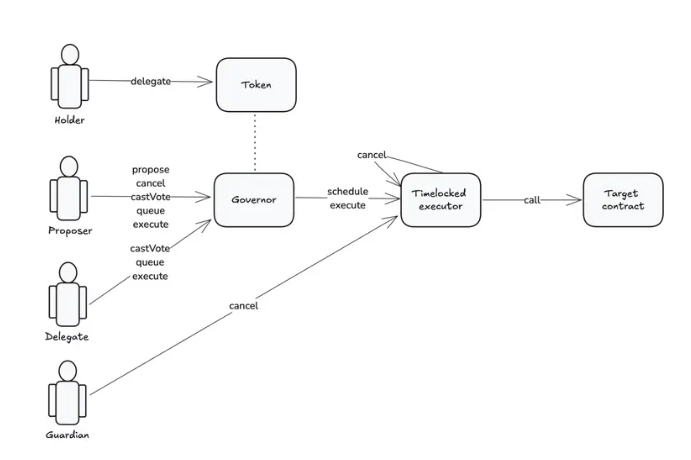

And this is the governance flow:

Final thoughts

Berachain and its innovative Proof of Liquidity mechanism are proposing a new approach to rebalancing incentives to users, validators, and applications by adjusting validator rewards dynamically according to the demand for economic security.

The network supports all the most common blockchain applications and could prove attractive to projects looking to build on it.

Will Berachain fall in the good grace of web3 users, projects and investors? That remains to be seen.

Posted Using INLEO

I just admire the model of incentivizing putting your money/funds to work which also serve as a way of securing the network in some ways. But I'm not really sure about the tokenomics, 34% for investors it reads.

I haven't checked that yet as I was mor einterested in the innovative PoL mechanism, thanks for pointing that out!

interesting stuff. its funny how the eyes see 'bear' chain when glancing at bera chain.. 😉😎🤙

haha yea that's a very peculiar name choice