This is the first actual post of my "DeFi with Science" series. The idea of this series is to try and show some of the "science" behind crypto and DeFi to help people make more informed decisions.

It won't be super in-depth stuff with a lot of mathematical formulas or blocks or code because the idea is to make it accessible to just about anyone. My main goal with this is to show a little bit of how things work "under the hood" so my readers can do a couple of things.

The first is being able to make their own decisions based on actual data instead of going with their "gut" or following what some guy on YouTube or Twitter told them to do.

And the second thing is having a foundation to build on, should they want to look for more in-depth knowledge.

While I'm not opposed to the old adage "It's better being lucky than good", the fundamental problem with luck is that it's very hard to replicate, and I, for one, prefer to make decisions that I can replicate and expect a positive outcome more often than not. I have written about this concept a few times, and I invite you to check out my blog if you want to learn more.

But I digress. Let's get on with the main topic of this post.

Risk and diversification

Risk is intrinsic to investment. Some assets or forms of investments are riskier than others but they all carry some degree of risk and because of that, it's very important that investors understand this risk and how to mitigate it.

Although it's impossible to avoid risk entirely, it's possible to mitigate it to acceptable levels. What is an acceptable level of risk will change according to the investor's profile but the strategies are more or less the same.

One of the easiest strategies to apply is portfolio diversification, which basically means distributing your portfolio in multiple assets rather than concentrating everything on just one or two.

The reason why that works is pretty straightforward: by having exposure to different kinds of assets, if part of them underperforms, you still have the chance to balance your performance with the other assets which are performing well.

That sounds good and easy, and it is, but it also leads to a question: how many assets should I invest in?

How much to diversify?

That question has more layers than it may seem. In theory, it may seem like having as many assets as possible is the way to minimize risk, but that strategy has problems of its own.

Over-diversifying, as it's called, can significantly increase management work because buying an asset is only the first step. Good investors know they must actively manage and rebalance their portfolios to ensure they get the most out of it, and the more assets they have, the more work they have to manage it.

Another problem is that by being over-diluted among too many assets, you may lose potential earnings in case only a few of them explode.

In short, it may seem tempting because you would need a significant part of your assets to perform badly for you to actually "feel" it, but the opposite is also true. To have significant profits, you would need most of your portfolio to overperform at the same time.

It would be great if there was a sweet spot, right? A number to aim for to have a good balance between risk reduction and a "healthy" number of assets in one's portfolio.

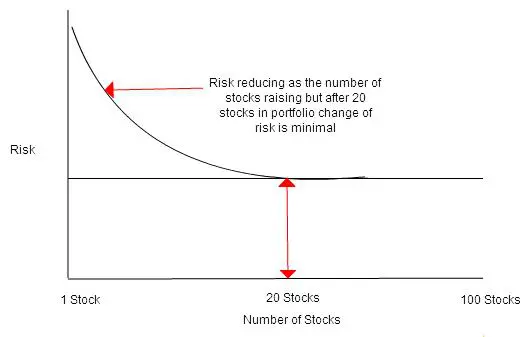

The good news is that such a thing does exist. There is a scientific approach that we can borrow from traditional finance to measure risk reduction against the number of assets in a portfolio.

The work has already been done for us, so I won't spend time going over all the steps that lead to the number, and instead, I'll go straight to the results.

As you can see, something around 15 or 20 assets seems to be a good place to be. You achieve a good risk reduction at this point and going beyond this number of assets starts to have diminishing returns as it will increase your management workload without bringing significant risk reduction.

This number is not set in stone. Depending on the size of your portfolio, it might be a good idea to experiment with fewer or more assets, but I find it to be a good starting point for the average investor.

One last thing is that diversification does not mean only having multiple assets. You want to seek assets that are actually diverse from one another. This topic deserves an article of its own, but for now, try to look for assets that "solve different problems," and you should be good.

Final thoughts

Understanding risk is very important to an investor. Knowing how to manage it, even more so.

Diversification is the easiest risk mitigation strategy but must be applied with caution. You don't want to have all your eggs in one basket but you don't want to spread yourself too thin either. Science shows that 15 to 20 assets are a good starting point for achieving a good balance between portfolio size and risk reduction.

Posted Using INLEO

I'm aware of the One Hard Asset that will outperform Silver, Gold and all the Cryptocurrencies, including Bitcoin, in Phase One of the U.S. Monetary Correction... Feel free ask me what it is... It will also get me in on the Ground Floor of U.S. Crypto Coinage, which will be Stable and 100% backed by U.S. Gold Coins...

What it is?

Common U.S. Coinage...

Congratulations @tokenizedsociety! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 16500 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: