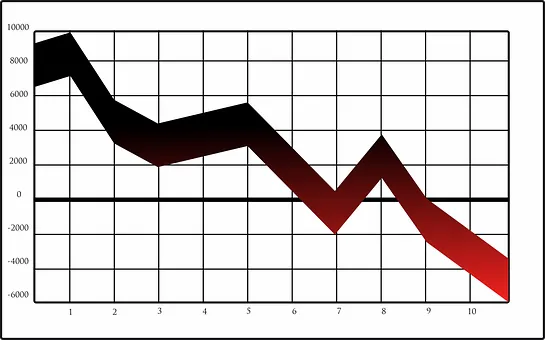

As cryptopreneurs, it is important that we always keep in mind, the fact that cryptocurrency markets operates in cycles. Crypto market could either be in a bullish season or in a bearish trend. These are already established facts so, when any of them shows up, you shouldn't be too surprised or taken unawares. It is the understanding of this that helps you hope for the best while also preparing for the worst.

However, some persons only want the green days and never want to see the red days in the market. Truth is, markets don't pump forever and neither does it dump forever. After a market pump, there will always be a dump and vice versa. It's your duty as a trader/ investor to know how best to react to every market condition.

Last year, we saw a lot of greens in the market as majority of cryptos gained massively and some did hit all-time highs. Bitcoin who has always been leading the way got to reach a new all-time high same with Ethereum and even Hive. For those who bought while prices were down, this is a good run for them. Also, the market pump did in a way get people's attention to invest and adopt crypto. However, the pump happens to be over for the time being as we have seen a lot of price retracements in different cryptos.

Preparing For The Bears

Can we say that we are in the bear market? Maybe Yes or maybe no; I'll leave you to answer that. Whatever the case, I'd like to point out that bear markets do surface and one needs to be prepared for it. Briefly, we will be discussing on ways that we can get ourselves prepared for bear markets.

When we say bear market, it is referring to a season in the market when prices are lowering instead of increasing. It is the season where crypto prices hit lower lows and people's portfolios see huge declines. It is a season that some persons do not want to see but it is needed for the market to be termed healthy.

Take and Keep Profits: It appears that during market pumps, a lot of persons get greedy while some are indecisive and confused about whether to or not take profits. Knowing that cryptocurrency is associated with a high volatility is enough for one to learn the art of taking profits and also keeping them.

No one can teach you how to take profits; only you can educate yourself on that. Yes, it's true that we talk about hodling your investments but taking profits is also necessary in my own opinion. Hodling everything even when there's a massive pump and not selling at all might result in regrets. Likewise, selling everything and hodling none is not wisdom. A balance needs to be struck and this is where your knowledge about business and investments is usually being tested.

More so, there's a lot of greed in the market. People want all their investments to result in 100x, 500x or 1000x all of the time. Because of this, they fail to take out reasonable profits and then a dump happens right before their eyes. I know that it is a very complicated situation but in order that we prepare against bear markets, it is pertinent that we take out some profits during the bull runs and keep them as an hedge.

Buy Stablecoins: In line with taking profits, it's best we store up our profits in currencies that are stable to avoid value depreciation. This is where stablecoins come in handy. We have a lot of stablecoins out there but care should be taken when choosing which one to buy into. Learning how to save or keep profits is a great way to prepare against bearish seasons. Many people make profits but keep very little.

Maximizing Bear Markets

When we do all of these, it helps us to take advantage of the bear markets instead of suffering as a result of bear markets. Having liquidity in the face of crashes allows you to make maximize the opportunity. The best time to invest is during dips or crashes and not during the bull run.

In essence, bear markets brings to us opportunities and only those who prepare for it get to benefit from bear markets. While enjoying the green days, always manage your risks, control your greed and prepare yourself fully to take advantage of any subsequent crash.

Posted Using LeoFinance Beta

Great points and during bear markets stablecoins will provide enough gains to prepare our move to buy low.

Posted Using LeoFinance Beta

Why I said we keep our profits in stablecoins is because price fluctuations doesn't really affect them. $100 USDT or $UST will remain unchanged. That way, we don't suffer a reduction in the value of our money.

Posted Using LeoFinance Beta

Amen Stablecoins LPs, best way to survive a bear market.

Posted Using LeoFinance Beta

Agreed with buying and holding stablecoins, They are a great thing to have with crypto and HBD offers a great one with the savings at 12%.

Posted Using LeoFinance Beta

Yeah, stablecoins like HBD appears even much better to hodl as it is not a centralized token rather it is an algorithm-based stablecoin. Coupled with the fact that it offers interest to those who save, it becomes a better option

Posted Using LeoFinance Beta

Right, it is one if not the most trusting ways for a stable coin. 12% is the added bonus

Posted Using LeoFinance Beta

Indeed very helpful blog to us and full of information about bear market. I agree that we should be prepare for bear market.

Posted Using LeoFinance Beta

I'm glad you found the piece helpful

Posted Using LeoFinance Beta

HaHa I am the worst at knowing when to pull out. But I did this last bout so now I get to remove some small amount of HBD and buy back Hive and Leo. Although Leo has stayed relatively stable.

Posted Using LeoFinance Beta

It's important we know when to pull out as well as when to keep hodling. Yes, Leo has steadied at the bottom of late but buying $LEO and/or is never a bad choice.

Posted Using LeoFinance Beta

I have found it very useful to take advantage of downturns to buy cheaply and if I get stuck on a price I put it to staking.

Posted Using LeoFinance Beta

Exactly my point, we should always endeavour to maximize every market dip by buying coins at cheaper prices.

Posted Using LeoFinance Beta

Don't forget my go to strategy which is passive income. HIVE earns me over 10% APR + Airdrops. SPS is still offering a decent APR + Vouchers. These things allow me to stay relaxed and keep my portfolio protected during bear markets.

Posted Using LeoFinance Beta

Like I said, there are many other options and strategies one can adopt to stay safe during the bear markets. Staking and earning dividends is one of those.

Great choice man

Posted Using LeoFinance Beta

This is an art that I have started practicing in 2021 and need to get much better at in 2022.

Posted Using LeoFinance Beta

Great one!

It's good that you observe the principles. Just keep at it and it will become a part of you

Posted Using LeoFinance Beta

One thing in Crypto market is,we should have the mentality that bear market must come and bull market must come.what we need on them is patience.

Posted Using LeoFinance Beta

Exactly! These things should always be at the back of our minds

Posted Using LeoFinance Beta

Yes

Posted Using LeoFinance Beta

Stablecoins put into Stablecoins LPs have been my way to preserve my capital and still earn.

Mostly... It has allowed me to fight FOMO as I am still earning while having stablecoins !

This is amazing

Posted Using LeoFinance Beta

Wow! Putting stablecoins in stablecoins liquidity pools is a very safe strategy, if you ask me.

No price fluctuations in your earnings and amount locked. Great