How are you my trader friends?

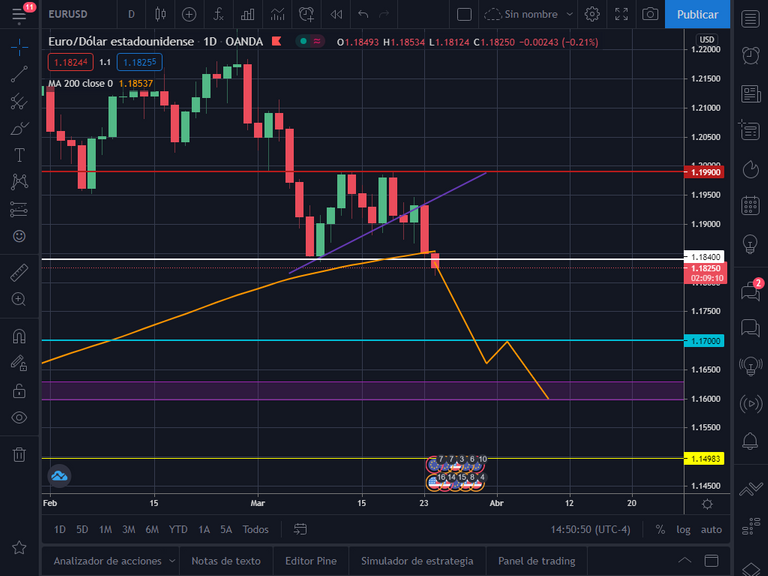

Last week we were analyzing the EUR/USD pair, where we found it struggling to recover towards the 1.20 price zone. But this was not to be.

I had proposed a bearish scenario with a target towards the next support at 1.1840. The scenario has been perfectly fulfilled.

The price is currently at the 1.1840 support zone and breaking the one-day 200-period moving average (yellow line), as shown below.

This is bad news for the EUR/USD, as this breakout could be confirming a possible trend reversal.

Personal opinion

I think it is best to stay out of the market at this time and wait for the close of this daily candle. We should wait for a convincing confirmation of a break below 1.1840 support and the 200 moving average.

If a convincing breakout is shown, price in the coming days or weeks could move down to the next supports at 1.17 and 1.16:

Failure to break below the 200-period moving average and 1.1840 support, could lead to price holding and a possible recovery to the 1.1990 and 1.20 ceiling:

I hope you find this information useful. Best regards colleagues! 👋

Important

The information provided in this publication should not be considered as an investment recommendation. Trading cryptocurrencies, forex, stocks, among others, is risky.

Posted Using LeoFinance Beta