Hi Everyone

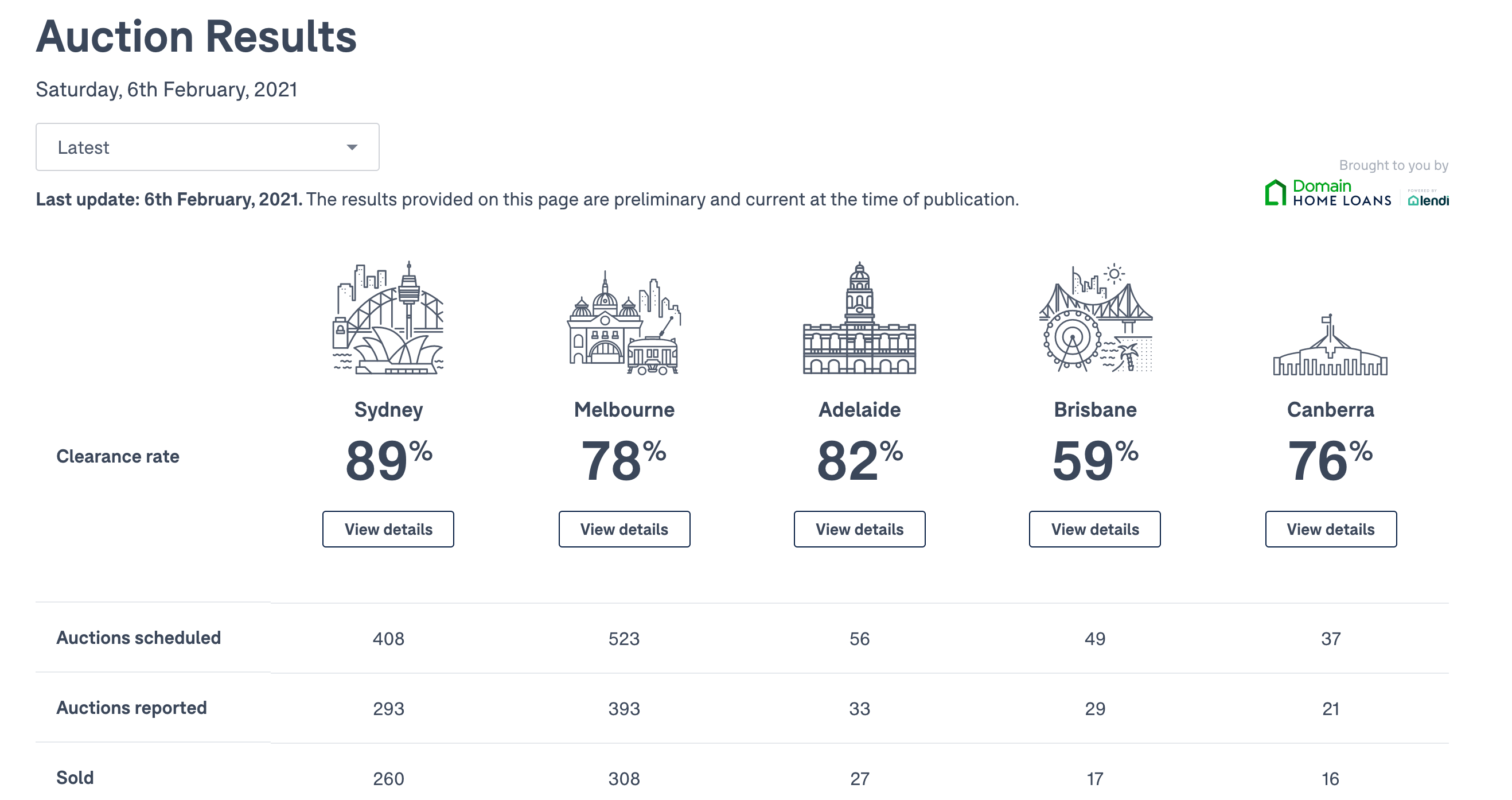

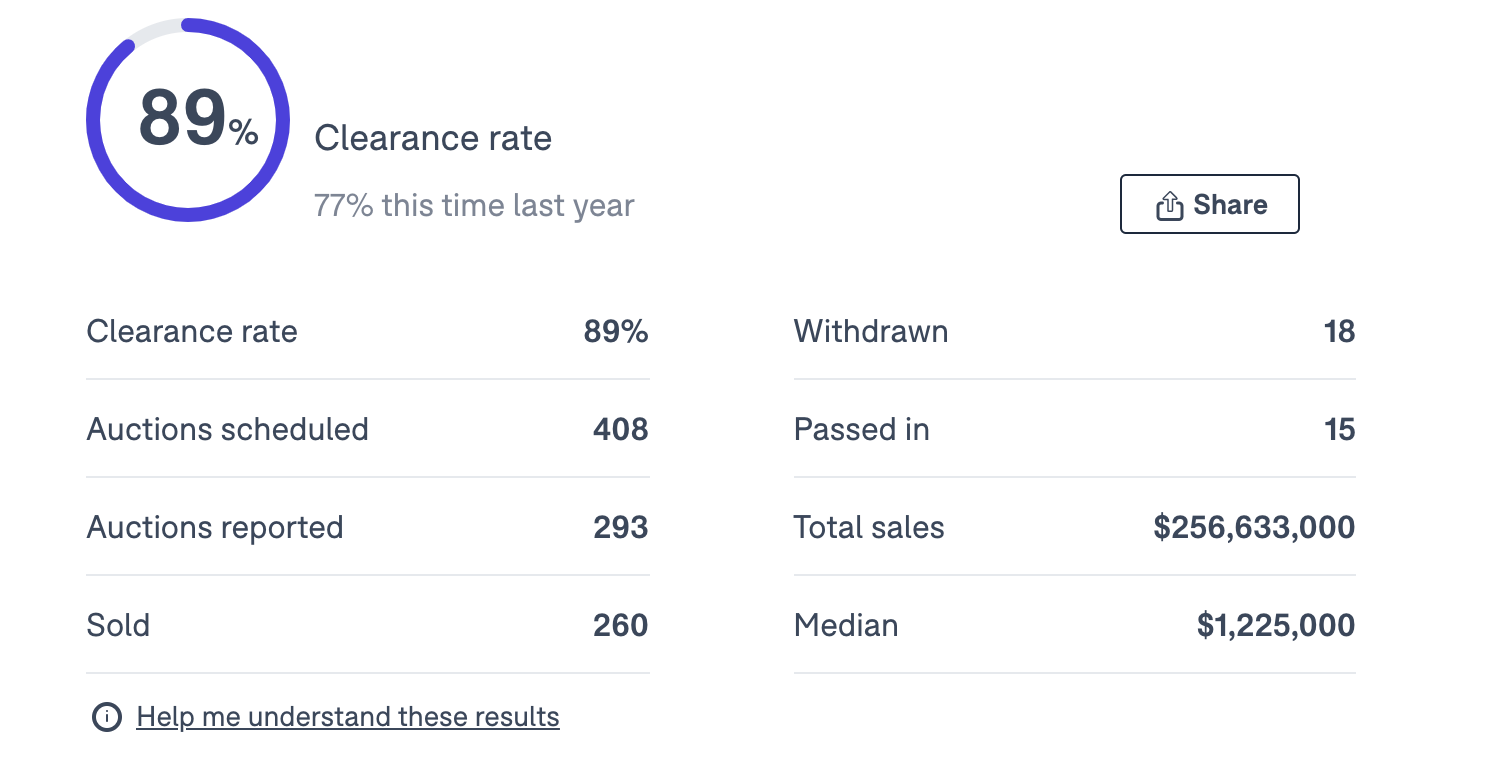

Another weekend has passed and the auction clearance rates has shown that although we are still in a middle of COVID restrictions, people are still keen to buy property particularly in Sydney. As you may be aware, we are in the process of finding our new home trying to take advantage of the low interest rates like everyone else but the market is starting to ramp up. Like previously mentioned in past posts, with less overseas buyers/bidders, things are less hectic on the market but still pretty competitive. Sydney is leading the way with the clearance rate at at 89%.

I actually wonder how people will cope with repayments when interest rates eventually go up. It can't stay low forever. Some even suggest that it will be negative interest rates.... is that even a thing? Non the less, people are snapping up houses left right and centre. In our area, properties are mostly on auction with only a handful up for sale and if they are, the prices are generally pretty high or something is wrong with the place. We've been looking for awhile and also talking to friends, many people are maxing out their borrowing power. We are more conservative considering we have 2 younger kids and don't want to take the risk and go all out. We are also considering if interest rates do go up, we don't want to be living on porridge to keep afloat.

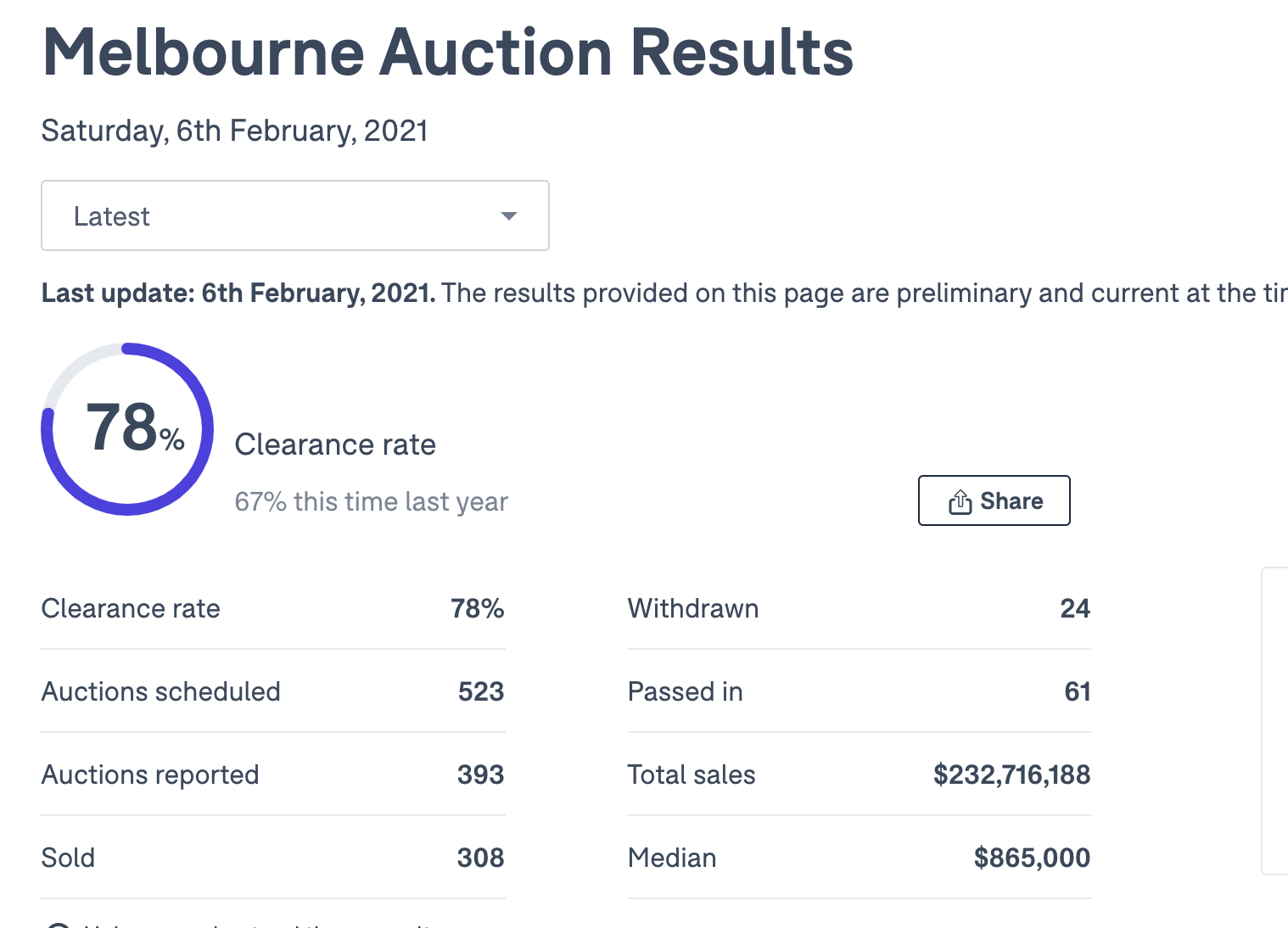

Quickly looking at the other big city in Australia, Melbourne. Their clearance rate isn't looking too bad. We had a friend there who bought a massive house (4 bedder with a nice yard) said auctions are also hot with some buyers with deep pockets. They had to go over nearly 30K of their budget to get their house which is still way cheaper than what we would pay in Sydney. Their median house price is 865k whereas in Sydney it is 1.22mil. You can see the difference clearly between the two cities.

animation by @catwomanteresa

Thanks for reading. If you like my post, please follow, comment and upvote me. There will be more exciting posts & destinations to come.

All photos & videos are taken by me & co in all my blogs/stories unless quoted.

Posted Using LeoFinance Beta

Ha ha, as promised another informative post, with many South African's who have moved to Australia I wonder how on earth they are able to afford the cost of home ownership considering our weak ZAR/AUS.

Sadly many auctions will come up with people not being able to afford holding onto their homes, possible loss of income or cost of living.

City to city rates do reflect massive difference in pricing.

!BEER

Haha thanks for your support :)

yes I believe the auction just favours those with the money to boost up the prices over the reserve. Also the real estates under quoting the price so keeps hopes high for those with a small budget

!ENGAGE15

Buy what you need, buying a home is most probably the biggest and longest debt one carries. Being realistic looking at a small home with more property to develop onto in the future is most probably a good route to follow.

Or look at feasibility of buying land and building a more self sustaining home not relying on electrical companies and water supply by installing from the start.

Happy hunting!

ENGAGEtokens.Negative interest rates violate the laws of physics.

Interest is the time value of money - what people are prepared to pay to have money now (ie to buy a house) rather than later from saving up.

Given that time can only move forwards, the time value of money must always be positive number. Negative interest rates are a fantasy created by a failing system of fiat currencies being printed wildly.

Real interest rates are reflected by the sort of interest you can get on BTC (ie 6-8.5% or more) from crypto.com, blockfi, Nexo and in the DeFi space.

I'm not sure what will happen to long term mortgage loans when the fiat currency they are denominated in and the financial infrastructure that issued them collapses.

But don't expect to be able to refinance any loan at these fairyland interest rates in a few years.

Interesting you mentioned refinance, yes that would be an issue .... Have to say the rich will stay rich or get rich, the poor will stay poor :(

!ENGAGE15

ENGAGEtokens.Good post ever i read.

haha thanks

View or trade

BEER.BEERHey @travelgirl, here is a little bit of from @joanstewart for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Well, start to look at shares of company selling renovation materials and furniture.