KEY FACTS: Florida Senator Joe Gruters has introduced a bill proposing that the state invest up to 10% of its funds in Bitcoin as a hedge against inflation. The legislation would allow Florida’s Chief Financial Officer, Jimmy Patronis, to allocate funds into Bitcoin across various state-managed reserves, including the budget stabilization fund. Gruters cited Bitcoin’s increasing adoption by major financial firms like BlackRock and Fidelity as justification for the move. This proposal follows Patronis’ earlier push to include Bitcoin in Florida’s retirement funds. It follows the trend of U.S. states exploring cryptocurrency investments, with Kentucky recently introducing a similar bill. While the initiative acknowledges Bitcoin’s value appreciation, it also imposes a cap to mitigate potential volatility risks.

Source: Florida State Seal

Florida Senator Proposes Bill for Investment State’s Funds in Bitcoin

There is a growing intersection of traditional finance and digital assets and Florida State does not want to miss out as Republican Senator Joe Gruters proposes a bill proposing that the state invest some of its funds in Bitcoin and other digital assets. This initiative aims to leverage Bitcoin as a hedge against inflation, a concern that has increasingly captured the attention of policymakers and financial experts alike. The bill, presented by Senator Joe Gruters to the Florida Senate on February 7, 2025, emphasizes the necessity for innovative financial tools to safeguard the state's assets. Gruters stated:

“The state should have access to tools such as Bitcoin to protect against inflation,”...“Inflation has eroded the purchasing power of assets held in state funds managed by the chief financial officer...”

Source

Gruters highlighted that inflation has eroded the purchasing power of assets held in state funds managed by the chief financial officer, underscoring the urgency of exploring alternative investment strategies.

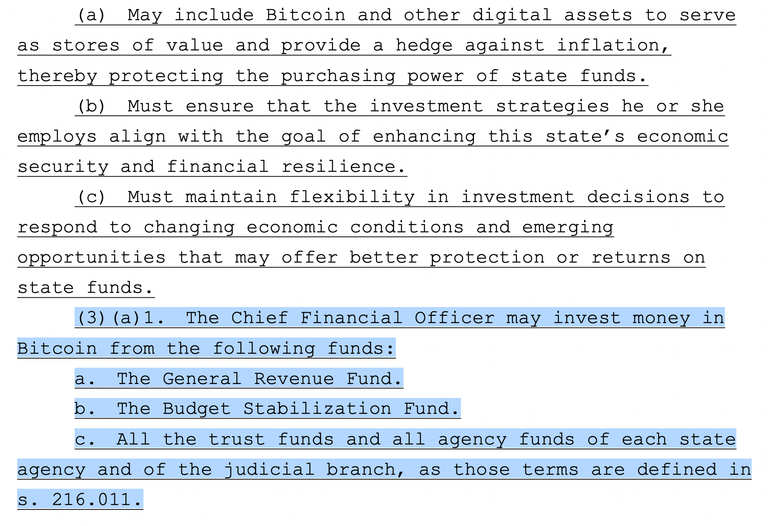

The proposed legislation seeks to authorize Florida's Chief Financial Officer (CFO), Jimmy Patronis, to allocate funds to Bitcoin across various state-managed financial programs. Specifically, the bill permits investments in the state's general reserve fund, budget stabilization fund, and additional agency trust funds. To mitigate potential risks associated with cryptocurrency volatility, the bill proposes capping Bitcoin holdings at 10% of any account's assets. This approach aligns Florida with evolving financial trends while establishing a more cautious stance compared to Wyoming's recent legislation, which suggests limiting Bitcoin investments to 3%.

Senator Gruters pointed to the actions of major asset management firms such as BlackRock, Fidelity, and Franklin Templeton, which have already adopted Bitcoin and view it as a hedge against inflation. He noted that Bitcoin has "greatly risen in value" and is becoming more widely accepted as an international medium of exchange, presenting a compelling case for Florida to consider investing state funds in the asset class.

Gruters suggests granting the chief financial officer permission to invest Bitcoin across various funds in Florida. Source: Florida Senate

This proposal comes only months after CFO Patronis wrote a letter urging the Florida State Board of Administration to consider adding Bitcoin to the state's retirement funds investments. In an October 29 letter, Patronis referred to Bitcoin as "digital gold," suggesting it could help diversify the state's portfolio and provide a secure hedge against the volatility of other major asset classes.

Florida's move is following a trend among U.S. states exploring the integration of digital assets into their financial strategies. Just a day before Gruters' filing, Kentucky became the 16th U.S. state to introduce legislation aimed at establishing a Bitcoin reserve. The bill, KY HB376, was introduced by Kentucky State Representative Theodore Joseph Roberts on February 6. If passed, it would authorize the State Investment Commission to allocate up to 10% of excess state reserves into digital assets, including Bitcoin.

The increasing institutional adoption of Bitcoin cannot be ignored. As major financial firms incorporate Bitcoin into their investment strategies, state entities are more likely to follow suit, recognizing the potential benefits of diversifying their portfolios with digital assets. This trend shows a growing acknowledgment of Bitcoin's role as a store of value and a hedge against inflation.

However, the volatility of cryptocurrencies remains a significant concern. While Bitcoin has demonstrated substantial growth, it has also experienced sharp declines, leading to debates about its suitability as a stable investment for public funds. The proposed 10% cap on Bitcoin holdings in Florida's accounts is a measure designed to balance potential gains with risk management.

The proposed legislation in Florida is crucial and as the bill progresses through the legislative process, it will undoubtedly spark discussions about the role of digital assets in public finance, the management of investment risks, and the future of state-level financial strategies in an increasingly digital economy. The outcome of this proposal could set a precedent for other states considering similar moves, potentially leading to a more widespread adoption of cryptocurrencies in public fund management.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO