KEY FACT:Solv Protocol, a DeFi platform, has announced the launch of an "on-chain MicroStrategy," with the aim of transforming Bitcoin (BTC) into a yield-generating asset within the decentralized finance ecosystem. Drawing inspiration from MicroStrategy's BTC acquisition strategy, which significantly boosted its stock value, Solv seeks to create a transparent, permissionless platform for strategically managing Bitcoin reserves. This it will do by leveraging staking on Bitcoin layer-2 solutions and engaging with DeFi protocols. With this, Solv plans to amplify returns for participants with over $3 billion in total value locked. Bitcoin holders now have new opportunities to generate active yield.

Source: Solv

Solv to Launch "Onchain" MicroStrategy

Solv Protocol, a decentralized finance (DeFi) platform that specializes in Bitcoin staking, has announced plans to launch an "on-chain MicroStrategy." This initiative aims to transform Bitcoin (BTC) from a passive store of value into an active, yield-generating asset within the DeFi ecosystem.

Solv's Co-founder, Ryan Chow unveiled the project on November 29, describing it as a "transparent, permissionless platform" designed to create a strategically managed Bitcoin reserve. The goal is to preserve wealth while generating yield and amplifying returns for participants. Specific details on the mechanisms to achieve this have not been disclosed.

So far, Solv Protocol offers various yield strategies across multiple blockchain networks. It generates returns by staking BTC to Bitcoin layer-2 solutions like Babylon and CoreChain, as well as engaging with DeFi protocols such as Jupiter and Ethena. As of now, Solv manages over $3 billion in total value locked (TVL), according to DefiLlama.

Source: Solv

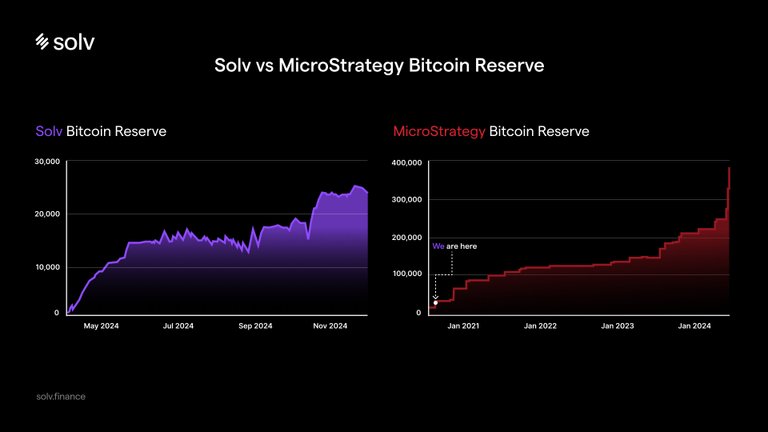

Solv's concept is inspired by MicroStrategy, a business intelligence firm that has become a significant Bitcoin holder under the leadership of Chairman Michael Saylor. Since initiating its BTC acquisition strategy in 2020, MicroStrategy's stock (MSTR) has surged, with shares up more than 450% year-to-date. The company has committed to a performance metric known as "Bitcoin yield," which measures the ratio of BTC holdings to outstanding shares, effectively setting BTC-per-share as a benchmark for corporate performance.

In October, MicroStrategy announced plans to raise $21 billion in equity and another $21 billion in debt to fund a three-year, multibillion-dollar BTC purchasing initiative dubbed the "21/21 Plan." Analysts predict that this strategy could generate a Bitcoin yield of 12.7% by 2025.

Chow noted that MicroStrategy's approach has "turned Bitcoin into more than a reserve-it's a catalyst for explosive growth," This redefines the possibilities for institutional Bitcoin reserves. Solv Protocol aims to emulate this model within the DeFi space, offering a decentralized platform for Bitcoin holders to actively generate yield on their assets.

This development shows a growing trend of integrating traditional financial strategies into the decentralized finance sector, to potentially provide Bitcoin holders with new avenues for asset growth and participation in the DeFi.

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using InLeo Alpha

The Microstrategy idea is really interesting. I have seen the @leostrategy example on hive and it is a welcome development. With argument, insitutional engagement of crypto will be the push to the moon.

LeoStrategy will continue to acquire $LEO and provide accretive yield to LSTR holders. LEO is headed for a $250M Market Cap

Thank you for mentioning leostrategy. They are doing a great work.