KEY FACTS: West Virginia State Senator, Chris Rose, has introduced the Inflation Protection Act of 2025, proposing that up to 10% of the state's treasury funds be allocated to digital assets and precious metals as a hedge against inflation. The bill specifies that only digital assets with a market capitalization exceeding $750 billion—currently only Bitcoin (BTC)—would be eligible, with custody options including on-chain storage, ETFs, or secure custody solutions. West Virginia State is joining other U.S. states, including Utah, Kentucky, and Michigan, that are considering similar legislation. Analysts estimate that such initiatives across states could generate up to $23 billion in Bitcoin demand.

Source: Seal of West Virginia

West Virginia Legislator Introduces Digital Asset Reserve Bill

West Virginia State Senator Chris Rose has introduced the "Inflation Protection Act of 2025," which aims to diversify the state's treasury investments by incorporating digital assets and precious metals. The bill, submitted on February 14, proposes that the West Virginia Treasury be authorized to allocate up to 10% of its total funds to these alternative assets. The legislation outlines specific criteria for such investments, including digital asset eligibility, investment cap, and custody options.

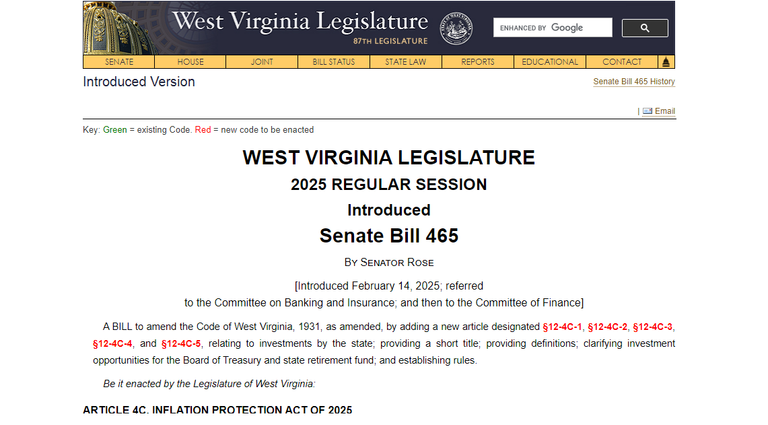

(a) The Board of Treasury Investments of West Virginia may invest a portion of public funds in precious metals, any digital asset with a market cap of over 750 billion dollars averaged over the previous calendar year, and stablecoins in any of the funds it oversees subject to applicable laws.

(b) The amount of public funds that the Board of Treasury Investments may invest in precious metals, digital assets with a market cap of over 750 billion dollars averaged over the previous calendar year, and stablecoins may not, at the time the investment is made, exceed 10% of the total amount of public funds in that account.

Source

According to the proposal, the treasury may invest in digital assets boasting a market capitalization exceeding $750 billion. Currently, Bitcoin (BTC) is the sole cryptocurrency meeting this threshold. The bill also proposed that the state can allocate a maximum of 10% of its total funds to the combined digital assets and precious metals holdings. Furthermore, the state has the flexibility to hold these assets directly on-chain, through exchange-traded funds (ETFs), or via other secure custody solutions.

The rationale behind the legislation is that many U.S. states are exploring the inclusion of digital assets in their financial strategies. Primarily, the bill is aimed at hedging against inflation and mitigating risks associated with structural deficit spending. Thus, the states aim to protect their treasuries from potential currency devaluation by diversifying into assets like Bitcoin and precious metals.

A snapshot of the proposed West Virginia bill to allow the state to allocate a portion of its holdings to digital assets and precious metals. Source: West Virginia Legislature

This legislative effort aligns with a growing movement across the United States. On January 23, President Donald Trump commissioned a working group to assess the feasibility of establishing a federal digital asset reserve. Meanwhile, several states have introduced similar bills. On February 6, the state's House of Representatives passed a bill permitting the treasury to invest in Bitcoin, select altcoins, and stablecoins. The proposal now awaits Senate approval.

In Kentucky, legislation introduced on the same day allows up to 10% of state funds to be allocated to digital assets, including Bitcoin. On February 13, Representatives Bryan Posthumus and Ron Robinson proposed a bill enabling the state to establish a digital asset reserve in Michigan, notably without specifying restrictions on asset types.

Analysts suggest that if multiple states adopt such measures, it could significantly impact the digital asset market. A recent analysis by asset management firm VanEck indicates that pending strategic reserve legislation across various states could generate up to $23 billion in demand for Bitcoin.

The West Virginia bill is slated for committee review before proceeding through the legislative process. As states continue to explore the integration of digital assets into their financial frameworks, the outcomes of these legislative efforts could reshape public fund management and influence the further adoption of cryptocurrencies in governmental finance.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO