The market has been flooded with cold water due to the Bitcoin Futures ETF approval, BTC moving ATH, El Salvador's achievements, exchange regulations and much more. It will be so in the future. The Governments around the world will desperately challenge cryptocurrencies through taxation, etc. But I am positive that BTC will definitely fight more bloody after institutionalization.

It is because of the very concept of decentralized tradable goods that Satoshi Nakamoto dreamed of. As soon as BTC and other cryptocurrencies become currency, the role of national monetary policy is bound to weaken. The 'Keynesian Philosophy' and believe in gold and jewellery, will be broken.

Governments, basically a group of civil servants, are afraid of change. Because we do not know what will be at the end of the change, because we have to take responsibility for the change, and that responsibility comes in the form of voters' judgment. Therefore, there are many times when we move without a principled judgment about what is right and what is wrong.

However, no one can yet determine how long such a regulatory drive will last, or how long cryptocurrencies, including BTC, will survive. You just have to keep your tactile sense every day and constantly inquire, judge, and ponder.

Today, I would like to think about the failures that such government movements and financial policies have created and their ripple effects. It is the repeated financial crises that have appeared since 2000 and the outdated responses of governments around the world. Understanding this will allow us to accurately judge the drive underlying the current regulatory move and guide the choices we need to make going forward.

Until now, I have found that inflation caused by intentionally issuing money to relieve debts or intentionally stimulate the economy has always had side-effects that government officials did not think of, and in the short term, the purchasing power of the general public It has been shown to have declined, and it has been said that in the long run, it has led to the breakdown of one axis of the system of trust that money should have.

The oil shock was back in the early 1990s, when the international stabilization period came again. But that stabilization period was just a period of calm before the tsunami came. Germany's sovereign debt crisis, 2008 Great Recession, Stock Market and Housing Crisis.

Academia cites various causes of the financial crisis. The fluctuations in international oil prices due to the conflict in the Middle East, which is called the world's gunpowder, and the excessive profit realization that various hedge funds represented by George Soros applied to countries with weak economic fundamentals. There is also the domino effect caused by civil war, political upheavals such as various civil wars and coup d'états, and causes such as black swans (ex. sub-prime mortgage crisis) that no one knew until it passed, although it was natural.

But their roots all boil down to one reason. One of the two axes of money, trust, is broken due to an oversupply of money or the breakdown of the trust network that guarantees money. So, if we assume that the economic system is supplied with a large amount of money, what will happen?

This is where the difference between Keynesian views comes into play.

In conclusion, no one was right. Since the late 1980s, the money supply has risen sharply, but inflation has not been so severe, and inflation has not been caught. What was the problem? Let's go back to Germany.

In 1997, Germany launched the Neuer Market, a stock market focused on high-tech stocks with a concept similar to the NASDAQ. Driven by the global internet frenzy, this Neuer Market indicator went up dramatically and then suddenly plummeted for no apparent reason. Eventually this Neuer Market is closed. As if there was nothing originally. All that was left were ants who bought stocks at high prices and only lost money.

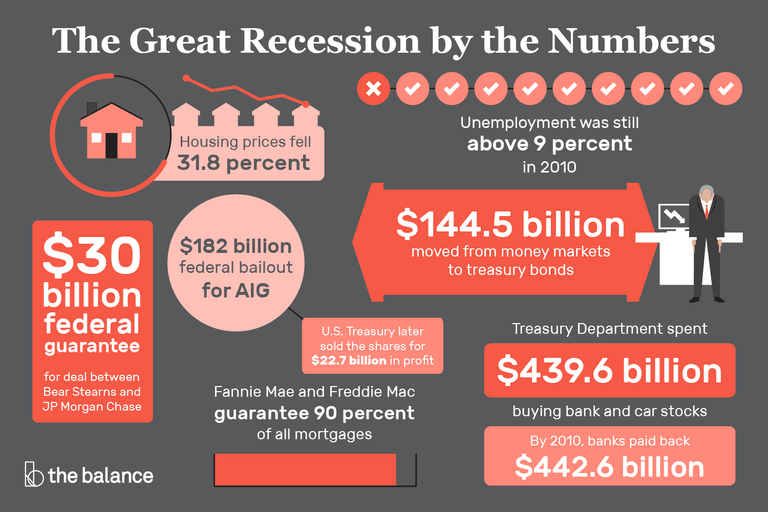

Greece's default declaration due to the German crisis in 2000, the Spanish financial crisis in 2007, and the bankruptcy of Lehman Brothers in 2008. These three seemingly different events have one thing in common. That's asset inflation. The money supply has increased, and this money has not been invested in goods or services, but is concentrated in financial assets. Financial assets are limited, and of course their value will inevitably increase explosively.

The stock did not go up because the economy was good, but because the money had nowhere to go.

What if the high-risk asset markets such as stocks, bonds, and real estate collapse? The state has no choice but to turn to the central bank for help. And so far it has been. Even when Lehman Brothers went bankrupt, when Spain became powerless, when the German stock market shattered, or even when the Indian economy was coughing, central banks of each country came to the rescue without fail.

Whenever various financial crises such as debt crises, real estate crises, currency crises, and demand collapses occurred, the central bank released more money instead of buying the national debt with a lie called 'quantitative easing', it is a very complacent idea to solve it by freeing up money.

Now How do you think that Crypto Market will influence and shape Inflation and Financial Crisis in near Future?

Posted Using LeoFinance Beta