Mention had already been made about the delisting of the Tether stable coin (USDT) from the most popular cryptocurrency exchange in the world; Binance. Possibly those of us who have made daily use of the platform, were struck by that warning in which we were informed that on such date, it would cease to have support. At that moment, an important commotion has been generated, but apparently, it would only affect the regulations of the European Union.

The worst thing that could happen for the user is to have funds in this currency and not be able to use it or carry out operations. In fact, this is something that has been said not to be contemplated, since the user would be free to do them. However, its conversion to another currency with similar characteristics is encouraged. Considering this, it is likely that many features would not be available, such as the use of that currency in P2P, which is peer-to-peer trading. This is something that concerned me quite a bit, because I am a regular user of this feature, as it is convenient and practical.

Let us also remember that this stable currency has the approval of a large number of users, for something simple to understand. It is stable and adapts to the linkage with fiat currencies, such as the US dollar. It is also one of the most traded currencies, because it has an immense liquidity with which you can operate, in P2P commerce, as I had mentioned before, but even in DeFi protocols, and payment services. We are talking then about a stable currency with a supply in circulation of 142 billion coins, with a market capitalization heading towards $142 billion, with a tiny variation considering such figures. Here we note that relationship in the peg to the U.S. dollar.

It is becoming increasingly clear that audits on certain cryptocurrencies, is a rigorous way of securing permission for their inclusion on an exchange. Clearly the platform does not want to deal with all kinds of situations that affect its reputation. However, on many occasions it is more about the regulations that the entities require them to comply with, in order to provoke certain pressure to comply with them, or to take the measures they consider pertinent. This is the reason why we have received news about this and other cases, which are included in the same topic.

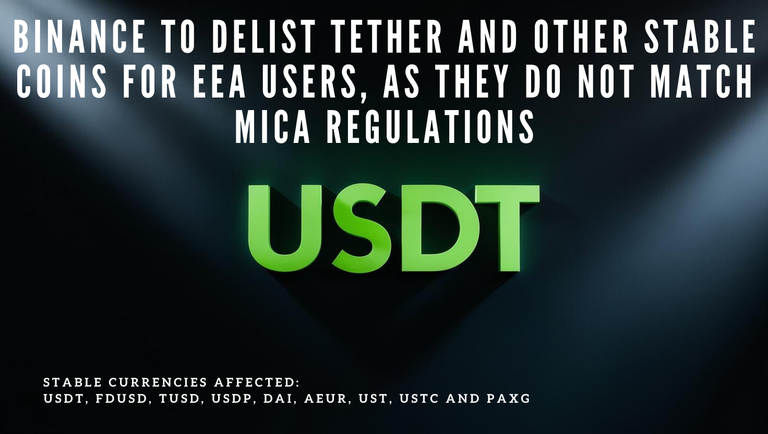

According to the European Union's Markets for Cryptographic Assets (MiCa) regulations, there are several cryptocurrencies that are not complying with the regulations, so Binance will have to remove nine stable coins in the European Economic Area (EEA) from its list. These include USDT, FDUSD, TUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAGX, which will be affected as of March 31 of this year.

As we had mentioned before, the user will be able to trade freely, but it is clarified that gradually some functions may no longer be supported, or may be restricted. In my opinion, I would be sure to make the conversion before that date, in order to avoid any inconvenience, especially if the funds involved are considerable.

Although MiCa came into force in 2023 as one of the most important cryptocurrency regulations, it was only in 2025 that the approval for issuing stable coins to EEA users came into force. According to Niko Demchuk's words, there are already some stable coins that have been authorized for issuance, which are Circle's EURC and USDC. This authorization allows Binance not to consider delisting this currency.

Demchuk also maintains that there are no major difficulties when applying for a license to issue stable coins. He considers that the process is simple, and you only have to open a company in the EEA, apply for the MiCa license with the profile of tending to be issuers of stable currencies, while complying with the requirements that are explicit in the MiCa. The reason for not accessing this type of transparency is not something I can understand, but there have been cases where Tether has lost.

For not complying with certain regulations, for example, CoinBase Europe decided in December to delist USDT, not so with USDC and EURC, which did comply, at that time, with the MiCa regulation. Tether's past has been quite controversial, having to pay fines (almost $60 million in total) and halt its trading activity. Legislators, regulators, and consumer protection groups point out that this company is not entirely transparent. However, a new CFO has been appointed to improve the perception and reception of the company. It is Simon McWilliams, and it is hoped that decisions under his guidance will bring the company closer to full transparency through a full audit.

Finally, Tether assures to have transparency as a priority, and indicates it through providing its quarterly certifications and transparency reports, which are accounting formats that the entities will need to consider whether the company is in compliance or not, although other factors are also taken into account, which the company intends to access through the audit of accounting firms such as Deloitte, PwC, EY, or KPMG; firms of great importance regarding financial auditing.

- Main image created in Dream Lab (AI) and edited in Canva.

- I have consulted information at decrypt.co.

- Translated from Spanish to English with DeepL.

Posted Using INLEO