If something was particularly notable, it was the arrival of Bitcoin ETFs. It was possibly a key element that influenced the trajectory of the leading cryptocurrency, but there are also things we should consider and that we can discuss in this article.

One might think that the mechanisms of a cryptocurrency are complex, and there is much to analyze and understand in depth. Dealing with a lot of features that make a blockchain unique is not for everyone, or at least, it requires some attention, especially if a significant portion of our funds are invested.

ETFs appear to be a large-scale solution because they introduce investors directly to the world of cryptocurrencies, from a much less risky standpoint. The person in question does not need to worry about self-custody, deal with seed phrases or private keys, or choose an exchange they trust. This could be a barrier for the average user who wants to enter this territory, not to mention the need to think about how to declare their financial situation when paying certain taxes. It seems that ETFs partially address this issue, attracting the attention of large investors.

To provide context, ETFs manage to attract investors but also large amounts of capital that are injected into the market. Similarly to how stocks in companies function, it is possible to be a direct investor through an ETF with many fewer complications and responsibilities. A Bitcoin ETF, for example, tracks the price of BTC in relation to fluctuations (volatility), earning profits for the manager or at least that's how I can understand it.

Traxer | Unsplash

Moreover, an ETF follows a legal framework and is supposed to have undergone certain regulations confirming that investing in them is safe, which, again, increases the confidence that investors need to decide where to invest. For now, we could mention BlackRock and Fidelity as some of the most representative ones currently.

We had to make this introduction to get in tune about the topic that concerns us today. We know that Donald Trump is very soon to assume the long-awaited position as President of the United States, and this brings many things with it. One of the things on the agenda is that Scott Bessent will be available to serve as Secretary of the Treasury, highlighting his financial expertise and how he has successfully invested in recent years. Trump blindly trusts that Bessent will lead the country into a "new golden era"; a comment that became very popular on the Truth Social platform, where he usually interacts.

Scott Bessent's career is nothing short of spectacular. He was an adjunct professor of economic history at Yale University from 2006 to 2010, but it should also be noted that from 2011 to 2015, he was the Chief Investment Officer at Soros Fund Management, overseeing funds for billionaire George Soros and various organizations funded by this entity.

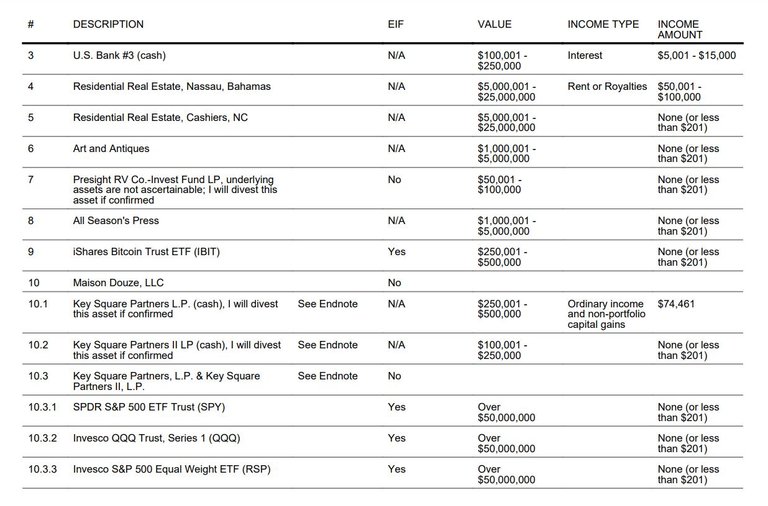

Bessent has disclosed his investment in one of BlackRock's ETFs called IBIT. A significant amount with an estimated share value between $250,001 and $500,000. He also holds stakes in important and well-known ETFs such as the SPDR S&P 500 Trust (SPY), gold and silver, and U.S. Treasury bonds.

Public Financial Disclosure Report

With this in mind, his net portfolio is of substantial value, reaching $521 million. This information became public after the U.S. Office of Government Ethics filed this financial disclosure.

Something worth noting is that with the arrival of new responsibilities, this prominent investor's stance has shifted, as he must now avoid conflicts of interest, creating a new scenario. According to federal guidelines, nominees must sell investments within 90 days after their Senate confirmation.

Bessent's divestment could be quite noticeable. It would begin with a series of divestitures in assets where he has invested, and he has also mentioned resigning from Key Square Group, a hedge fund he founded. News sources claim that Bessent will divest from IBIT, but this remains unclear.

The BlackRock ETF (IBIT) is the largest investment fund with over $50 billion under management, where Scott Bessent has a significant stake. It remains to be seen what will happen when Donald Trump finally takes office, and what direction the current nominee for Secretary of the Treasury of the United States will take.

- Main image edited in Canva.

- I have consulted information at decrypt.co.

- Translated from Spanish to English with Hive Translator.

Posted Using INLEO