$BASE has a very interesting use case. The issue is how they are going to maintain the peg. $BASE can act like an index fund for the entire crypto market. But I don't see a reason to HODL for the long term without any assurance on the maintaining of the peg. Even DEC has not been able to hold its value at $0.001 despite your ability to make purchases at @splinterlands at the $0.001/DEC price.

As for use cases, I would seriously recommend Dash. https://www.dash.org is everything BTC aimed to be. You already have 1 second transactions with InstantSend feature. You have privacy with PrivateSend (on chain mixing service with 4-16 mixing rounds the last time I checked). Dash is literally the first DAO. At ATH they had $10 Million USD monthly budget.

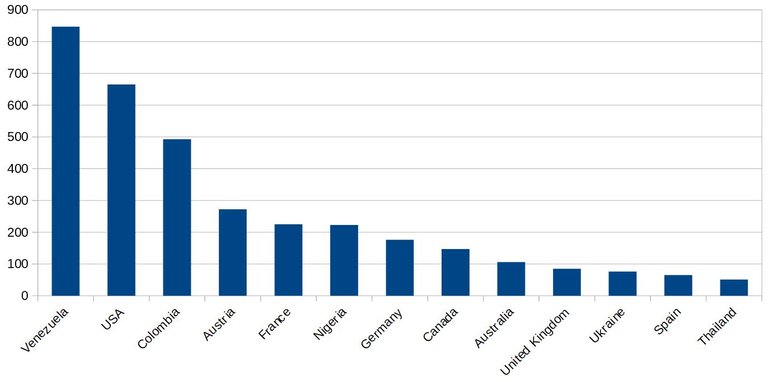

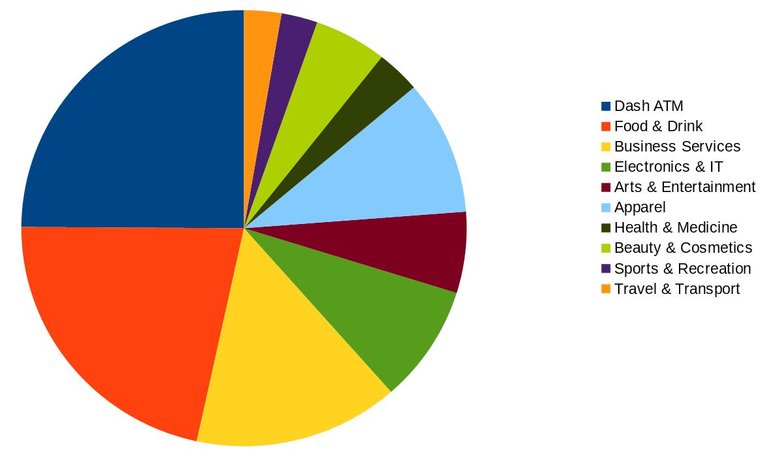

Dash became hugely popular in Venezuela. You can take a look at https://discoverdash.com for Dash accepting businesses

Posted Using LeoFinance Beta

I guess you didn't understand (or maybe I didn't explain well enough).

As I said, $BASE is a synthetic token, with a rebase mechanism and therefore what's called an 'elastic' supply. The 'price' of the token 'doesn't matter that much', what matters is the market cap.

Why? Because you're receiving/losing coins depending on the price.

For example, let's say that the price peg is 0,5$ and the actual price of the coin is 1$.

At 22 pm the coin 'rebases' and will increase their supply in a 100% (everyone will see their coins doubled). That, obviously will generate selling pressure that will 'hopefully' make the price to return to their peg.

Hope that helps.

I don't like Dash, but that's true that's helping a lot of people in Venezuela. Compare BTC with all the other coins it's a mistake. Nothing is as 'decentralized' as Bitcoin.

Cheers

Posted Using LeoFinance Beta

pretty solid comment, complete with graphs and charts!

Posted Using LeoFinance Beta