Hi HODLers, Hiveans and Lions,

Schwab as many others Brokers-Dealers is a good way to gauge how retail investors feel about the current market conditions and their willingness to take more risk.

Apart from a good quarter thanks to organic growth in terms of users and as the stock market reached new highs, Assets Under Management did too.

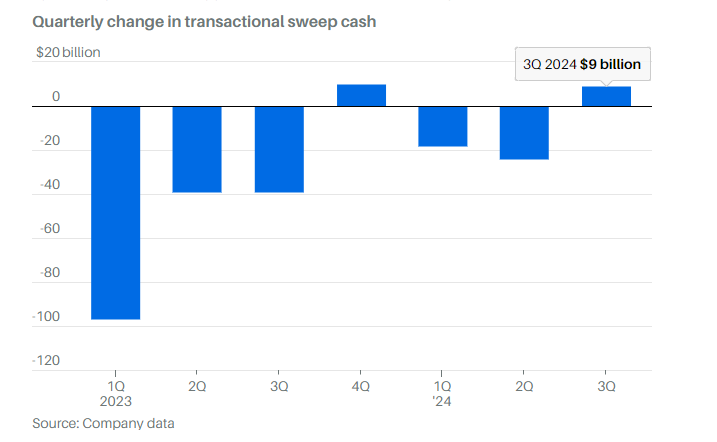

What was very interesting in my opinion is the graph that you can see below. Almost for the first time in the last 2 years, transactional sweep cash is on the rise. This is the cash that clients have on their account and which earns very little interest rates.

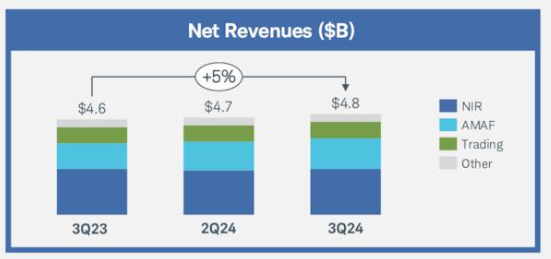

Over the past 2 years, clients have been moving cash on hand to higher paying instruments such as Money Market Funds or Bonds/CDs accounts. As seen below the NIR (Net Interest Revenue) is the main part of Schwab's revenues and is directly linked to the spread they make from client's cash balances and how much they get paid when lending it at market rate.

All these moves from their retail and institutional client base also highlights that investors are back and are redeploying cash invested in Money Market Funds or CDs into the bonds and stocks markets!

I do not own Schwab but was thinking about it prior to this earnings report. I might open a long term position as the company has underperformed its peers and is healthy.

I do own a sizeable position in Robinhood $HOOD and this Schwab Q3 Reports makes me optimistic for $HOOD's own Q3 Report expected on October, 30th.

Stay safe out there,

Posted Using InLeo Alpha

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.