I am sure many of you have noticed the crash on Bitcoin last week where people are screaming the end of time, apparently it was due to the US market pullback but who knows right.

Anyway this is part of the brutal reality of crypto where liquidity is being pull out of the market and assets have a less value, or at least that what the price does reflect since value shouldn't be defined or affected by the price.

It is funny how market sentiment evolve over a short period like a few days, I feel like it went from panick selling at the end of last week to just ho it is actually within acceptable level and BTC is now close to 60k again and people are gaining more confidence and buying a bit more.

Hive did take a hit as usual, goes down with BTC but up by itself.

One good thing about hive is your APR on HBD, Curation and HP interests is based of HIVE numbers not dollar value which means you only losing temporarly in term of dollar value income but this could easely be reverted and if the price if does 5X then your income will too.

For me at this moment it would be a good time to change my strategy from all in to hedge with stable coin in order not to be caught by the newt 3+ year bear market like I did the previous time.

First rule of Warren buffett: "Never lose money"

2nd rule ''don't forget rule number one'

Leodex Liquidity pool on maya

Due to this change in price I wanted to see how it impacted my small contribution to the LEO pool.

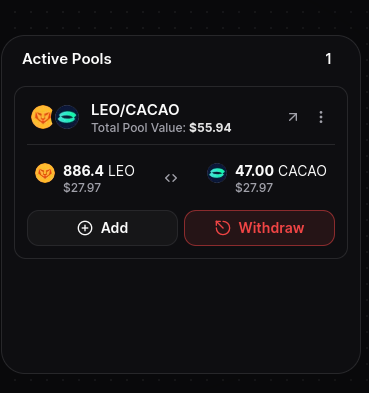

Below is a screenshot as of today, you can see the value in USD term is down to $55 split equily between 886 LEO and 47 CACAO.

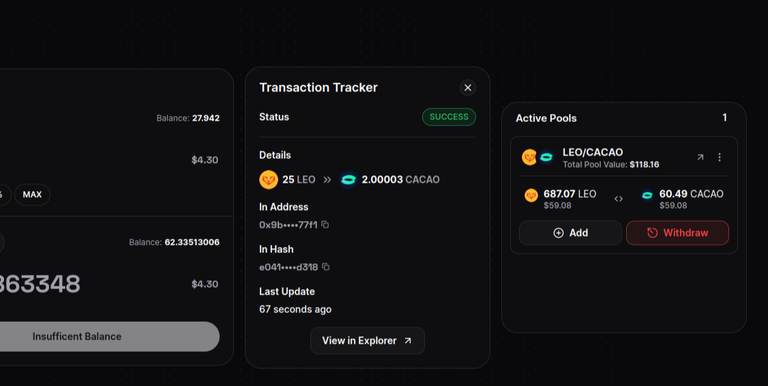

This is in comparison to a previous thread I posted in May 2024 where my position was worth $118 for a split between 687 LEO and 60 CACAO so basically during that time my position was selling some CACAO and buying some more LEO to equalize the position.

https://inleo.io/threads/view/walterjay/re-walterjay-uivvlgfb

in the process I have 200 more LEO in the pool but 13 less CACAO.

At the moment I don't have the intention to pool more ressources, my focus is more on increasing my HP stack at this time as I feel it is one of the last opportunity within the next few month to increase that stake at a good USD price. As of writing HIVE is back down to around 0.17/0.18c per HIVE so a $3000 investment today would equal about 17,5k HIVE power and those shares of hive can generate easily over 8% in curation reward (you have to account for inflation here).

You can checkout my two previous articles:

- What is inside the HIve whitepaper ?

https://inleo.io/@walterjay/reading-the-hive-whitepaper-was-looking-for-an-answer-gnk

- Creating you own list on inleo.io

https://inleo.io/@walterjay/creating-my-first-list-on-inleoio-with-tutorial-3sx

Until next time, Walt.

Posted Using InLeo Alpha

Posted Using InLeo Alpha

Congratulations @walterjay! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 150 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: