SOURCE

In my previous writings, I've delved into the enduring allure of gold, a precious metal often referred to as the world's longest-standing currency. Over the centuries, gold has retained its significance, serving as a bastion of value even in the face of ever-shifting financial landscapes. Central bankers worldwide have recognised its worth, frequently turning to gold as a reliable alternative to fiat currencies when uncertainty looms on the horizon.

The dynamics of gold pricing often dance in opposition to the foreign exchange rates of the U.S. dollar. When confidence in fiat currencies, particularly the dollar, wavers, central bankers tend to bolster their gold reserves. This intricate relationship between gold and the dollar reveals a fascinating interplay between economic stability and the allure of precious metals.

SOURCE

For those who harbor concerns about the current financial or political climate, history has shown that gold can offer refuge to anxious investors. A nation's reserve status hinges on various factors, and central bankers, in their role as guardians of economic stability, tend to exercise caution and prudence.

The U.S. dollar has long held the coveted position of the world's primary reserve currency, yet recent years have witnessed a gradual erosion of its dominance among central bankers. Currently, the dollar accounts for 58% of global central bank reserves, down from 69% in 2014 and a substantial 75% in the year 2000. This 23% reduction over the past two decades prompts us to consider potential repercussions for the global economic landscape if this trend continues.

In the midst of the dollar's gradual decline as the premier global reserve currency, it becomes imperative to assess how this shift may impact our long-term economic framework—an exploration we will delve into later. Over the last couple of years, gold prices have displayed resilience compared to other financial assets, underlining its status as a reliable store of value.

Since the Bretton Woods agreement following World War II, many foreign exchange rates have maintained ties to the U.S. dollar to varying degrees. While President Nixon's decision to take the dollar off the gold standard in the early 1970s altered the Bretton Woods system, the dollar's influence remained significant in global currency markets.

SOURCE

The rationale for central banks to hold substantial U.S. dollar reserves is clear. With 58% of the world's central bank reserves denominated in U.S. dollars, contrasted with the U.S. GDP representing approximately 26% of global GDP, the dollar's global financial dominance is apparent. This disproportionate ratio affords the U.S. currency and economy a unique advantage, as it helps maintain low-interest rates, provides risk management advantages for U.S. companies dealing in commodities, and acts as a magnet for foreign investment in the United States.

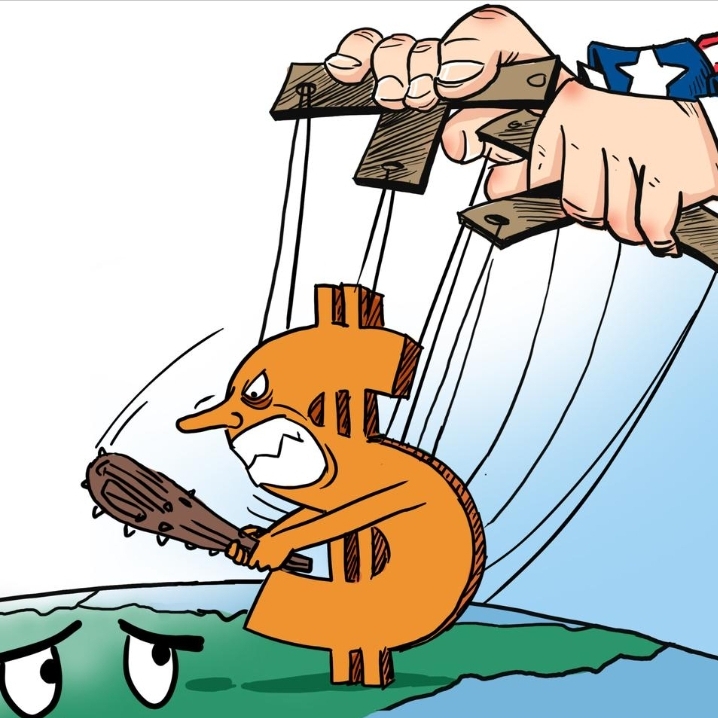

In essence, the U.S. dollar's status as the world's primary reserve currency grants the U.S. economy a considerable edge. However, it's essential to acknowledge that this advantage has been slowly diminishing. A subtle shift appears to be unfolding within central banking circles, particularly among emerging economies. While this "revolt" against the dollar may be somewhat peripheral, it stems from the U.S.'s increasing use of economic and financial sanctions as diplomatic tools against its adversaries.

SOURCE

The phrase "In God We Trust" may grace every U.S. dollar, but the trust dynamic among global trading partners varies. Emerging economies are beginning to question their trust in the U.S., leading them to explore alternatives. Foremost among these alternatives is the oldest form of currency—gold.

As the global financial landscape continues to evolve, gold's resurgence as a trusted currency and store of value raises intriguing questions about the future of finance and the enduring appeal of precious metals. Gold and silver boast a rich historical pedigree as mediums of exchange, with their use dating back centuries in both Europe and Asia. These precious metals have served as the bedrock of commerce, underpinning countless economic transactions throughout the ages. Their enduring legacy is a testament to their reliability and adaptability, as they have consistently proven their mettle in facilitating the trade of goods and services.

If you dont own any precious metals, then why not tell us? As a community we encourage ALL engagements and encourage everyone to take the plunge and own at lease a sinlge ounce of silver or a fraction of gold. If your struggleing to find a safe and secure place to buy, reach out to the community as there is always someone willing to offer their time and advice to help you out.

40+yr old, trying to shift a few pounds and sharing his efforsts on the blockchain. Come find me on STRAVA or actifit, and we can keep each other motivated .

Proud member of #teamuk. Teamuk is a tag for all UK residents, ex-pats or anyone currently staying here to use and get a daily upvote from the community. While the community actively encourages users of the platform to post and use the tag, remember that it is for UK members only.

Come join the community over on the discord channel- HERE

Want to find out more about gold and silver? Get the latest news, guides and information by following the best community on the blockchain - #silvergoldstackers. We're a group of like minded precious metal stackers that love to chat, share ideas and spread the word about the benefits of "stacking". Please feel free to leave a comment below or join us in the community page, or on discord.

Hi @welshstacker, Thank you for participating in the #teamuk curated tag. We have upvoted your quality content. For more information visit our discord https://discord.gg/8CVx2Am

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag. You have created a Precious Gem!

I can't wait to see what people use to "make change" for our "Circulating" Silver and Gold Coins...

I would appreciate it if you pushed silver a little harder 🤣

As you wish

You Fiji folk ain't so bad after all 🤣