SOURCE

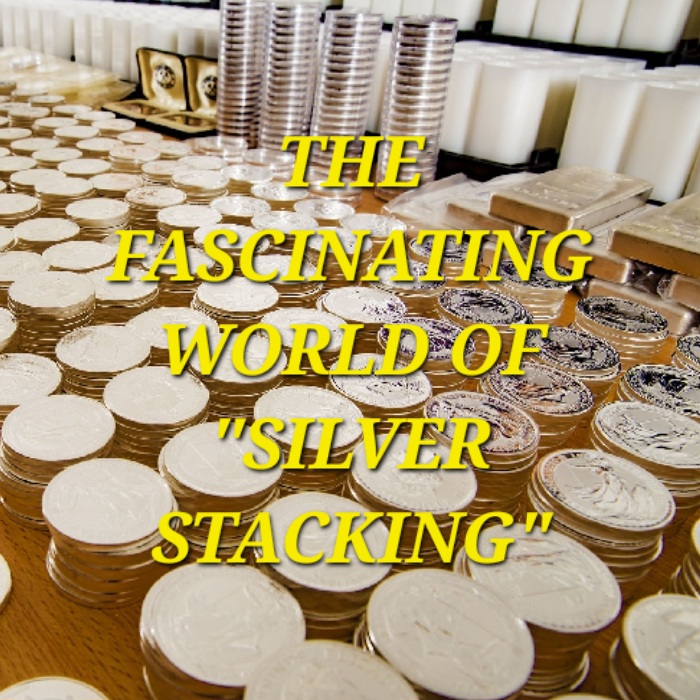

In the realm of alternative investments, one practice has gained significant traction among savvy individuals seeking to secure their financial futures; silver stacking. So, what exactly is silver stacking? In essence, it involves the deliberate accumulation, preservation, and "stacking" of silver bullion.

Silver stackers are individuals who take a long-term approach to building their wealth by acquiring various forms of silver bullion. They acquire bullion coins, rounds, bars, and even hand-poured silver pieces, safeguarding them with care while patiently observing their monetary value appreciate. Their intention is to hold onto their silver stack indefinitely, selling only when necessity dictates or when opportune market conditions present themselves.

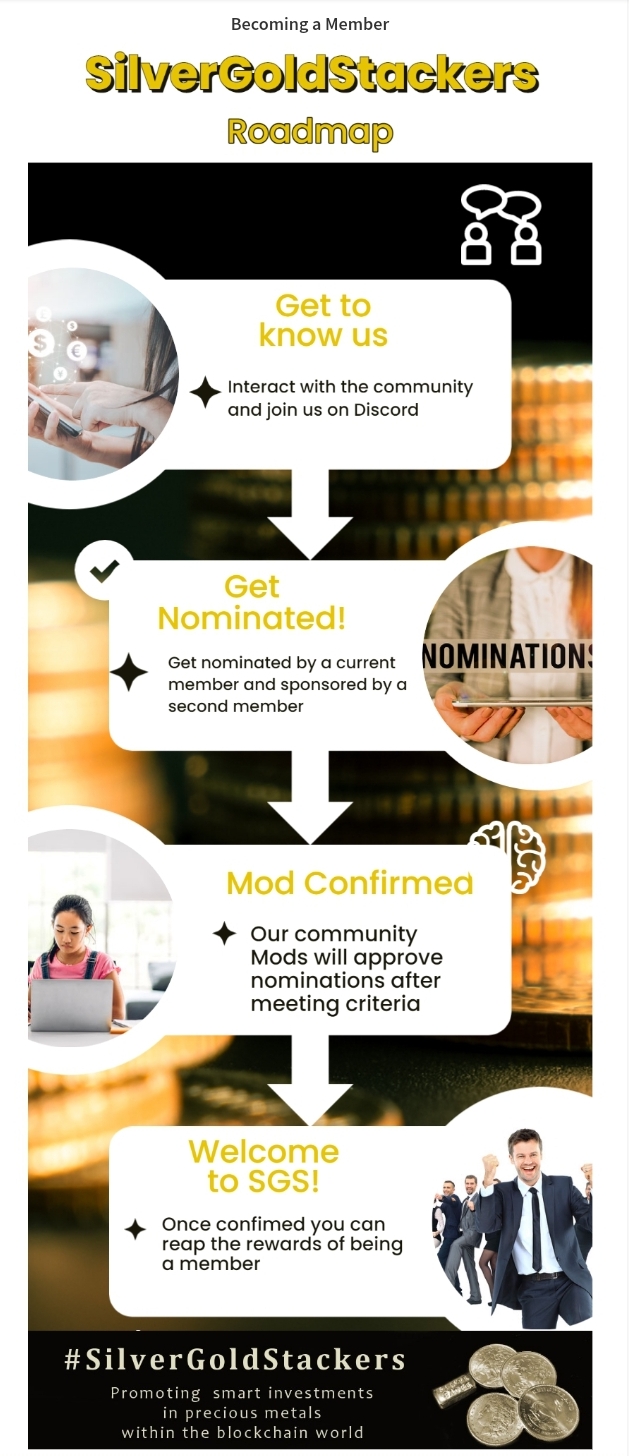

Traditionally, silver stackers preferred to keep their investments a closely guarded secret. However, in recent years, a growing number of enthusiasts have embraced the idea of sharing their collections on platforms like #hive, fostering a vibrant community centered around silver stacking. Welcome to the world of #silvergoldstackers

But where did this intriguing practice originate? To trace its roots, we must venture back thousands of years when silver held a prominent role as the primary form of currency worldwide. Mined since 3,000 BC, silver became the cornerstone of countless economies. The earliest coins were minted in Athens, and later, Spain emerged as a major supplier of mined silver. Throughout history, various nations unearthed and mined silver, recognising its enduring popularity as a medium of exchange.

However, the emergence of the gold coin era in 1837 marked a significant turning point. Germany's adoption of the gold standard led to the liquidation of its silver reserves. Coincidentally, this period coincided with the discovery of vast silver mines. As Germany's empire expanded, so did the gold standard. Fearing a potential spike in inflation due to falling silver prices, many nations swiftly demonetized larger silver coins.

In the United States, the Coinage Act of 1873 halted the production of silver dollars and restricted smaller silver coins to a maximum legal tender of five dollars. As the world continued to uncover substantial silver deposits, the prices of silver steadily declined. In 1918, during World War I, Britain faced a currency crisis in India. To fund critical purchases, the British government had issued more silver certificates than it could back with actual silver. The United States stepped in by melting unused silver dollars stored in Treasury vaults, exacerbating the already bleak outlook for silver. The situation worsened with the government's implementation of The Silver Purchase Act of 1934, which aimed to nationalise domestic silver mines.

Amidst these challenging circumstances, individuals began amassing silver, hoping for a resurgence in its value. And their hopes were not in vain. In the years that followed, silver prices gradually climbed as the United States became a leading seller and completely removed silver from its coinage.

SOURCE

By 1968, silver certificates were no longer redeemable for silver, and demand for the precious metal surged, growing at an average annual rate of 16% while production lagged at less than 2%. The price of silver slipped from U.S. treasury control, resulting in a twofold increase in the value of a troy ounce. People persisted in stacking silver, recognising that while it might not yield the same profitability as gold, its consistent appreciation over time promised a substantial return on investment.

In 2011, the debt crises in the European Union and the United States propelled silver to a record high. Despite increased price volatility, that year marked the highest annual silver price in history, accompanied by soaring demand for physical silver investment. The popularity of Silver Eagles surged, causing a shortage of coin blanks. Consequently, more investors turned to silver bars, triggering a 67% increase in sales. The effects of supply shortages have persisted, especially during the ongoing pandemic, which has further accelerated the demand for this precious metal.

As the world grapples with economic uncertainties and individuals seek alternative means to safeguard their wealth, silver stacking continues to hold appeal. The allure lies not only in the potential financial gains but also in the tangible nature of owning physical silver. The practice embodies a steadfast belief in the enduring value of precious metals and offers individuals a path to fortify their financial portfolios.

So, whether you choose to discreetly stack your silver or proudly showcase your collection to fellow enthusiasts, the art of silver stacking represents a captivating journey through history, economics, and personal finance. As silver's allure endures and its market dynamics evolve, it remains an intriguing asset class worthy of exploration for those seeking to secure their financial futures.

If you dont own any precious metals, then why not tell us? As a community we encourage ALL engagements and encourage everyone to take the plunge and own at lease a sinlge ounce of silver or a fraction of gold. If youre struggleing to find a safe and secure place to buy, reach out to the community as there is always someone willing to offer their time and advice to help you out.

40+yr old, trying to shift a few pounds and sharing his efforsts on the blockchain. Come find me on STRAVA or actifit, and we can keep each other motivated .

Proud member of #teamuk. Teamuk is a tag for all UK residents, ex-pats or anyone currently staying here to use and get a daily upvote from the community. While the community actively encourages users of the platform to post and use the tag, remember that it is for UK members only.

Come join the community over on the discord channel- HERE

Want to find out more about gold and silver? Get the latest news, guides and information by following the best community on the blockchain - #silvergoldstackers. We're a group of like minded precious metal stackers that love to chat, share ideas and spread the word about the benefits of "stacking". Please feel free to leave a comment below or join us in the community page, or on discord.

I'm planning on handing down my Silver to my adult kids.

As for my Precious poured silver, I may keep it with me should I get a Viking funeral. A curse on the souls that try and disturb me at my rest!

Welshie you are a Welsh of knowledge ….

Nothing you can google and get answers 10x better.

If that’s what you think. You obviously don’t know me very well. I don’t even own a computer, I just have a phone. Im not tech savvy at all.

Yes, Weshie!!!

Hi @welshstacker, Thank you for participating in the #teamuk curated tag. We have upvoted your quality content. For more information visit our discord https://discord.gg/8CVx2Am

You received an upvote of 97% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag. You have created a Precious Gem!

Congratulations @welshstacker! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Great work ! I learned a lot of what you mentioned in your post in the The Story of Silver: How the White Metal Shaped America and the Modern World

Book by William L. Silber that I posted about a little while back

My aunt also loves to stack silver, she has more than half a kg of Silver.

It might be appealing on paper. But the price of silver does not move a lot in price! Maybe is just fun of accumulating and collecting them is appealing to a lot of coin collectors.

Its true silver will never make you rich, but it will stop you from becoming poor. Yes, there are some collectable silver coins that you can make a great profit on for holding for a few years, but true silver stackers understand that silver (and gold) are a way to preserve wealth and transfer "value" across time.