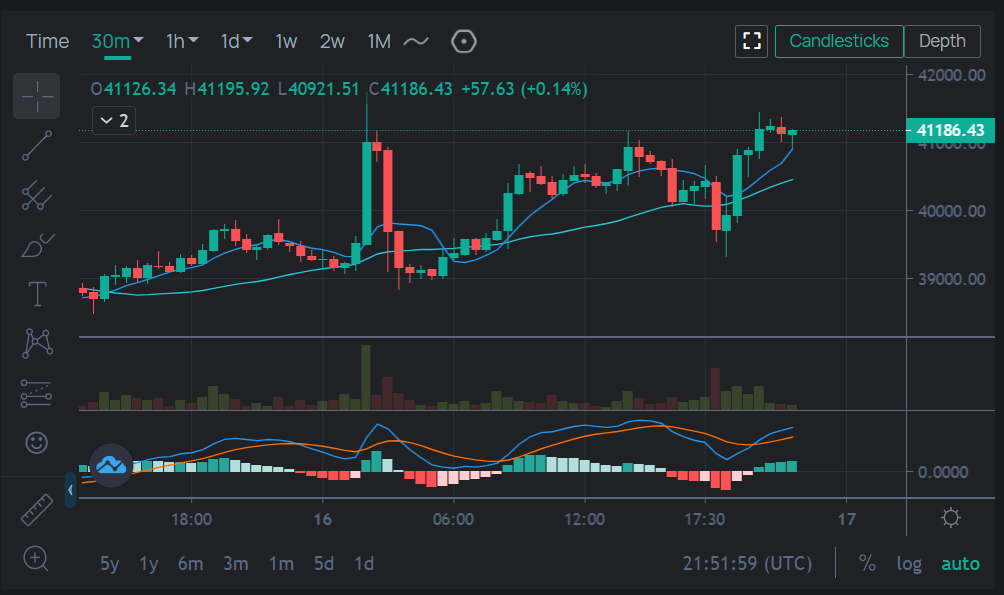

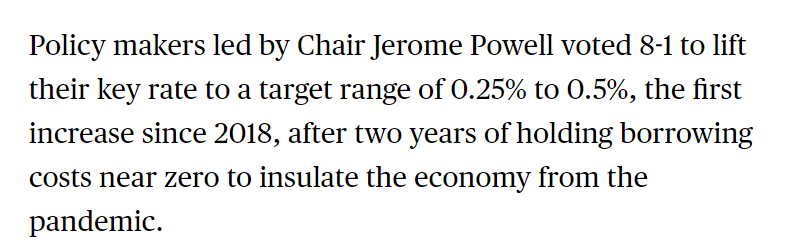

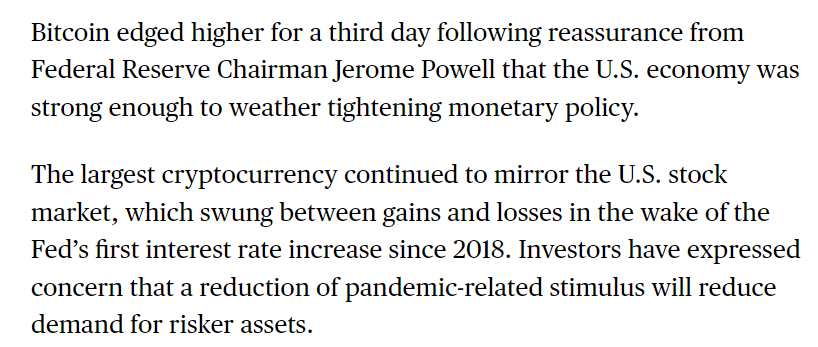

Bitcoin has been trading in a range for a while, but the good news it is that it didn't dump on the Federal Reserve rising the US Interest rates up .25% a fairly mild move, but one that sometimes can cause market reactions.

Not only did Bitcoin not dump the price moved above $41,000 for the first time in a week.

Earlier in the week the UK was discussing banning POW Crypto such as Bitcoin was creating the FUD, but the legislation was rejected.

While many continue to talk about regulating cryptocurrencies for one reason or another, I think the potential for the economic wins that accompany an emerging technology brings, is also a large factor of why they aren't getting a lot of support in the regulation or banning of Bitcoin.

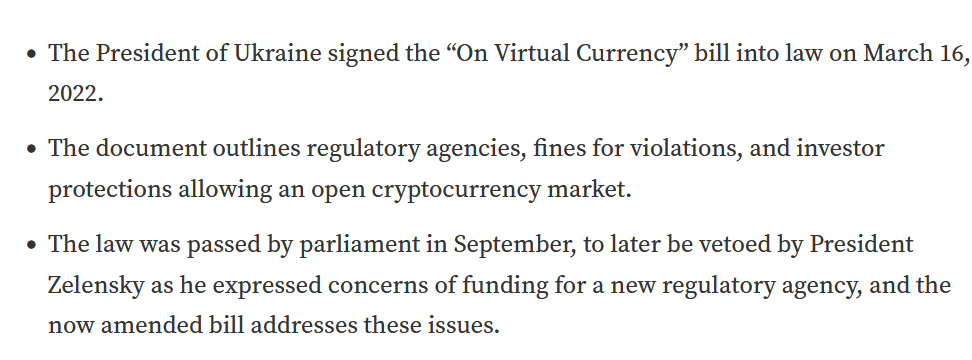

Meanwhile both Russia and the Ukraine have passed legislation to legalize and bring BITCOIN out of the shadows for obvious reasons both Nations could find major reasons to use Bitcoin in the face of a Global financial war, US Sanctions, and difficult access to USD as well as profitable mining brings Bitcoin attention center in the Global conflicts playing out.

https://finance.yahoo.com/news/russian-crypto-miners-brace-sanctions-162225701.html

https://finance.yahoo.com/news/russian-crypto-miners-brace-sanctions-162225701.html

As China and HongKong fight Covid outbreaks and get caught up in the conflict in the conflict there is still more uncertainty in all markets as everyone watches the Global Elites melt down and impact the entire Global Economic system. Many are calling for recessions or worse, and whether or not Bitcoin will remain a hedge against all this uncertainty, I feel much better knowing I have Bitcoin and other cryptos and while I can't prove they will save the day for my family, I certainly hope it provides us with additional options in these challenging times!

I stand with the people who are facing challenging times during a conflict they didn't ask for and can't control.

picture from Pixabay.

Posted Using LeoFinance Beta

A couple of days ago I read an article explaining that one possible result for the sanctions applied to Russia is an increase in politically neutral assets to be used as reserves instead of dollars. The sanctions proved to other countries holding dollars that in extreme situations they are at risk of being blocked from the Western financial system, and concluded that neutral assets such as gold and bitcoin might become more prevalent in the international reserves of many countries. Which would be extremely bullish for crypto over the long term.

Posted Using LeoFinance Beta

That would be bullish!

Posted Using LeoFinance Beta

Once the conflict is over, there are going to be huge gains for crypto....I can feel it

I do think we are in for a pump, but too much uncertainty still.

Posted Using LeoFinance Beta

Even if there is a recession, I have a feeling that BTC will recover soon enough. I just don't see any reason in looking at their information because most of it doesn't really matter. The price tends to move along with the whales and I think it's easier for them to push based on the news.

Posted Using LeoFinance Beta

I think when there is news about speculation you get speculation, but when something really happens it moves markets.

Posted Using LeoFinance Beta

I am highly amazed that people still give a damn about covid. Isn't it clear that it's just a flu.

Posted Using LeoFinance Beta

China..

Also HongKong has a large elderly population living in group homes, which is turning out poorly as it did here.

Posted Using LeoFinance Beta

This is just very funny,they keep on looking for means to put an end to crytpto due their own self interest.

Not having enough power to inflate this is one major reasons for every of their moves.

Truth. They don't really know how to change the situation.

Posted Using LeoFinance Beta

I feel like we are leading upto a break out and we're going to see a moon soon.

I think this market cap will be one of the biggest to date. But I could be wrong.

Posted Using LeoFinance Beta

me too

Posted Using LeoFinance Beta

24 rate hikes left :D 1.9 by end of the year.

Super slow. JP hopes inflation goes away from allow :D So inflation stays longer.

The stimulation end / bond sellout will be interesting. Special if war fear is gone at some point and bonds dumping massive.

Could end up in a massive drama.

There are so many dramas available right now how to pick the right ones! lol.

In anycase I'm hopeful bitcoin is a good place to be.

Posted Using LeoFinance Beta

BTC is the last asset standing in my opinion. As you say, we have to see how it holds up but I think the macro landscape will only serve to push it forward. I expect to see some "positive" price action around May... wait and see, I suppose.

Posted Using LeoFinance Beta

Always waiting and seeing. LOL

Posted Using LeoFinance Beta

That's the name of the game. Projet, extrapolate, and strategize... wait for confirmation, adjust if fundamentals change.

Posted Using LeoFinance Beta

It’s very weird, so many news but not price action?

I've been finding that ood too, I guess the uncertainty is outweighing the news?

Posted Using LeoFinance Beta

$WINE

0.200 WINEXCongratulations, @theguruasia You Successfully Shared With @whatsup.

You Earned 0.200 WINEX As Curation Reward.

You Utilized 2/3 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.310

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us