As cryptocurrency enthusiasts, programmable money isn't really something new for us. But what if a central bank controls it, and makes it the primary currency? Is it still something we would desire? That becomes a relevant question now that the European Union is aiming to make it happen. During 2023 they plan to finish talks about it, and after that they will start to implement it in the entire European Union.

But what is it about? And do we understand the risks? First some explanation:

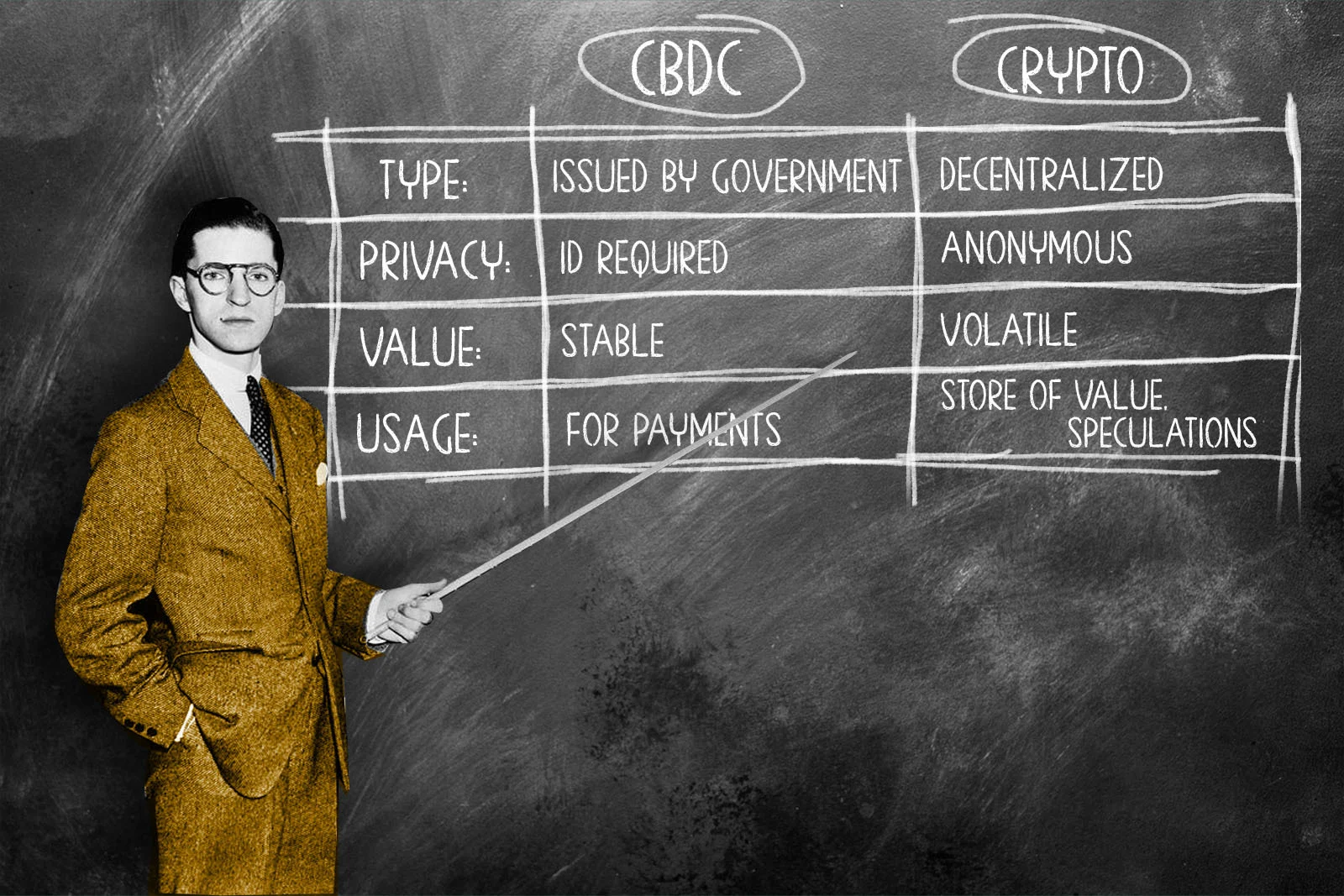

Central banks worldwide, including the European Central Bank, are focusing on issuing their own digital money, Central Bank Digital Currency (CBDC). In addition to coins and banknotes, these currencies can provide people and businesses with new payment options and improve the use of digital financial services. At the same time, the CBDC also brings many new risks.

One of the dangers of these CBDCs is that there is no limit to the level of control that governments could exert over people if money is just electronic and provided directly by the government. CBDCs would give federal officials full control over the money going into (and coming out of) every person's account.

"A recent survey among 66 central banks by the Bank for International Settlements shows that more than 80% are working on central bank digital currencies (CBDCs). The European Central Bank is one of them." states the website Settlemint.com.

The Federal Reserve said the following about implementation in the United States:

"While the Federal Reserve has made no decisions on whether to pursue or implement a central bank digital currency, or CBDC, we have been exploring the potential benefits and risks of CBDCs from a variety of angles, including through technological research and experimentation. Our key focus is on whether and how a CBDC could improve on an already safe and efficient U.S. domestic payments system."

CBDCs are literally digital cash. Unlike traditional (physical) cash, which can be transacted anonymously, digital cash is fully programmable. This means that these CBDCs enable central banks to have direct insight into the identities of transacting parties and can block or censor any transaction. Central banks argue that they need this power in order to combat money laundering, fraud, terrorist financing and other criminal activities.

But as we will see below, the ability of governments to meaningfully combat financial crimes using existing anti-money laundering and know your customer laws ("AML/KYC") has proven woefully inadequate, at best, while effectively eliminating financial privacy for billions of people.

The ability to block and censor transactions also implies its opposite; the ability to require or incentivize transactions. A CBDC could be programmed to only be spendable at certain retailers or service providers, at certain times, by certain people. The government could maintain lists of "preferred providers" to encourage spending with certain companies over others and "discouraged providers" to punish spending with others.

In other words, with a CBDC, cash effectively becomes a state-issued token, like a food stamp, that can only be spent under predefined conditions. Means testing could be built into every transaction.

But censoring, discouraging and incentivizing transactions are not the only powers available to central banks with programmable cash. Banks can also disincentivize saving, holding digital cash, by capping cash balances (as the Bahamas have already done for their CBDC) or by imposing "penalty" (negative) interest rates on balances over a certain amount.

This can be used to prevent consumers from converting too much of their bank balances, credit money issued to them by commercial banks, into cash. After all, if too many people rush to demand cash (hard money) at once, commercial banks will be deprived of funding and might even collapse.

Residents of countries with sovereign currencies lacking historical stability have been among the most active adopters of cryptocurrencies as a means of exchange, especially where they are perceived as less risky than the available alternatives. So the current state of financial infrastructure in a given country will play a key role in determining the speed and extent of adoption of CBDCs.

But, if the popularity for individuals to move their deposits from commercial banks to the CBDC holdings increases over time, this will put pressure on banks and lead to loss of funding for the institutions. This could lead to a knock-on effect for businesses and households as the banks may not be able to make loans anymore.

So the bottomline:

These are some of the advantages of CBDCs. (Summarized by HustleEscape.com)

1: Simplification of monetary policy. One of the challenges with traditional monetary policy is that it relies on intermediaries in the banking system. While wholesale CBDCs would streamline transactional flows of currency in the banking system, retail CBDCs would allow central banks to establish a direct connection with citizens. This direct financial connection opens up a range of policy options for expansionary (and contractionary) monetary policy. This could include instant transfers of helicopter money, as well as a range of bespoke monetary policy approaches (more on that later).

2: Financial inclusion. CBDCs will simplify the process of distributing funds. In some countries this will play an important role in providing financial access without the need to establish expensive banking infrastructure. CBDCs will also help to facilitate government transactions, such as the issuance of benefits like universal basic income (UBI) and the collection of taxes.

3: Efficient cross-border transactions. CBDCs would enable more efficient remittances from one country to another. This would significantly reduce the costs of sending and receiving currency, as well as increasing competition in the financial sector.

4: Reduced illegal financial activity. A transparent ledger will make it easier for a central bank to track transactions and prevent fraud. In turn, the central bank can support in reducing illegal activity.

5: Support for the fintech sector. A CBDC might support and facilitate the emergence of the fintech industry, helping to legitimize and streamline the new technological landscape.

And here are some of the disadvantages. (Summarized by HustleEscape.com)

1: Traceability, you will no longer transact anonymously:

Of course physical cash will not be delegalised immediately. CBDCs will initially be advertised as a convenient add-on to the existing system, helping drive transactional efficiency and improve cross-border transactions. But make no mistake, the disappearance of cash is inevitable.

2: There will be no option to hold physical cash:

In CBDC world, you cannot withdraw your digital tokens and hold them under the mattress. Eventually there is no option for physical cash.

3: Programmability offers new weapons for serial economy killers:

Here’s where things get really worrying. With the centralisation of our relationship with the financial system, CBDCs give central banks a unique opportunity to make money programmable.

4: Personalised monetary policy:

Taken collectively, the issues of traceability, absence of physical cash and programmability raise important ethical questions. By extension, they also raise the likelihood of personalised monetary policy. With a bank of Big Data on individual spending, saving and investing habits, coupled with digital identification infrastructure, the central bank will have enough information to tailor its monetary policy.

Want to learn more? Check out some of the sources I used.

Also have a look at what the people think about CBDCs in The Netherlands:

https://hive.blog/hive-122315/@dutchresearcher/central-bank-digital-currency-the-digital-euro-is-coming-and-the-people-are-not-amused

Sources:

https://www.finextra.com/blogposting/21584/the-risks-to-society-of-central-bank-digital-currencies

https://settlemint.com

https://www.federalreserve.gov/central-bank-digital-currency.htm

https://bitcoinmagazine.com/legal/the-dangerous-implications-of-cbdcs

https://www.hustleescape.com/cbdc-advantages-disadvantages/

The information you provide about CBDCs in this post confirm what I had learned about them since June 2021 when I discovered LeoFinance. It won't be pretty for those of us not connected with the central banks.

Since the move to CBDC is inevitable, there needs to be a medium of exchange created which can pick up where cash left off. I want to say it's decentralized cryptocurrency, but that's on the radar and under threat of elimination. Instead, something innocuous needs to enter the picture for us. Maybe sports trading cards can be re-purposed as cash? Stranger things have happened, such as negative interest rates, so why not?

I was going through my list of followers and I wanted to see how things are going. It's been a while since we last communicated; I hope things are OK at your end.

If you want to reply and keep the Comments section in this post for post comments, feel free to drop me a message at my Message Board

It's too late for me to upvote this post, so please accept this slice of !PIZZA, a bit of !LUV, and and an !LOL / !LOLZ instead.

$PIZZA slices delivered:

@magnacarta(4/5) tipped @yourmarklubbers

https://leofinance.io/threads/@magnacarta/re-leothreads-2c3dc1wa7

The rewards earned on this comment will go directly to the people ( magnacarta ) sharing the post on LeoThreads,LikeTu,dBuzz.