Some setups for a trade with volume profile tool in tradingview

But, What the hell is volumen profile????

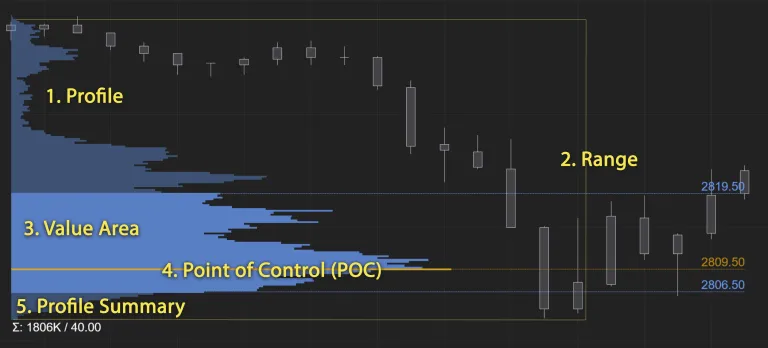

Along with this concept, there are others that we must understand in order to talk about volume profile. In the graph on the right you can see some of the concepts I comment. Within the volume profile, one of the prices where the highest trade point has occurred is marked, this point is called the Control Point or PoC.

In the same way, the area where 70% of the total trade is produced is named Value Area and is delimited by the VaH (Value area High) and the VaL (Value Area Low). When the price moves away from this zone it can be because of a total change of trend or it is possible that it returns to the equilibrium zone.

How I'm using this data to trade?

Like I told you in my last post Three rules to enter a trade We shouldn't enter in a trade only for one only reason.

The first data we can obtain from this indicator is possible resistance and support lines if these lines have a sense with the rest of the chart we could have a solid indicator to setup a trade. We can mix this information with Fibb levels to reinforce the indicator.

This indicator can be used in tradingview, but one key is what interval take to get caught for the indicator? One way is take a interval of price go up or go down. Lets see an example and will be more simple to explain.

In the graph we distinguish the PoC and the VaH and VaL values that establish a price range where almost all the volume moves and therefore it is likely that once the price goes out of that range it will tend to go back in. This interpretation is very relative and should always be seen in conjunction with other indicators as discussed above.

As you can see the price has bounced off 0.19 and has risen rapidly to 0.38. At this point we see that there is a rebound if we want to enter a good price would mark the PoC that has been below at 0'31. As you can see the price actually returns to this area twice

Another way to use it.

This will give us an idea of the supports and resistances that are being created and can be a useful indicator to move within the daily trading.

It is striking how PoC from immediately preceding days mark the resistance or support of the price the next day.

Lets take a look at WLEO

We can therefore expect two scenarios, a consolidation at the current level that would change the PoC to a lower price, or a recovery of the price to levels close to the current PoC.

I hope that the publication has been to your liking and that you find it useful. To do this you will certainly have to do more research on the volume profile and how to use it. I will try to tell you about my experiences as I learn to use it.

Any comments would be very useful.

Greetings!

LeoFinance is a blockchain-based social media community for Crypto & Finance content creators. Our tokenized app allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

| Track Hive Data | New Interface! | About Us |

|---|---|---|

| Hivestats | LeoFinance Beta | Learn More |

|

|

|

| Trade Hive Tokens | Hive Witness | |

|---|---|---|

| LeoDex | @financeleo | Vote |

|

|

|

Posted Using LeoFinance Beta

I appreaciate you explaining how this indicator works.

I don't actually use any of the indicators, I find them very useless and misleading but this is only for me.

If you saw any of my analysis you could see that I use pure price action only!

Posted Using LeoFinance Beta

Most of indicators come from the price, but I consider the volume is another important factor to see the market, and we always see it in function of time, this indicator is only a tool that allow us see the volumen in relation of the price. Thank you for comment, best regards.

Posted Using LeoFinance Beta