Greetings my friends of this beautiful community, I wish you a happy weekend, without fail I will tell you on another occasion everything I have planned to do, but as usual I will enjoy participating in the Engagement of this weekend, I want to show you my experience about the first topic, which I consider of utmost importance..

Topİco 1.

Do you consider that giving children financial literacy training is the responsibility of the parents or the school, and why? If you do it with your children, how have you done it? Use your own photos..

I must tell you that I understand that the financial education of children is a shared responsibility between parents and schools, since both have the role of educating and forming men and women capable of building a prosperous individual and social life..

Therefore, parents and teachers must play a fundamental role in teaching children financial skills that will help them make wise and responsible decisions in the management of their finances, for which they must have both theoretical and practical training..

Schools could include financial education subjects in their curricula or establish conferences, role plays, workshops and lectures on these topics. .

In my case, since I was very young I involved my children in the planning of the household budget, they knew how much we earned and what we had to spend, how much we had to save to buy something more important or to go on vacation..

As they grew up I got him more involved, also something I did was to give each one the money they could spend buying tickets when we went to the amusement park, that made them enjoy the ride more because each one spent it on what he liked the most jjjj, no one was dissatisfied..

They learned to save and invest by adjusting the money they had available for school..

Today they tell me that playing Monopoly or Eternal Debt were games that made them think about how to maximize their earnings and manage their income and expenses..

The reality is that they had to face a very different financial management system than the one I showed them and used. They went to live in the USA and quickly assimilated the use of credit cards and the relationship with the bank and insurance, although more complex, they tell me that what they learned in their childhood has allowed them to make responsible decisions in planning their income, expenses, investments and savings..

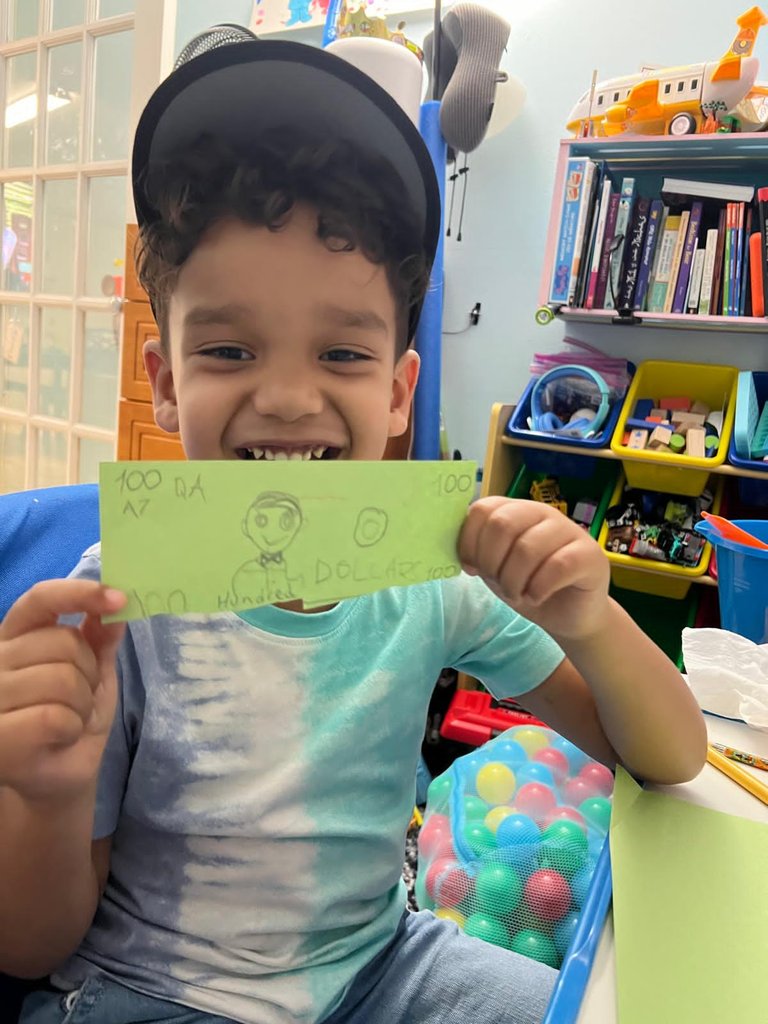

I am pleased to know that my grandson is only five years old and my daughter is already showing him the value of money, he knows that even if he likes a toy sometimes he must wait for the right time to buy it, he already knows that there is an order of priorities and as my parents used to say, you have to cover yourself as far as the sheets will go..

The more we prepare our children from an early age to face life, the more capable they will be and the fuller their lives will be..

.

.The images are my property.

I used the translator DeepL