Not sure I'm getting this right, you'll provide volume to certain tokens? I thought liquidity pools and swaps removed the need for market makers.

Not sure I'm getting this right, you'll provide volume to certain tokens? I thought liquidity pools and swaps removed the need for market makers.

Hello. Let's take Zing Token as an example. In the Hive/Zing market, the trading volume in the last day was $133. In the Zing/Hive liquidity pool, the trading volume in the last day was $401. The situation should be exactly the opposite. In other words, the place where the trading volume should actually occur should be the token market, not the liquidity pool. And the price formation should occur in the token market.

Let me talk about just one of the problems that the current situation will create; The current Zing price in the liquidity pool is 0.00273 Hive. In the Hive/Zing market, it is 0.00263/0.00359 Hive. The price in the liquidity pool should be close to 0.00311 Hive. As long as the token market does not have the trading volume and liquidity advantage, healthy price formation cannot occur, no matter which way the price moves. I chose Zing because it is a known example. 90% of the tokens in the Hive-Engine have the same problem. Arbitrage bots like Mcbot, God0, Konvik etc. provide some balance. However, they do not provide real users with the opportunity to make a profit due to low transaction volume etc.

We have started studies like the one here regarding Cent. One of the purposes of creating this token is to prevent the problems I mentioned. Such things will remain very weak. However, it is necessary to start from a certain stage.

The reason it should be the opposite is cause there's no fees there?

But yeah I always thought the arb bots would take care of the spread, not sure why it's still that bad. So if it helps with that then I can understand it. Thanks for explaining!

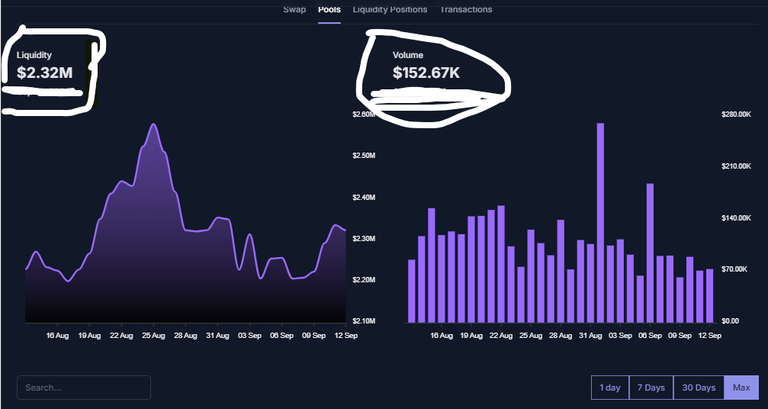

Thank you. There is no transaction fee when trading in the token market. There is a 0.25 transaction fee in liquidity pools. Logically, where the transaction fee is 0, the transaction volume should be higher. However, almost all users who make large purchases/sales prefer the liquidity pool to prevent price slippage. In fact, liquidity pools are destroying the token market in the medium/long term. I can explain this clearly with a visual;

The entire ecosystem is waiting for an investor with deep pockets to come and revitalize the market. However, unless we take steps with the incentives, events and studies I mentioned above, the same result awaits most Hive-Engine projects.

I have been wondering about these accounts. Now I see; they are bots.

These types of bots are more active during bull seasons. They catch more opportunities because the risk appetite of real users increases. They are generally more passive during these times.

I was wondering because I often see them on both sides of the trade. On different days of course.