Hello. First of all, thank you for trusting and participating in the project and the 'Hive-Engine Investments' study. First, let me answer your question about the accounts.

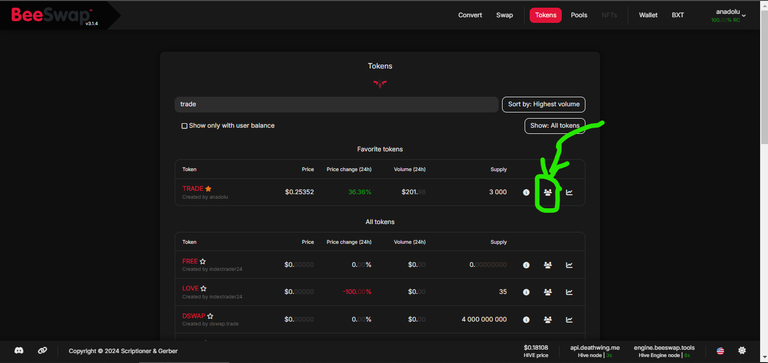

- Anadolu account is the creator account of the token. Therefore, a note is seen on the creator account every time a new token is minted. So far, 3,000 Trade tokens have been put into circulation. And all of the tokens were sent to the @centtoken account. The account added 730 tokens to the liquidity pool for LP rewards. 2 Trade tokens are distributed daily in the liquidity pool. All but 505 of the remaining tokens were sold in the Hive/Trade market. 500 tokens were entered into the market as a sell order. 5 Tokens are in the @centtoken account. There is no token distribution other than the tokens distributed in the liquidity pool and the tokens sold by @centtoken. There was no token printing, distribution, etc. other than sending to the @centtoken account. There will be no such distribution in the future.

As for the sales and distribution strategy;

- As I mentioned in the introduction text of the token, I have gained a lot of experience in such matters. However, I must confess :) A large purchase like yours was not expected. Initially, 1500 tokens would be printed and 730 tokens would be added to the liquidity pool. The remaining tokens would be sold in the market. Therefore, some of the users would add their tokens to the liquidity pool, while others would make purchases and sales in the market. Thus, depth, transaction volume and liquidity in the pool would balance each other and become stable.

As a result, 1500 more tokens were sent to the @centtoken account than planned. And the balance was achieved by gradually increasing the sales price. The account does not enter orders only to sell tokens. In addition, it enters a sell order in the token market to protect users who trade in the market from price slippage. To give an example; If @centtoken removes the sell order and a user enters a loaded buy order at the market price, they will encounter extreme prices such as buying 1 Trade token at the price of 500 Hive. Therefore, it is quite natural for the account to enter sell/buy orders at various levels. When the transaction volume, liquidity and depth begin to mature, such measures will not be necessary.

- Token printing and sales by the @centtoken account will only be done when needed according to the strategy of the study. For example; Adding LP rewards to the Hive/Trade liquidity pool, Token sales, etc. However, while doing this, we will of course consider factors such as the price of the token, the inflation rate, and whether the market is in a bull season or bear season.

As mentioned in the introductory text above, when the token was announced, I purchased approximately 300 Trade tokens. The reason for this was to ensure that the Hive/Trade liquidity pool was created and started distributing rewards as soon as possible. (Liquidity pool creation fee is 1000 BEE and the fee to activate LP rewards is 100 BEE.) I added some of my tokens to the liquidity pool. I also entered buy and sell orders for some of them to contribute to the formation of depth in the market. I also recommend you to follow the price movements and buy/sell when you see it necessary. In addition to all this, constantly evaluate the risks, whether in other cryptocurrencies or Hive-Engine tokens. And take the necessary precautions. I wish you success.

https://he.dtools.dev/richlist/TRADE

https://he.dtools.dev/@centtoken?symbol=TRADE

https://beeswap.dcity.io/pools?search=trade

https://beeswap.dcity.io/tokens?search=trade

Awesome! Thank you for the detailed reply!