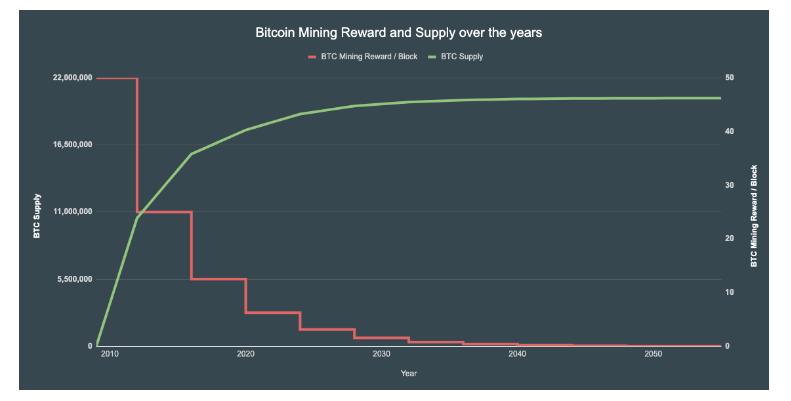

The current supply of digital gold-Bitcoin is now 18.366 million and with the upcoming halving event it will further become scarce.

So as it approaches the maximum total supply of 21 million the curve gets flatter. The mining will be more difficult post halving as nos of BTC mined per block will be reduced to 6.25, roughly after 5 days.

The operational cost for a miner at this price of Bitcoin may not be an issue.

It seems like BTC is already priced in for the upcoming halving event, now trading at ~9300 USD.

But the million-dollar question is how would BTC trade post halving event?

It may be a volatile event on that particular day. It may also be a "buy the rumor, sell the news" event.

We can not project every future event from the historical halving events pattern, as in the last 3 years particularly after the epic rise of BTC in 2017, BTC has become mainstream, and as the mainstream media houses started to cover the BTC news and broader crypto space, more and more investors from the traditional financial market have jumped into BTC. So this halving event may be going to be a little different from the past.

So, post halving event, do you think the recent sharp rally from 4k to 9.3K would sustain with follow-through buying across the broader crypto market or will correct by 20 to 30%?

- Screenshots- Coingecko