So bear markets can be boring, and I think this is what gets people in trouble. They make questionable moves during these times because they run out of patience and literally want to do something, but don't know what to do. So they do something dumb. This is not the way.

Bear markets don't have to be boring, you just have to make sure you are looking at the right things. So I want to share today some of the ratio trades I have been working with, evergreen trades where the surrounding markets don't matter much.

DBLN:LVL

These two tokens have something to do with @psyberx - their current 'hit' game is Serfdom and Sorcery, and while the team has worked hard to assure people that PsyberX FPS game hasn't been forgotten, there has been tons of FUD around the topic.

That said, while text-based Serfdom and Sorcery is not for everyone, some people really seem to like it. It has bridged its DBLN token to Koinos and Wax, plus its home on HIVE, and the game itself gets frequent updates with interesting new mechanics.

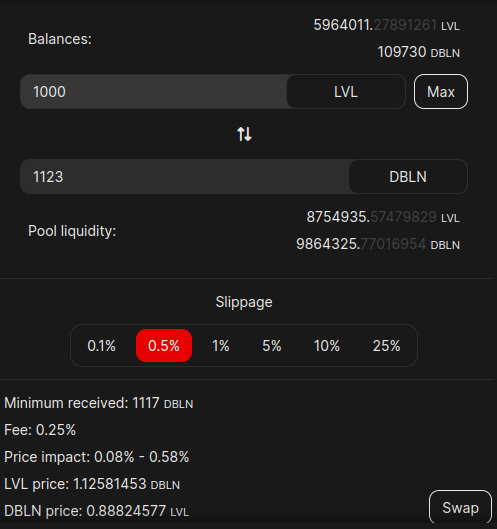

The thing that has interested me, however, is that DBLN trades against LVL in an LP pool. Both tokens also have a pool with SWAP.HIVE, and as with most markets, the prices of each go up and down, mostly independently.

So I have used the base case of 1 LVL = 1 DBLN for about 6 months now, when I can get more than that on either side of the trade, I swap. Its been going really great, and right now, you can get 1.12 DBLN for each LVL. Recently, I was swapping for 1.5 LVL for each DBLN. Back and forth, back and forth, this ratio trade has been absolutely bonkers for just how many times I have been able to swap back an forth.

Risks vs Rewards

So really this ratio trade has nothing to do with HIVE price in dollars, or LVL or DBLN price in HIVE (other than the ratio between the two prices in HIVE). But in the end of the day, we don't want to accumulate tokens that are going to zero, or at least we want to exit the positions before they do so.

The team seems active, and have been around for a few years, still building, so at least for now, I think that risk is minimal. But there is something else to consider -

DBLN is an inflationary token, while LVL is a fixed supply. Since DBLN is the game having updates, its pumping more frequently, but one should be careful, if LVL ever has some significant progress, it will likely leave DBLN in the dust. So if you think there is a chance that @psyberX will not abandon their FPS game, it seems LVL is the one of the two to accumulate in the long term.

Are there any other risks I haven't mentioned here?

BXT vs HIVE

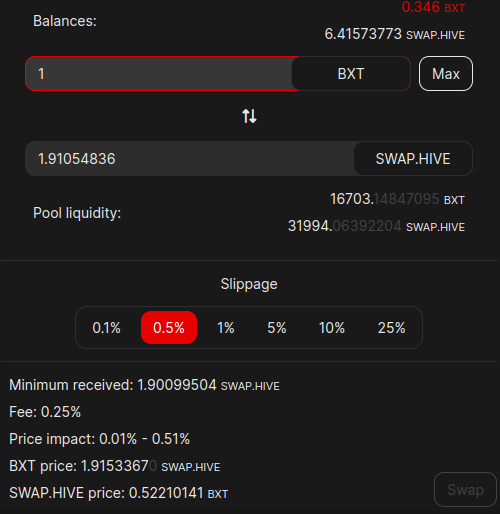

As I showed in my Impermanent Gains explanation - BXT vs HIVE is an interesting pair. This is because BXT is priced in HIVE without any regards to the HIVE price in dollars. It is an inflationary token, so the 'ratio' should shrink over time, but we can capture some value as it goes up and down around the natural ratio - even if that is moving slowly downward.

I have recently been targeting 2 HIVE per BXT - and currently the ratio is below this, you can pick up a BXT for ~1.92 HIVE per BXT. How low can this go? I don't know.

But I do know that BXT has some future updates planned, so I think this is a pretty safe bet as a ratio trade. BXT is backed by HIVE dividends, so even if HIVE pumps, BXT is in a good potition to maintain its value in HIVE terms.

You can also match BXT with swap.HIVE in a pool for 22% apr in BXT while you wait for the ratio to switch.

Others?

As I am writing out this post, a few others come to mind, SIM for example has rotated around the key price point of 0.0003 swap.hive several times recently.

But each one comes with its own risks, and some of my best ideas maybe I don't want to share too openly right now - if I'm right then I'm just sharing my alpha and if I'm wrong than I could hurt people - but these ideas above I think are interesting and open enough that there is plently of space to play around.

What are the ratio trades that you are working with? The best ones for a bear market will have little to know effect based on USD price movements of the larger market space. Let me know in the comments below for my upvote and a chance for some HSBI units!

Have you looked much into the HIQ/INK/BEE triage? Something you may want to delve into 😉

I’ve done dumb trades because I was bored. I try not to anymore.

As long as you learn the lesson it can still be valuable!

Interesting post @ecoinstant. If you don't mind my asking, do you take this concept outside of HIVE and do any trading in bigger pools?

I know many are advocates for trading. I have never been wildly excited about it, for two reasons:

I do not know the future. And I have certainly experienced enough "surprises" about this, when attempting to invest over my lifetime, to comfortably last me the rest of my life (and probably ... another one ... for those who believe in reincarnation ... 😉).

As a value investor, it seems trading cares absolutely nothing for the value of any enterprise. Which is the result of someone's hard work / vision ... It seems only to "care" about timing and what can be ... "extracted" ... then move on ...

That said, I have been reconsidering this a bit. If only to rationally consider whether there is a way to reduce the impact of crypto's volatility on my investments. But ... Hard for me to get past these 2 issues ...

I have not done many trades yet.

I was considering pulling out of the SIM LP pool and just buying SIM to increase SP and HIVE dividend...

I also need to get a plan for LABFUND (#4 on the rich list) and ARMERO (#19).. basically I down for whatever project you are rolling out and the longer term vision.

Awesome! Okay so ARMERO is going strong, keep holding on those and we will keep dominating dCity the best we can and paying out divs approximately weekly.

LABFUND is working through buyback, but I did the calculations and the NAV was going even higher, like 1.35 HIVE per token in circulation - the only problem is that we aren't really producing dividends anymore, citizens are getting of short supply and there are no more ARMERO tokens coming through to distribute.

@superlab is selling its SIM and buying back LABFUND, at 1 hive in price right now, and I might have to ease that up over time, but you can list your LABFUND if you want to get rid of it, if you are in a hurry somebody would buy it slightly cheaper I am sure. As for what is next... I am not totally sure! @armero is going very strong and it will probably take me two years to wind up the LABFUND.

Of course INCOME and ECOBANK are two other things I do, I think INCOME is the right one to buy now while HIVE is cheap (it pays out HIVE daily and does some other interesting things).... I could consider swapping your LABFUND for INCOME tokens - I am checking the richlist and see you don't have any yet - have you heard of it?

I have heard of INCOME - I honestly have no idea what I don't have any. I think there has been several times I have looked at getting into it and for probably never saved enough hive.

Is labfund winding down and the city will be sold off or transferred over time? IF that is the case then a swap sounds appealing. I have heard of ECOBANK, love the project and congrats on the new property add. wish I had more money for more tokens to participate in everything.

Those are good groups. I'm interested to see how SIM works over the next month.

!ALIVE

You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @ yeckingo1. (5/20)@ecoinstant!

The tip has been paid for by the We Are Alive Tribe

through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power (2x 50 HP) and Alive Power (2x 500 AP) delegations (4 weeks), and Ecency Points (4x 50 EP), in our chat every day.

through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power (2x 50 HP) and Alive Power (2x 500 AP) delegations (4 weeks), and Ecency Points (4x 50 EP), in our chat every day.