I don't really make memes. I'm too old to be good at it. But I had to go on down to the mines yesterday because the Federal Reserve is literally off its rocker!

Monetary policy nerds like me can take some solace in the fact that this coronavirus scare is bringing our favorite topic to the forefront. In the past few days, we've heard the word TRILLIONS in association with a wide variety of monetary actions. In fact, monetary policy is even getting prepared by government institutions that are not even the Federal Reserve. When everybody starts caring about monetary policy, that's when you know we're in an economic crisis. Usually, no one gives a rat's ass about what I know!

Let's just take a look at what was announced over the weekend:

A $1 TRILLION a day commitment to repo operations to provide liquidity for commercial bank operations. This mechanism started just two weeks ago with $50 billion, three days later was expanded to to $198 billion and now is at $1 trillion. The pace of growth here is simply astounding.

New swap lines to 9 second-tier central banks - i.e. not Europe, England, China or Japan - to tap up to a combined total of $450 BILLION, money to ensure the world’s dollar-dependent financial system continues to function.

Here's the non-Fed stuff. Congresswoman Rashida Tlaib (D - Mich.) has submitted a bill for the Treasury Department to mint two TRILLION-dollar coins to backstop a People's Bailout. The legislation is still under debate in the Senate and most likely will not include the coins, but there will be some kind of action to support lower and middle class workers. I mean there has to be... RIGHT? I certainly hope so. Whatever this QE for the People ends up being is gonna have to be substantial enough to cover people's salaries and mortgage payments and whatever, literally everything, for 2-3 months AT A MINIMUM.

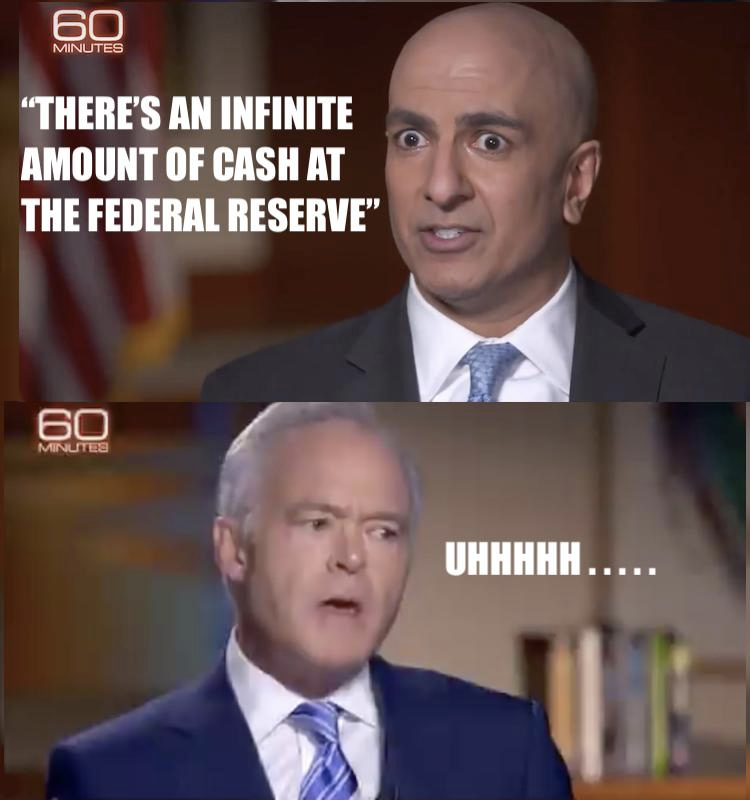

All of which leads us to Neel Kashkari, a veteran of the Great Recession & current Minnesota Fed Chair, who made a rather eye-opening, some would say even creepy-ish appearance on CBS' 60 Minutes this weekend with the following startling quote and response from Scott Pelley.

The American economy has officially "jumped the shark" as they say with regard to old sitcoms that have run their course but want to eek out another season or two so the actors and staff can make good on their second home and boat payments.

I don't care what Kashkari says: Infinite cash is not a thing.

Buy bitcoin. Silver. Literally ANYTHING that is not infinite.

How long will it take for the penny to drop that the value of something with infinite supply is zero?

Americans are pretty dense. And caught up with themselves. And believe what the TV tells them. It could be a while, actually. But judging by the move in silver yesterday, maybe there are some smart folks out there!

Houray for QE infinity! So glad Bitcoin was invented! Brrrrrrrrr

Brrrr Brrr Brr

Didn't they use the term "ample fractional reserve"?

In what language does "ample" mean zero?

That's American English, sir!