Preface

Before we get to the article, I'll take my time to apologize in advance for those who refer to the golden spirit as "whiskey" instead of "whisky". The Americans and Irish will disagree with the title, the others around the globe will not. Since I'm not Irish nor American, I took the freedom to save me a couple of letters in the following paragraphs.

Holy water

The word whisky is a term used to refer to a distilled spirit made from a variety of grains, including rye, barley, corn and wheat. Though the methods might slightly differ, all whiskies are practically made the same way. The grains get mixed with water and yeast for fermentation, which become alcohol. Then the "beer" gets run through a still that heats the substance into concentrated vapor. On the other end of the still we are left with a clear, high-proof distillate. This distillate then goes into a barrel where it will sit for at least three years to give it it's unique flavor and smell.

The longer a whisky sits in the barrel, the more complex and outspoken the flavors will get. This is, however, also very dependent on conditions of the warehouse the whisky is stored in. Most whiskies are produced in the northern hemisphere where they experience significant annual shifts in temperature, which improves the quality of the spirit. Most distilleries even rotate casks from the top to the bottom in their warehouse over the years to affect the liquor’s aging and ultimately taste.

There are various types of whisky, all of them having their own rules of production. Bourbon for example is a type of whisky exclusively produced in America where it's mash (the mixture of grains used for distilling) has to consist of at least 51% corn. Because of this, bourbons are a lot sweeter than for example Scotch. Other popular types are Irish whisky, Blended Whisky, Rye Whisky, Japanese whisky etc. They all have their unique characteristics we could dive into, but that would take us on an whole other journey which I'll perhaps save for another article.

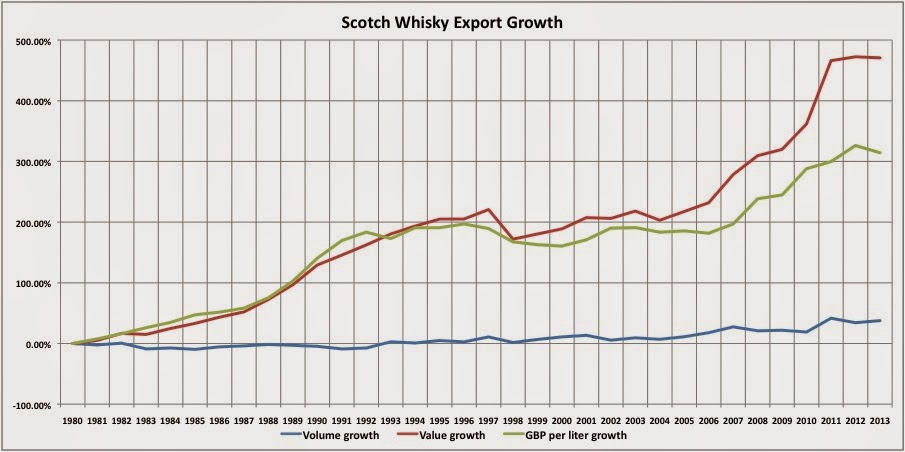

The last 30 years whisky has seen a massive increase in popularity. Looking at a shorter time frame, in the last decade, a massive Bourbon-boom has been occuring in America. The bourbon-industry in Kentucky for example has now become a 8.6 billion industry, generating 20100 jobs in 68 different distilleries, 250% up in the last ten years. The numbers of Scotch aren’t inferior. In following graph, you can see the value of a bottle of Scotch going up over 470% in a 30-year timeframe. Whisky nowadays is more popular than ever before, and that of course, creates opportunities.

Liquid gold

The value of whisky has risen exponentially the last decades. Demand went up by such a margin that distilleries around the globe had problems producing and more importantly, storing, their whiskies. A good, rich whisky easily ripens for at least 12 years in a combination of casks before it gets bottled. During this aging process the ‘“Angels take their share” and the alcohol evaporates, leaving less whisky in the cask when it’s time for bottling than what went in initially. Therefore, the production of let’s say a 40-year old whisky is a very expensive endeavour. Not only do they have to reserve a place in their storage for 40-years, but in the meantime the Angels keep asking for their share, often losing over 50% of the cask to evaporation.

Once bottled though, the whisky stops it’s aging process. Therefore, whisky maintains it’s quality if left unopened. This makes whisky a nice asset to collect. In 2019, the 60-year old Macallan Fine and Rare, a bottle distilled in 1926, sold for 1.9 million dollars. The Apex 1000, an index that tracks rare whiskies, appreciated by 162,91% from 2014 to 2019, outperforming gold by 150%.

Interestingly enough, a report from 2017 shows that 80% of the second-hand purchases of whisky aren’t for investment-purposes, which shows that collectors are willing to pay an ever-increasing price for their favourite drink.

The whisky industry is now more diverse than ever, and more and more investors have embraced the idea to expand their portfolio with some bottles of liquid gold. What was once seen as a premium spirit for the wealthy, has now become an investment opportunity that can achieve great returns when you find the right bottles. And if not, you’re still left with a great drink to enjoy.

Thanks for reading.

See you next time.

Sources:

I bought a couple of bottles several years ago as an alt investment, stored in The Netherlands I think, they've done OK!

You do have factor in storage costs, but they're not too expensive.

And I can safely say it's an investment I enjoy! Love whiskey, in fact I'm thirsty now!

Posted Using LeoFinance

Earlier this year I was working in my garden when my neighbour came to me with a sac full of bottles. She asked me if I liked whisky, and I said yes. She gave me the sac and told me I could have everything that was in it since she was going to throw the bottles away anyway since they didn't drink anymore. In it were 8 bottles of whisky, some opened, some unopened. One of them was a Hibiki 12 year-old, a discontinued Japanese whisky worth 350 euro's nowadays. I told her the worth of the bottle since I don't think she knew, but I could keep it. That's where my interest in collectable whiskies started.

But drinking them is of course where the real joy is. Enjoy your drams! :)

That's a nice little story, what a great way to start!

Posted Using LeoFinance