The world as we know it is about to change radically as a result of Covid-19. The biggest changes will come in how we live our lives, how we work, how we socialise and how money moves. All this will change profoundly! I’ll leave it down to individual choices for the first three but in terms of how money moves around the world, we will need to find a new way of financing the global economy when this virus has passed. You may be reading this and thinking why am I mentioning this now, whilst the current crisis is still in full swing, but please remember that the Bretton Woods conference which set out a postwar economic system, was agreed a year before the end of hostilities and only a month after D-Day in 1944. It established a new global exchange rate system tied (in part) to the value of gold.

As a result of the conference, 730 delegates, from all 44 "allied nations", created the International Monetary Fund and the World Bank to bail out struggling countries and decreed that the US dollar would be the global reserve currency. This meant that US dollar became the currency into which all other currencies should be exchangeable.

The world needs to start thinking about organising a new "Bretton Woods" now, and not muddle through, hoping to put it all back together with sticking plaster over the next few years, once this is over. At the outset, politicians will tend to prefer maintaining the current system, even though it will have been completely broken by Covid-19.

Over the coming weeks, consumption will collapse, as will confidence in the current financial system. The hospitality sector as we know could possibly be over.... Most airlines will have ceased flying and gone into administration. House buying and selling will disappear and with it home furnishing and renovation companies and outlets with them. No one will start a major new project and very few existing construction projects will be completed. Broadly speaking, the economy will cease to function.

Even if major banks and central governments are proactive NOW and lend immediately to robust businesses backed by last year’s profits, banks will experience widespread default from unpaid loans, mortgages and overdrafts, think 2008 financial crisis X 100. Capitalism will be suspended.....

My most optimistic view is that we put the economy to sleep, inoculating it as best we can with massive injections of cash or “helicopter money”. This could be done if governments and central banks act together to deposit free money in businesses’ and people’s accounts, as is happening already in some countries (think USA). Even if this was to happen, this would not allow the masses to continue so much to spend as normal, but would only alleviate contagious mass defaulting from occuring. This monetary ‘vaccine’ would best work alongside (and not instead of) governments taking on the wage bill for workers. The bill for all this is going to be astronomical!!

Whilst "helicopter money" could be delivered without incurring significant debt, it would mean tearing up the central-banking rule book(which wouldnt be a bad thing IMO). Although this is the most sensible thing to do, governments may well choose to raise the money by issuing massive amounts of sovereign debt, which will need to be paid back by the likes of you and me for generations, through taxation, aka theft!!

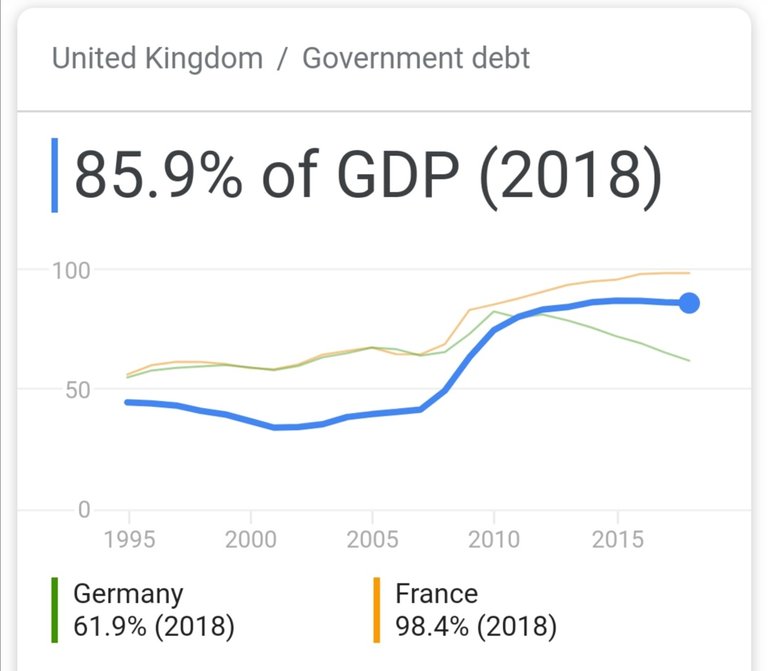

Let's take the UKs neighbours as an example - Ireland is one of the most export-dependent economies in the world. Therefore, it’s not unreasonable to assume that Ireland’s national income or GDP could sink by at least 10-25% this quarter as well as the same the following quater, depending on how long this crisis continues. The UKs own budget deficit (or national overdraft), even though we are less dependent on exports, could still spike to over 100% of GDP, and become unrepayable.

Unemployment, even with the wage subsidy from the government (to dissuade employers from laying off staff), is bound to sky-rocket, possibly to 20%, currently under 4%. The usual escape valve of emigration will not be open to the youth because nearly every developed country in the world will also be in recession with mass unemployment.

Having taken some of the measures I outlined above, every sovereign countries debts will be crippling, a short saving grace will be that interest rates will remain on the floor. Big central banks will create more money and use quantitative easing to fund this debt, as they have done since 2008!

Globalisation, is predicated on travel, trade and the free movement of capital right?? This will go into reverse and not just slowly, but at full-tilt. This speed could be slowed, but not reversed, and will depend on the type of governments that emerge from the crisis on the other side. There is a higher likelihood of more nationalist, protectionist and less cosmopolitan politicians emerging in countries traumatised by this virus. If we want to preserve the liberal order, which has delivered relative prosperity for the past 40 years, we need to convene the G20 immediately with a view to a new Bretton Woods arrangement. This disparate group should include all major nations from all continents and the three biggest economic players: the United States, China and the European Union.

Before its first emergency meeting, which will probably be held over Zoom or Skype, the G20 would have asked its brightest thinkers and economists to come up with some creative ideas to kick-start the post Covid-19 world.

These recommendations will inevitably be watered down once the politicians get their hands on them. The US, for example, would definitely demand that the US dollar remain the global reserve currency. Under current situations, China simply wouldn’t wear that, and the Chinese might even be backed by EU governments to start a new World reserve currency.

Could we be looking at a brand new global reserve currency, which might be based on a basket of currencies including the yuan, euro and dollar?? Would the like of China and Russia, push for a gold backed currency, since they are now major players in the global, gold game....

This new virtual unit of credit could then put a worldwide value on all debts and assets. I would assume precious metals would be revalued at a much higher price at first due to the uncertainty and lack of trust in governments directly after this crisis. A new WRC could then restart supply and demand and might even lead to cash and coins being issued in the new clearing currency by a reconstituted IMF. This would be one which the old western countries would no longer have total control of.

Apart from what kind of money we will all be using, the most pressing issue would be debt...... And lots and lots and lots of it!!

In the worst case, bankrupt western governments might have to print trillions of Euro, Pounds and dollars to give their citizens enough money to survive. That's all we will be doing is surviving. It’s not unreasonable to assume that governments would consider nationalising vast swathes of the economy, especially those in travel, hospitality and essential services such as rubbish collection and banking. This is already under way in some countries, with what little privatisation left, will still depend highly on government handouts. That means sovereigns, for a while, would own hundreds of thousands of distressed companies, all their debt, all their assets and all of their wage bills which could then be leased or sold back in chunks to those who could afford it.

This is when, I believe, that those of us that had the foresight to stack precious metals will come in to our own. With the newly valued assets being worth considerably more than today, buying up large swathes of land, the decimated housing market or shares in newly emerging companies will become far more affordable for those of us that have prepared now.

But even if none of the things I've talked about are implemented or even debated, something urgent and drastic will have to be done incredibly soon to prevent complete monetary meltdown. As for the future of monetary policy, just as the calendar was bifurcated into BC and AD, the economic future will be delineated into two eras - the ante-corona (AC) and post-corona (PC).

Most of the worlds population still seem to think that things will go back to the way they were once the pandemic passes into history. They don't realise that the Everything Bubble has been pricked and we're going to face repercussions perhaps for maybe a decade or more.

It seems like Modern Monetary Theory and Universal Basic Income along with money printing and debt monetisation is going to be the dominant "solutions" that the powers who be will try to use. That all goes hand-in-hand with the cronyism and massive social engineering that has become more and more prevalent every year. It looks horrible to me as I see massive currency debasement as an unwanted side-effect of it all.

Jim Rickards talks a bit about the SDR (Special Drawing Right) becoming the new reserve as a basket of currencies - a bit like you suggest above. The US people will not want to give up reserve currency status, but since the US now has the most covid cases and may end up being devastated economically they might not have a choice.

These are undoubtedly historic times that we are living through. I pray we can make it through the other side with some decentralised solutions that can take humanity forward and not leave us in some kind of Orwellian future.

A simple - "nice post" would have done mate 👍 😂🤣😂🤣

Sorry mate. I was trying to engage and add value to your post. It was a really good post!

If we want to preserve the liberal order, which has delivered relative prosperity for the past 40 years,

The liberal(a communist subterfuge shoehorn) has only led to centralization, and quasi socialism.

It has done nothing to deliver prosperity. Hindered it yes.

(Jekyll island - 1913 -guaranteed the eventual economic meltdown. A mathematical inevitability, as in all debt based systems).

I'll still give ya an upvote tho!lol

You're right, I probably shouldn't have included that in there. I'm actually anti-central banks and current NWO. I think they've kept humanity suppressed for decades with their debt and death Ponzi Scheme, but for some reason the majority of sheeple think governments have their best interests at heart! I suppose if you don't realise you're trapped in a system designed to keep you subservient then you think this is the norm....

but for some reason the majority of sheeple think governments have their best interests at heart!

I'm doing my bit to knock 'em out of it!

https://peakd.com/hive-100421/@lucylin/ymzthtfp

Great article bro!! I even reblogged it 😉

Did you know when bretton woods first passed they made everyone hand over all of there silver and gold to the government at a fixed price? After they collected it they re-valued it at much higher price.. So who is to say they wont do that exact same thing again?? I stack too, i just dont trust governments..

I don't think they "made" people hand over their silver and gold, I believe they told everyone it was needed to help ccc the war effort and played on pride and loyalty (trust). They gave them the price it was valued at at the time, then once people had handed over their gold, they revalued it 3 times higher over night, or as stackers would say g "devalued their fiat" over night.

My grandpa (98 years old) said they threatened people with legal recourse if they were found to have any bullion after a certain date.. At least thats how he remembers it, here in America.. Im sure the history books make it seem much nicer than it was..

I mean, I would never turn mine in but lots of people would definitely be fooled by this ploy.. especially if they thought they were "helping their country"..